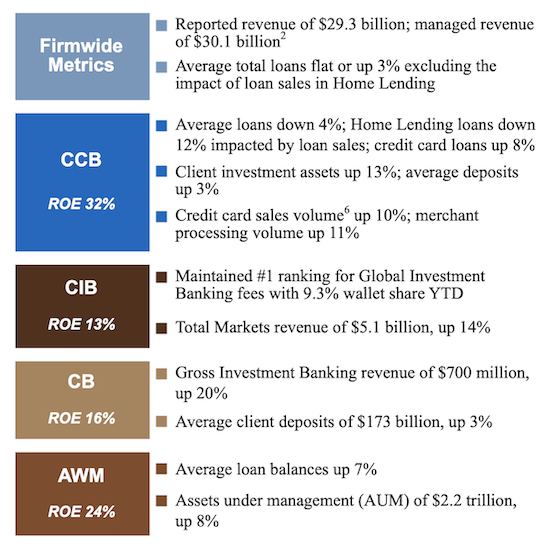

Yesterday JP Morgan released results that beat expectations. The stock went up 2% immediately in the futures market before the open, and closed the day higher by 3%. Earnings came in at $2.68 versus consensus of $2.50. Revenues of $29.3bn also beat expectations. Net income for the period was $9bn. Wow these banks are big. Here are some of the divisional highlights.

As a refresher, CCB stands for Consumer and Community Banking, CIB means Corporate and Investment Banking, CB means Commercial Banking and AWM means Asset and Wealth Management.

CCB contributes 49% of revenues and 47% of profits. That beast of a segment grew by 5%. CIB contributes 32% of revenues and 31% of profits. Net income for CIB grew at 7%. CB contributes 7.5% of revenues and 10% of profits which declined by 14% in the quarter. AWM which contributes 12% of revenues and 7.5% of profits had flat revenues and declining profits of 8%.

All in all these were a good set of numbers. We continue to believe that the banks will benefit from a robust US economy. They have great brand strength and lots of money to find other growth avenues. In short, they have fingers in every single pie.

Expectations are for the company to make $10.24 in 2019. That puts the stock on 11.4 times earnings. Well below the market average. The dividend is also at a very juicy 2.9% yield. We continue to recommend JP Morgan as the best bank and a must have in your portfolio.