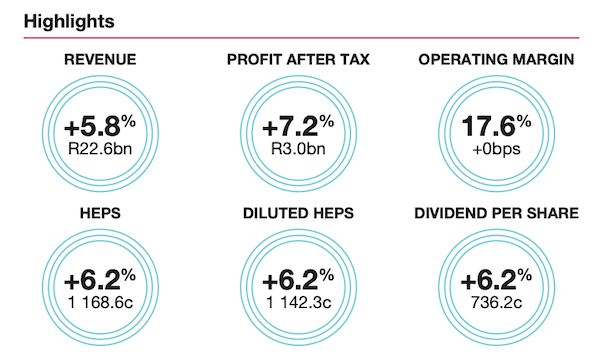

On Friday Mr Price released full-year results. Here are the highlights.

The market thought these numbers were fantastic and the share price rallied 11%.

It got me thinking, how has Mr Price done over the last 5 years considering that they didn't do a large offshore acquisition like many of their peers? I then decided to compare that performance to Woolworths who bought David Jones in Australia.

As you can see, Mr Price has not exactly blown the lights out. But they have managed to at least hold most of its value. Whereas Woolworths has trickled downwards as they wrote down that DJ acquisition.

As you know, we hold Woolworths and still do. We don't think now is the right time to sell. The bad news is priced in and they still can turn that Australian business around. If the SA economy turns, both Woolies and Mr Price will enjoy solid gains in sales.