Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Last week Uber reported its second quarter numbers, which disappointed traders. The stock is down around 14% since reporting after the market closed on Thursday. The drop is mostly driven by slower revenue growth than expected and losses being bigger than expected. For the quarter the company posted a loss of $5.2 billion, of which $3.9 billion came from stock options. Wow, that is a big number! Stock options might not be a cash expense for the company, but it does mean that you, as a shareholder, have been diluted. On the revenue side, Uber showed growth of 14% to poste $3.2 billion for the quarter.

When evaluating Uber, it is essential to remember that you are investing in it for the very long term. It is similar to Amazon in the early days, where their focus was not on making profits but on growing their market. This is what the Uber CEO, Dara Khosrowshahi, had to say when asked about profitability of the company:"I think we are very very early in this incredible journey." He had to throw in an extra 'very' there to emphasis how far Uber is from making consistent profits.

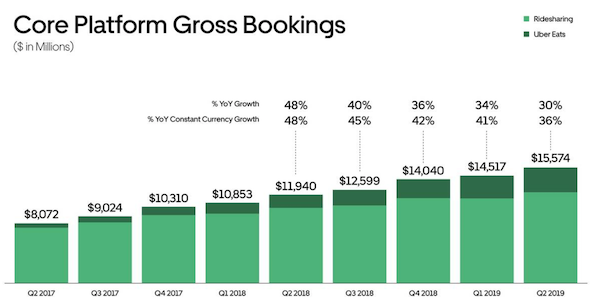

The numbers that matter when looking at Uber are more around their growth, and how they are doing in terms of size and scale. Gross bookings for the quarter were up 37% to $15.8 billion, with the full-year forecast for $65 to $67 billion. That is incredible growth for a company that is only ten years old. Uber Eats grew revenue by 72% to $595 million, and should continue to show spectacular growth. In terms of usage statistics for the group, they now have 99 million Monthly Active Customers, and completed 1.67 billion trips over the last three months. The income statement shows that they spent $3 billion on research and development in the quarter too; it is important to stay ahead of the competition.

Overall, the company looks to be growing well and investing in its future. As a shareholder expect the ride to be very bumpy as they continue to add scale. When it all settles in many years from now, it should be a highly cash flush business, running a product whose name is ubiquitous with all ride hailing.