Market Scorecard

Global markets are rather ugly at the moment, which is not a great way to start the week. Chinese stocks are down over 3% this Monday morning, with Tencent down around 4%. Predictably, the JSE All-share has opened lower today. The one buffer that our local market will have is a weaker Rand, which is almost trading above $/R15.00 again. Over the weekend,

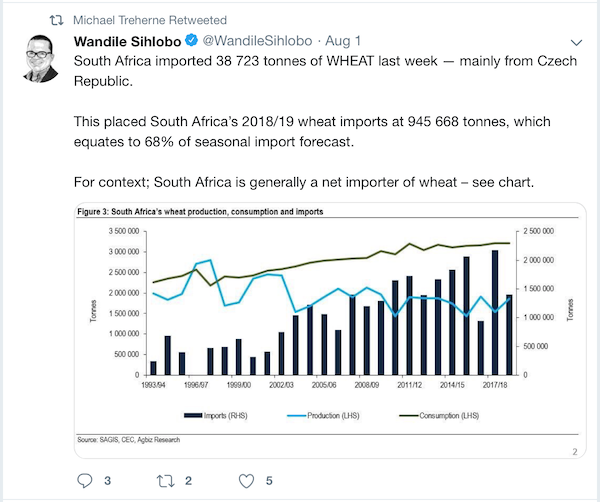

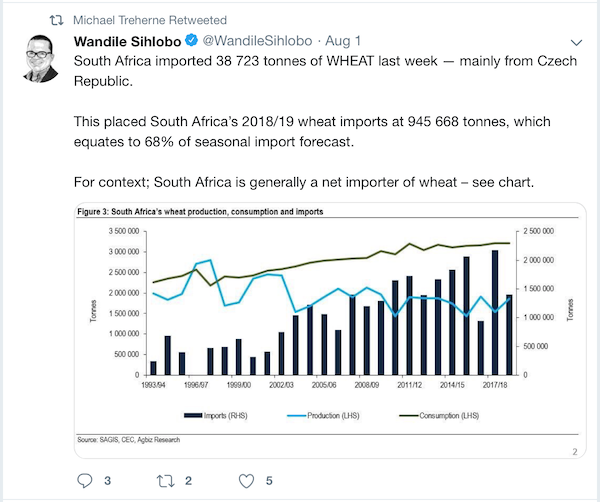

China announced that their State Owned Enterprises would stop buying US agricultural products, which is a direct shot at Trump. Farming areas of the US are mainly full of Republican/Trump supporters. By making them feel the impact of his trade war aggressions, the hope is that makes the White House think twice.

China has also allowed its currency to weaken against the US Dollar. Effectively, a weaker currency means that Chinese goods are cheaper for the US to import, helping negate the effect of Trump's tariffs on products imported by China. Bloomberg is reporting that key Chinese officials are on holiday at the beach for the next two weeks, on some kind of "bosberaad". These Sino American tensions will probably hang around for the foreseeable future. Over the last 18 months we have seen tensions rise and fall a few times, and we are still standing. Our advice to you is to

keep calm and carry on.†

On Friday the

JSE All-share closed down 1.66%, the

S&P 500 closed down 0.73%, and the

Nasdaq closed down 1.32%.

Our 10c Worth

One thing, from Paul

We consider

online travel agencies to be an exciting investment opportunity. Thanks mostly to cheaper flights, making both local and international travel more popular and affordable. Culturally, it is becoming normal for both young and older people to visit other countries. We own shares of the largest listed online travel company,

Booking.com but there are others like

Expedia,

Tripadvisor,

Ctrip and

Trivago.

Airbnb is not listed yet.

†

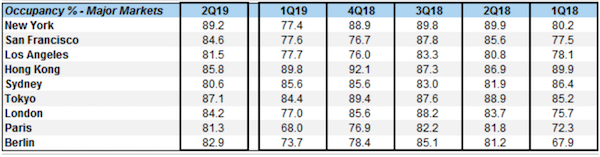

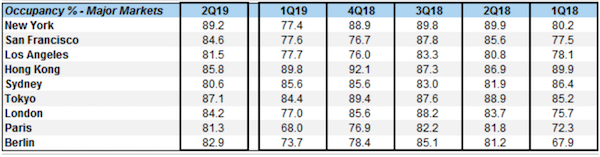

One thing that I have noticed in recent industry reviews is the complaint that

there are simply not enough hotel beds to sell. In other words, hotel occupancies are too high, limiting growth. It's taking time for hotel property developers to catch up.

†

Here is a table from Smith Travel Research (STR), an American company based in Tennessee, that tracks supply and demand data for the global hotel industry. What it shows is that

hotels in major urban tourist destinations around the world are basically full. Note that a hotel occupancy rate of around 85 percent is considered ideal, because the cost of managing anything higher is very high in terms of cleaning and other staff resources.

†

†

There is some seasonal variation in the data. For example, New York, which is horrible in the first quarter of the year (it's freezing there from the start of January to the end of March) is "only" 77.4% full. It's 90% full for the rest of the time.

†

Booking.com†reports its quarterly numbers on Wednesday after the market close. We expect them to make about $22 per share of earnings, which is about 15% higher than this time last year.

Michael's Musings

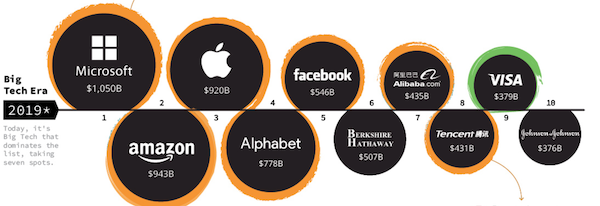

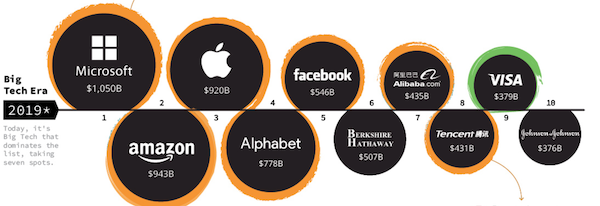

It is always interesting to see how companies evolve over time. The size of a company, as measured by its market capitalisation, is a mixture of how successful it is today and the growth potential that the market thinks it has for the future. At the moment, tech companies dominate the list of the biggest. It is easy to understand why.

They are highly profitable, sitting on tens of billions in cash and only half the globe currently has access to the internet. You can read more here -

A Visual History of the Largest Companies by Market Cap (1999-Today).†

Of the ten companies pictured, Vestact owns all of them to varying degrees, and we plan to continue to hold them. Things change, and one day our thesis on these companies may change. In time we will move on to other investing themes and hopefully we will move into the next global leaders. For now, we are happy where we.†

Bright's Banter

Spotify

released its second quarter earnings and the highlight was the fact that it has over

108 million premium subscribers who pay $10 per month and 232 million monthly active users. The Swedish music streaming giant saw revenues increase 31% year-on-year to $1.86 billion, helping to narrow the loss to $3.34 million.

Spotify recently introduced a campaign which offered customers access to Spotify premium for $1. This pushed the average revenue per user down by 1% to EUR 4.86 from EUR 5.42 as compared to last year. The company expects to see this number continue to go down for the rest of the year as the campaign is ongoing.

Spotify said that it had reached an agreement with two of the four major record labels for licenses and is in ongoing talks with the other two. The company also said that

podcasting had attracted 50% more audience as compared to last quarter, thanks to those acquisitions of Parcast, Anchor, and Gimlet media which I wrote about a few months ago.

Apple Music now has 60 million paying subscribers, which is a bit disappointing considering the fact that when Apple Music launched in 2015 it hoped to overtake Spotify.

The chart below shows how Spotify has managed to keep Apple Music at bay in the Music Streaming arms race. The chart shows a widening gap between the two.

You will find more infographics at

Statista

Linkfest, Lap it Up

As the cost of university tuition increases, parents are finding bizarre ways to ensure that their children are eligible for financial aid. For every system, there will always be a loophole -

In a sequel to the 'Varsity Blues' admissions scandal, parents are gaming guardianship.†

Anyone for temperature controlled clothing?

Anyone for temperature controlled clothing? It is probably only a matter of time until we start to see things like these in mainstream retail stores -

The world is getting hotter. Can temperature-controlled clothing provide some relief?.†

Vestact Out and About

Vestact Out and About

Get your weekly wrap here, with Bright and the team from BDTV -

The Week That Was - 02 Aug 2019.†

Byron gets a mention in this article talking about the performance of South African companies which invested offshore in recent years -

Truworths shares hit nine-year low on R1.7bn UK write-down.†

Signing off

Signing off

US earnings season continues, but slows down a bit. Vestact will be watching out for†Booking.com†on Wednesday and Uber on Thursday. South African earnings season is about to start, with our local banks reporting this week. Today there is PMI data from South Africa, the UK and the US. In the middle of the morning today there will be a South African business confidence read. That is unlikely to be good.†

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista