Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Stryker stock has been a little weak lately. Our medical devices holding in New York had a great run to above $220 per share on good results, but sagged to below $200 in recent days, on news that they will spend up to $5.4 billion to acquire Wright Medical Group (share code WMGI).

Memphis, Tennessee based Wright Medical is a global medical device maker that was founded in 1950 and focuses on extremities and biologics. Stryker is offering $30.75 for each share of WMGI. That's nearly a 50% premium to Friday's closing price. This is probably the reason that Stryker's price fell. Deals of this nature raise the concern that they are overpaying?

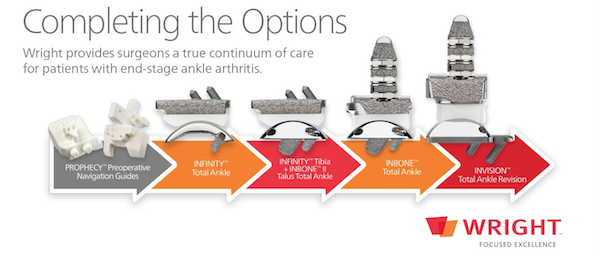

The fit with Stryker seems to be good. Wright Medical's team, products and customer base will slot into Stryker's trauma and extremities business. They have annual sales approaching $1 billion a year, and is a leader in orthopaedic products to repair shoulders, elbows, wrists, hands, feet and ankles. The picture below shows the options for replacing an ankle joint. The biologic products are interesting too, and include consumables used in orthopaedic surgeries such as bone wedges, bone repairing putty, membranes, grafts and glues.

The boards of directors of both Stryker and Wright Medical have approved the transaction and the deal is expected to close in the second half of 2020. It is expected to have no impact on Stryker's earnings this year, and only a very modest impact in 2020.

I would not be overly concerned that Stryker is becoming too adventurous. $5.4 billion is a lot of money, but Stryker's market capitalisation (the best measure of their enterprise value) is $75.3 billion, so this is well within their financial comfort zone. On we go!