Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

MultiChoice released results yesterday for the year ended 31 March 2019. Holders of Naspers received Multichoice shares earlier this year by way of a share unbundling. We wrote to Vestact customers in February, advising you to keep these shares, as they were likely to do well.

As we noted then, "Multichoice is the leading video entertainment operator in Africa, with over 13.5 million household subscribers (at the end of March 2018) in 50 countries across multiple platforms, including digital satellite, digital terrestrial and online. Of those users, 6.9 million were DStv subscribers in South Africa and 6.6 million subscribers were elsewhere in Africa."

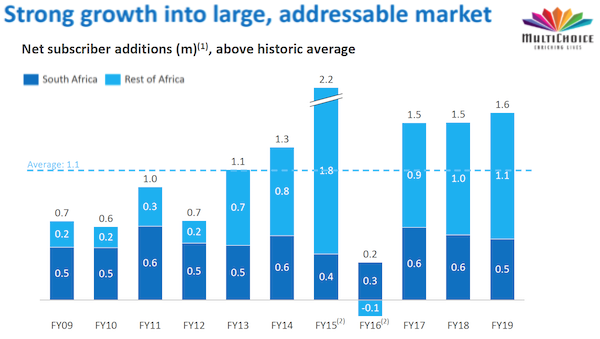

We pointed out that "Multichoice also has lots of growth potential in Africa outside of South Africa. There are at least 40 million addressable households across its 50 markets. Some of these operations are new and currently loss-making, but scale is everything."

In yesterday's results, this growth was in evidence. They increased the subscriber base by 12% to 15.1 million active households. Of that, 1.1 million net additions were in Africa outside of South Africa, which was up 17% compared to last year.

Sign-ups for digital delivery services, like Showmax and DStvNow are growing fast. Local content production is up, and the sports offering is still amazing.

The group has a very strong financial position. Revenue was up 6% to over R50 billion and core headline earnings rose 10%. In line with the plan communicated at the time of the listing, there was no dividend declared this time, but they plan to pay out R2.5 billion in the financial year 2020 (that should be about R6 per share).

The stock has done well since making its market debut, rising from a low of around R93 per share shortly after coming onto the market to R130 per share now. Hold on to this one, or even buy some more.