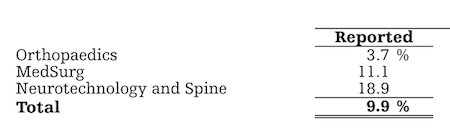

On Thursday night Stryker released second quarter results which impressed the market. Sales increased by 9.9%. Take a look below at their three divisions and where that growth came from.

Of the $3.7bn in sales, Orthopaedics contributed $1.3bn, MedSurg (Medical Surgery) $1.6bn and Neurotechnology and Spine $0.8bn. As you can see, this is an exceptionally well rounded medical devices business. The picture below is of a Robotic Arm Assisted Surgery Device known as Mako.

Acquisitions contributed to 3% of their sales growth. This is important to note because part of their strategy is to implement strategic bolt on acquisitions. There is a lot of innovation in this sector, Stryker has the size and scale to scoop up exciting new products and add them to their distribution networks.

The good sales growth resulted in adjusted earnings per share increasing by 12.5% to $1.98, well ahead of consensus. The overall earnings outlook was also increased nicely to $8.15-$8.25 from $8.05-$8.20.

This is a well run company operating in a growing sector. Medical devices is a lot less scrutinised by regulators than the drug companies. Stryker is a solid entry to the healthcare sector and should be held in all accounts.