Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

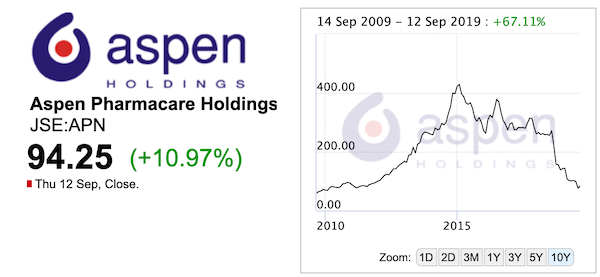

We have owned Aspen Pharmacare in Vestact JSE portfolios for many, many years. We started buying them in July 2005 when the share price was R27.55.

I wrote at the time, "we believe that Aspen is a company which could double its earnings repeatedly in the years ahead, producing outstanding returns for its shareholders". At that point it had group turnover of around R3 billion. It was a South African company only, with a quarter of their sales from personal care products, and the other three-quarters from the manufacture and distribution of generic medicines.

I attended Aspen's results presentation in Sandton yesterday. The group now has manufacturing and sales operations around the world, and group turnover of R40 billion. It has transformed itself into a leading player in high-margin, speciality branded sterile pharmaceuticals, especially anaesthetics and Thrombosis drugs.

The company is still run by its founders, Stephen Saad and Gus Attridge. They are both significant shareholders, and have avoided diluting their own stakes by not issuing any new shares since inception.

In a period from 2010 to 2015 they expanded globally at a hectic rate, doing a string of deals to acquire production assets and drug portfolios from global multinationals like Merck, GlaxoSmithKline and Astra Zeneca. They mostly funded these acquisitions through raising debt, at low rates, in Europe.

Aspen has been a grave worry lately, as their debt levels were too high and sales were not as strong as hoped. In fact, sales and profits have been flat since 2015. Total outstanding debt levels ballooned to R53.5 billion.

In the last year, worries about breaching their debt covenants (4 times debt to EBITDA) caused the stock price to fall all the way from a high of R430 a share in February 2015 to a low of R65 on 20 August 2019. That is just disastrous! We are long-term shareholders and have great patience, but it has been hard to stay positive on Aspen.

Thankfully, debt levels have peaked and are coming down swiftly, thanks mainly to the sale of their infant nutritional business earlier this year. Total debt stood at R38,9 billion at year-end. Cash conversion is strong, and the drugs that they make and sell have great margins. Management makes a convincing case for lower capital expenditure and improved sales in Europe and Asia in 2020 and beyond. The business in the US has considerable potential.

A key ingredient for the Thrombosis drugs is heparin, which is made from the mucosa inside pork bellies. Thanks to a global outbreak of swine flu, heparin supplies are constrained and prices are currently sky high. Thankfully, Aspen built up a stockpile of heparin last year, and can now sell it on to third-parties at a tidy profit.

The South African business is puttering along. The high volume anti-retroviral business is being re-engineered in partnership with an Indian manufacturer of HIV drug ingredients.

I'm happy to tell you that as the outlook has improved, so has the stock price. In response to the results out yesterday, the Aspen share price rose 11% to close at R94.25. The annual dividend was skipped, but that is not really a big deal. The dividend yield was never very high in the past.

So in summary, please be patient. I am aware that we have asked our clients and fellow shareholders of Aspen to be patient before, and watched the share price fall ever lower. Based on my reading of the internal trends in the business, I'm confident that this company is in growth mode again.