Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

The world's largest biotech company, Amgen released its third-quarter earnings that beat the streets expectations. The company saw strong volume growth for the seventh consecutive quarter which can be attributable to new drug launches like migraines drug Aimovig and the launch of biosimilars including Kanjinti for breast cancer.

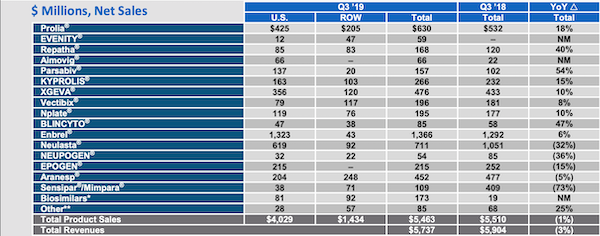

Revenues for the quarter were down 3% to $5.7 billion year-on-year due to the impact of biosimilars and generic competition against its key products like Neulasta which saw its revenues fall 32%. Drugs that grew by double digits or more include Prolia, Repatha (cholesterol), Aimovig, Parsabiv, Kyprolis and Blincyto. Enbrel, Nuelasta and now Prolia are still the big revenue drivers for Amgen.

Operating income is up 7% to $2.5 billion with margin expansion of 3.1% to 45.3%. That lead to earnings per share increasing by 14% to $3.27 thanks to a reduced number of shares outstanding and a 9% decrease in operating expenses. Share buybacks lowered the number of shares outstanding by 7% year-on-year.

Revenues from Amgen's own biosimilars and something to watch in the short to midterm more than doubled from $82 million to $173 million on a quarter-on-quarter basis. At the current growth rate, these biosimilars will be quite significant in Amgen's life in the next couple of years when they cross the billion dollar mark per quarter.