Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Yesterday I went to the Discovery full year results. Despite the gloomy environment there was a lot of energy and optimism amongst the management. I guess that is the culture Adrian has created.

As expected from the trading updated, normalised earnings fell 7% to R5bn because of an increase of investment in new businesses; predominantly the bank. In fact, 21% of group earnings were reinvested in new initiatives. There were also some once off abnormally large life claims which resulted in a 9% drop in that division's profit contribution.

Take a look at the profit contribution per division. The image also includes new business costs at the bottom.

Let's take a brief look at each division.

Health.

This is the second biggest profit driver of the company and the one most under threat from NHI. Of course Adrian spoke about this. He showed how it would be unsustainable in the current format and explained how they would certainly be able to help if the government allowed. There was at least some push back, but in a very diplomatic way. This company is very energetic, innovative and fast moving. In six years time, when NHI is supposed to arrive, I believe Discovery will be a very different looking business, less reliant on the health division. Having said that, the division showed good growth with a 10% increase.

Life.

This is the other big cash cow which allows Discovery to reinvest in exciting new businesses. This division is showing great benefits from Vitality's behavioural manipulation. There has been scrutiny on how they value this asset but Discovery has the stats showing how their healthy clients stay clients for longer because their premiums are cheaper due to embracing the Vitality program. The unhealthy clients get charged more and end up leaving. What an incredible model; it is like a herd of buffalo, the weak get taken out. Discovery is left with the best disease-free herd of buffalo in the land. Certainly that is worth more than the other weak herds of buffalo?

Vitality UK.

Remember this is the brand they have gone with for their health and life insurance business in the UK. This is finally showing solid signs of growth and traction after big marketing spend. Management do moan about the low-interest rate environment which results in poor returns from their float.

Discovery Insure and Invest.

Insure actually slowed a bit, they weaned out a few low quality clients. More importantly it is now very profitable. This has come from a loss making business to a solid profit contributor (R155m) in four years.

The growth of Discovery invest has been very impressive, we work in this industry so we know that it is tough to start from scratch and grow assets under management; it shows the strength of the Discovery brand. In a just over half a decade they now have R92bn under administration. Of that, they were able to make R966m in operating profit. A very successful venture so far.

Discovery Bank.

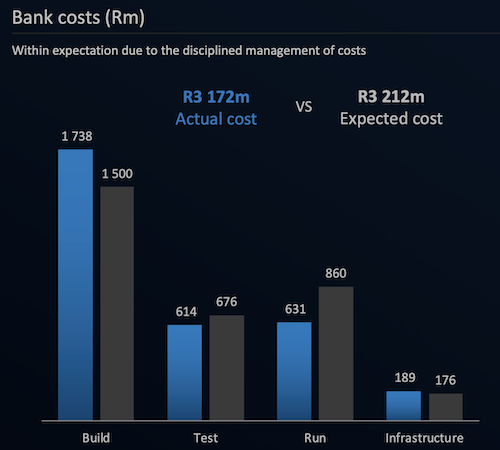

We are finally seeing the public rollout. There were 50 000 accounts when these results were released. As you can imagine, the bank will attract quality clients who embrace the rewards programs across the platforms. The below image show's the cost breakdown of the bank. I have no doubt they will make that back and more.

Ping An.

This is another "New Business" that is starting to bear fruit. New business grew by 67% and for the first time reported a profit of R100m. As I said earlier, Discovery will look very different in six years time; this will be one of those drivers in my opinion.

Vitality Platform.

For me the most exciting and unique part of this business. Preventative healthcare is our future and Vitality is one of its leaders. Amongst the partners, there are now over 3.6 million users. Could this become similar to a social media phenomena where everyone shares their health stats throughout hundreds of millions of users? It is possible. And like social media, there will be two or three winners, who will grab the bulk. This is another business finally showing a profit (R161m). They are following through with their ventures.

All in all it was a good set of numbers. You should know by now that we are not deterred by short term profit hits because of reinvestment in new businesses. We have to give Discovery the benefit of the the doubt to turn the bank into a big profitable machine, like they have done with their other ventures. We are still conviction buy on this stock.