Market Scorecard

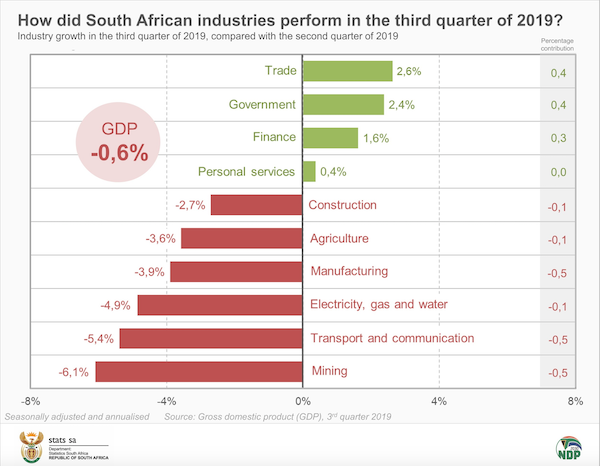

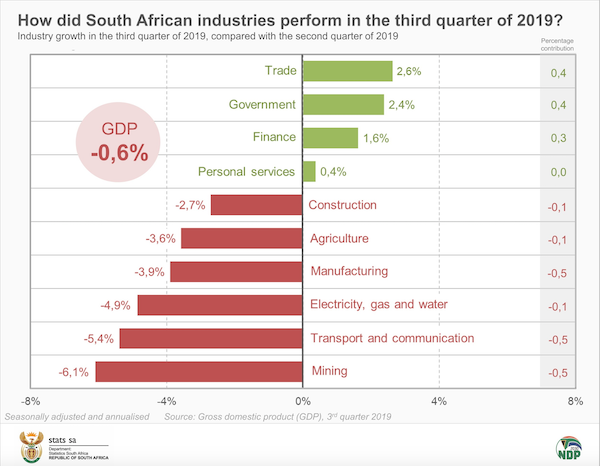

Yesterday, Stats SA confirmed how tough things have been in the local economy.

Our GDP contracted by 0.6% for the third quarter, which was worse than expected. On the news the Rand weakened a bit. A lower growth rate means that our debt to GDP ratio gets worse, both because our GDP is lower and due to SARS receiving less tax. South Africa has a serious growth problem!

As things stand in South Africa, it looks like it will be worse before it gets better. When the hard decisions are made at the SOE's, where the government stops throwing good money after bad, the economy will have to go through a transition period of getting used to not having government spending. A big contributor to GDP has been the government, but now that they have run out of money they will have to cut back on spending. As they cut back on spending, GDP will go backwards but it will create gaps for the private sector.

Hopefully, the private sector will pick up the baton quickly, and the transition period will be painless. Time will tell.

As the hopes of a trade deal being signed this year fades, the US stock market has dropped around 2.5% from its record high position last week.

Trump seems to be playing hardball by saying that maybe it is best only to sign a deal after the 2020 elections. The next deadline in these talks is the US tariffs on China, scheduled to kick in on the 15 December. Will they be moved, will they be implemented or will some mini-deal be signed before then? Looking at broader global trade, the US is now also taking aim at France, Brazil and Argentina by implementing new tariffs on them. Sigh.

Yesterday the

JSE All-share closed down 0.60%, the

S&P 500 closed down 0.66%, and the

Nasdaq closed down 0.55%.

Company Corner

One thing, from Paul

You may have noticed that

we do not devote much time to profiling the CEOs of the companies that we hold in Vestact portfolios. It's not that company management are unimportant. A good strategy is developed and implemented by a talented team, and sound decision making is crucial for modern multi-national corporations. Conversely, a rotten manager can do a lot of damage.

The reason that we de-emphasise company leaders is that they come and go, and we try to own businesses for much longer than the average tenure of its bosses. Also, the business model is often more important than the person at the top. As Warren Buffett once wrote, "I try to buy stock in businesses that are so wonderful that an idiot can run them because sooner or later, one will."

I was thinking about all this because I saw overnight that

Google co-founders Larry Page and Sergey Brin will step down as CEO and president of Alphabet (Google's parent company). Google chief Sundar Pichai will also take over as CEO of Alphabet.

Page and Brin created Google in 1998 while students at Stanford University and are still very significant shareholders. Thanks to their holdings of super voting Google Class B shares, they jointly control just over 50% of the voting power of the whole group. Page and Brin are both only 46 years old, so I guess that they will be around for a while. Of course,

Sundar Pichai is a genius, and is doing a great job of running a business with tremendous prospects, so we should be fine.

More on the transition here, on tech news site Slate:

Google's Co-Founders, Who Have Been Disappearing From the Company for Years, Are Stepping Down.

Our 10c Worth

Our 10c Worth

Byron's Beats

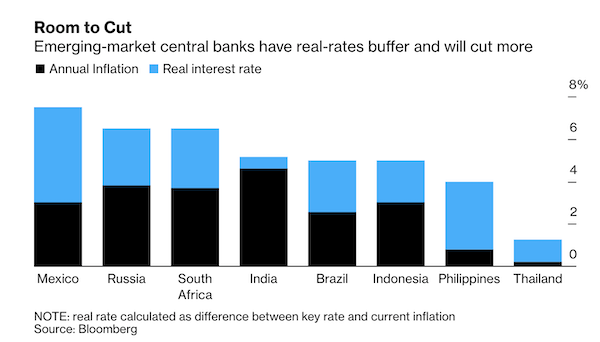

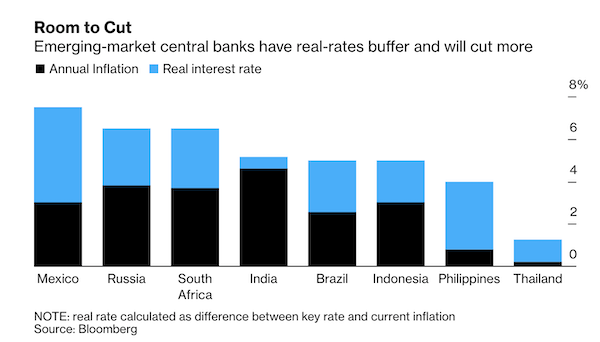

When it comes to interest rates and frustrations with central bankers, South Africa has some familiar company. Take a look at this image from the following

Bloomberg article.

As you can see, Mexico, Russia and Brazil are also being conservative with their interest rates

As you can see, Mexico, Russia and Brazil are also being conservative with their interest rates. I do understand why, to a certain extent. Developing market currencies are volatile. This gives central bankers less room to move because a sharply weaker currency can have immediate inflationary results.

But the article goes on to quote Gabriel Sterne, an Oxford academic, who believes the central bankers should not be too conservative. I tend to agree. Times have changed and the world is hungry for growth. Many central banks have already changed their mandates to include a focus on growth.

It is an ongoing debate which is hard to conclude because there are so many moving parts.

But I did find it interesting that we are not the only developing nation playing it safe.

Michael's Musings

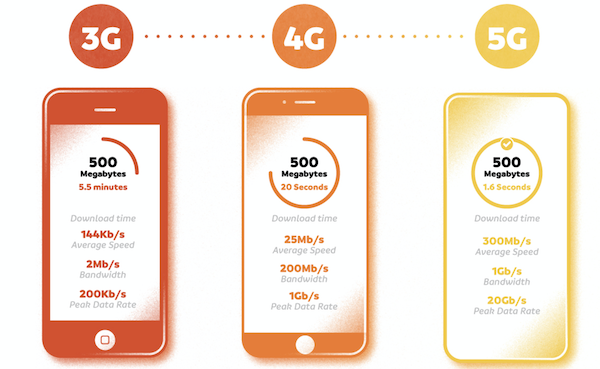

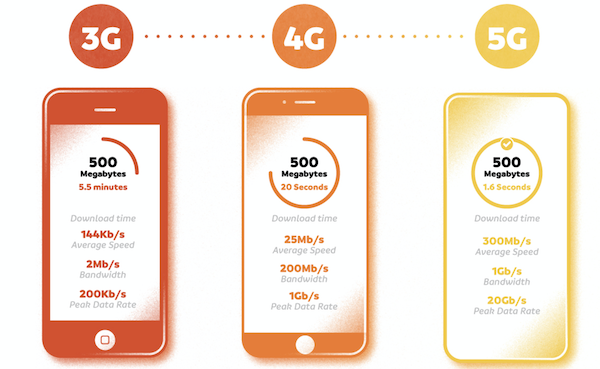

This brilliant infographic shows why people are making such a big deal about the arrival of 5G. Note how the iPhone also changes in the image.

Do you remember when 3G was introduced in the early 2000's?

Do you remember when 3G was introduced in the early 2000's? Moving from EDGE to 3G was huge. Looking back now, I'm not sure how we coped with a 2mb/s download speed. Looking forward, I'm not sure what I will even do with 300mb/s. Not even streaming Netflix in ultra HD needs speeds like that. In this case though, as speed increases, industry will start developing technology that can take advantage of that speed and then we will never be able to go back to slower speeds again.

The next generation, 4G, arrived around the time of the FIFA world cup. All the cellphone networks were competing around who had the best quality coverage of the 4G network. If I remember correctly, Cell C was taken to court for claiming that their network was 4G+ - a clever marking campaign from the company. Google tells me that

some companies are already looking to creating 6G, which is pencilled in to launch in 2030 and will have speeds of 1 terabyte per second.

You can read more here -

The Future of 5G: Comparing 3 Generations of Wireless Technology

Bright's Banter

OrderIn co-founder Heini Booysen, is back with another startup since he left OrderIn about a year ago. Apparently, he still has a small stake in OrderIn where his passion for online food delivery was ignited.

His new startup Darth Kitchens rents rundown commercial space and turns it into shared "Ghost Kitchens" for restaurants, who will then use the likes of UberEats, Mr D, and OrderIn to deliver their food to customers.

The company was recently backed by Cape Town based, early stage investor, Silvertree Holdings -

Silvertree invested R5 million in exchange for a 51% stake in Darth Kitchens and plans to put a further R30 million into the business.

The business case for ghost kitchens is simple: it costs between 25% and 35% more for restaurants to dedicate staff to fulfil online orders. So create a ghost kitchen with low-cost rent, dedicated to producing online-only orders. However, the concept is still in its early stages as it is not foolproof just yet.

One problem is that there is nothing proprietary about this idea. All you need is a 'bit' of money, vacant property downtown, with a few kitchen fittings, some suppliers and you're ready to rumble. Of course its never that easy but it'll be interesting to watch how everything unfolds.

Linkfest, Lap it Up

If you are a Vestact client, you are probably a part owner of the top 3 sites - we have owned Alphabet (Google) and Facebook for years. It is interesting to see the size difference between position three and position four.

You will find more infographics at

Statista

Have you started planning your 2020 holidays yet? Here are some suggestions for interesting and beautiful destinations that you can visit. On the list is Botswana's salt pans -

20 Best Places to Go in 2020

Signing off

Signing off

Global markets are mostly red. Economic data out today includes European PMI data and US ADP employment figures, a precursor to the main numbers being released on Friday. The Rand is slightly weaker today at $/R 14.65. The JSE All-share is starting the day lower.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista