Market Scorecard

Following the ADP jobs numbers on Wednesday, the official employment figures out on Friday were equally disappointing. Well, disappointing is relative. The number of new jobs created in the US was only 75 000, instead of the 185 000 expected. The unemployment rate stayed steady at 3.6%, so not terrible numbers. What it did confirm though is that the US economy is slowing, which means interest rate cuts! Stocks were flying on Friday on that anticipation, the banks weren't though. Lower interest rates means weaker margins for them.

More good news for markets is that the US and Mexico have reached an agreement to delay tariffs that were meant to be implemented today.

Vestact have been saying for a while now that we believe interest rates will be lower for longer than many people expect. Now with talk of interest rate cuts, that trend looks to be extended. As it stands with current economic data though, it would be surprising to see the Fed drop interest rates aggressively. So maybe the market is getting a bit ahead of itself? Only time will tell. What this last week does demonstrate though, is how quickly sentiment can change and how quickly markets respond to that change in sentiment.

This is why timing the market is so difficult. No sooner have you moved to cash because of an impending trade war, then the Fed is expected to drop interest rates and the market does a complete 180. Too volatile and too difficult to do.

It is why we advise clients to just be patient long term holders.

On Friday the

JSE All-share closed up 1.77%, the

S&P 500 closed up 1.05%, and the

Nasdaq closed up 1.66%.

Our 10c Worth

Byron's Beats

Apparently Google made $4.7bn from the News Industry in 2018. As you know, Google sells advertising space on the internet. As you may also know, most people read their news online these days. Advertising in Newspapers a few decades ago was thriving, but today, Google owns a huge chunk of that market. Although this is only a corner of the market where Google operates, it is big and influential.

It may get blocked by the competition authorities, and it will certainly freak out the lefties who think tech has too much power, but I think Google should buy Twitter. Twitter and news are synonymous. They have hinted at this before. Take it or leave it Sundar Pichai.

Michael's Musings

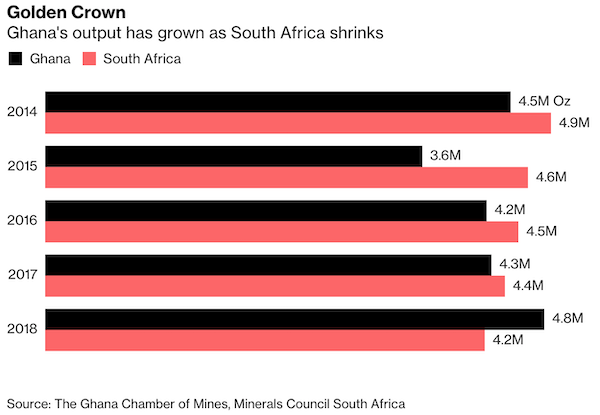

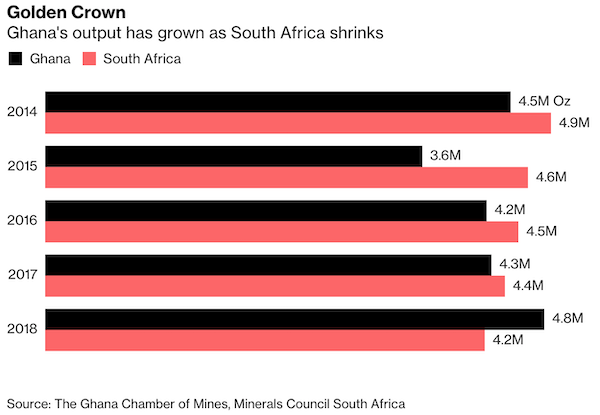

I remember the day I heard that South Africa lost its crown as the globes top gold producer. The shiny metal holds a central place in the formation of our country; Joburg exists because of gold found here only 133 years ago. The Anglo-Boer war was over the right to control the wealth created from these new mines. I read somewhere that if you total all the gold mined through history, more than half of it has its roots in South Africa. I tried to find a cool link about it but couldn't find one.

Last night, my phone popped up with a Bloomberg article saying that South Africa is no longer the largest gold producer in Africa. The new holder of that crown is Ghana -

The African Nation Built on Gold Loses Its Crown to a Rival.

This change highlights how our economy has changed over the years. Every time our GDP figures are released, I am reminded how small our mining industry is becoming; South Africa is now a services-based economy.

The same applies to the JSE, in years gone by the market was dominated by mining companies.

If you bought an index tracker, your returns were dominated by how well commodities were doing. Now, it is dominated by multinational industrial companies, where the price movements in Chinese Tencent has a bigger impact on the index than any single mining company.

Bright's Banter

There's a new "trade-war proof" fund in town. It has a mandate that only allows it to invest in companies that have a large number of government contracts, making a huge bet that they will be shielded and insulated from the tariff man and his tariff shocks. What could go wrong working with the government?

The fund can be found under the ticker/code "TWAR" which I guess stands for both Twitter WAR or Trade WAR.

According to Quartz, the fund aims to target multinationals that have strong innovation and intellectual property and benefit from what it calls "government patronage".

The funds top five holdings have earned a combined total of approximately $100 billion in US federal contracts since 2008. By focusing on companies that have shared their intellectual property with governments, the fund is bucking the received wisdom that technology transfer is a threat to companies.

They believe that sharing intelligence incentivises government to favour those companies, and that in return will be protected against political shocks which aren't limited to just trade wars. I'm sceptical of this super alternative mandate, its top holdings include General Electric, Cisco, AMD, Xerox, and IBM.

Linkfest, Lap it Up

Linkfest, Lap it Up

Ouch! That is a steep price tag, not to mention the time delays of changing suppliers -

Europe's 5G to cost $62 billion more if Chinese vendors banned.

That is a lot of patents!

That is a lot of patents! Maybe the moral of the story here is to go into patent law?

You will find more infographics at

Statista

Vestact Out and About

Catch up with the team to hear about news moving markets last week -

The Week That Was - 07 June 2019.

Signing off

Signing off

Data out of Asia this morning was positive, Japan had better than expected GDP growth and China had better than expected export data. Then at 10:30 our time, the UK has GDP figures, how much will Brexit uncertainty hurt their economy? Then at 11:30 our time, the Proteas try to win their fourth toss in a row. The JSE All-share is higher this morning.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista