Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

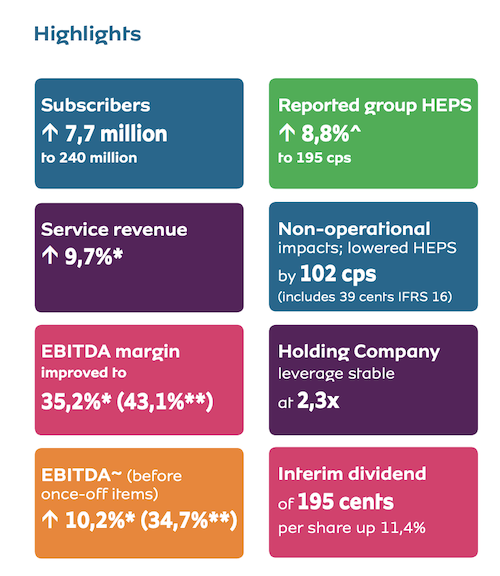

On Thursday MTN released results for the 6-month period ending 30 June 2019. Here are the highlights.

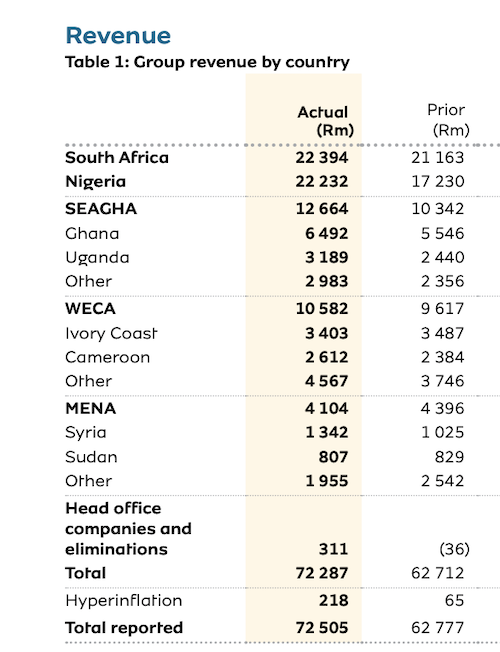

Within that revenue number, voice increased by 4.5%, data increased by 19.8%, digital revenue (added services such as music) dropped 42.5%, and fintech increased by 40.7%.

Revenue per region painted an interesting story. South Africa was tough, reflecting the economy. Nigeria showed big improvements after a very rocky patch. Those 2 regions are nearly equal in size, contributing 61.6% of total revenues for the group. Having said that, Nigeria is a lot more profitable than South Africa, due to large 4G and 5G capex locally.

In Nigeria the group is very excited about their banking license. I do worry that somehow the government will clamp down if they do too well out of it. At least now, with a part of the business listed in Nigeria, interests are aligned. As Charlie Munger always says, never underestimate incentives.

Other than South Africa and Iran, all their regions are growing nicely. The company is going through a much better patch. There is still a lot of political risk but that also means less competition and better margins.

The stock was up initially but ended down 2.9%. MTN also wrote off R211m of a R400m payment owed to them by Cell C. The media jumped on this news understandably assuming that Cell C is in huge trouble. Cell C hit back stating that they are up to date with the payments. Either way, this cannot be good news for Cell C.

We still believe this is a long term hold in a sector that just has to grow as Africa craves connection.