I am now heavily invested in Uber. After its rather muted listing earlier this month, there was plenty of opportunity to load up on stock at around the $40 per share. It's now the third most valuable holding in my portfolio, which should tell you something considering how long I have been an equity investor.

One of the reasons that I got really stuck into this one is that I believe that there will only be one dominant ride-hailing player in most markets. That's partly due to consumer choice and driver availability, and partly due to the ability of larger players to raise lots of capital to fund losses during this growth phase.

Mobility is very important to humans. Car ownership is expensive and inefficient, and driving is dangerous. In time, supplying additional services like food and shopping delivery, and autonomous vehicles will improve margins.

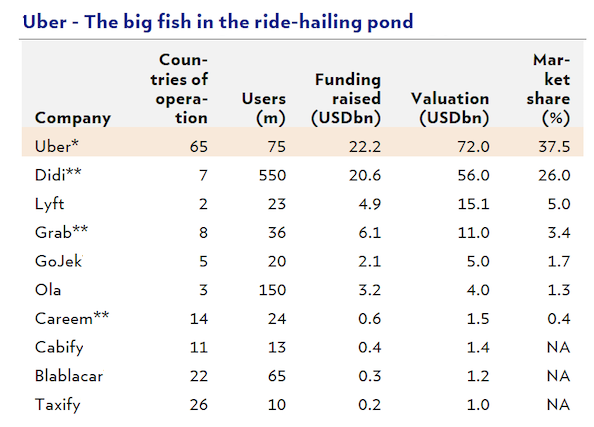

The table below is from a Julius Baer report, and ranks the contenders. Uber is in pole position. Remember too that Uber also owns 15% of Didi Chuxing, 23% of Singapore-based Grab and 38% of Yandex taxi in Russia. It has already agreed to pay $3.1 billion to buy 100% of Careem.