On Friday morning Richemont released their full year numbers. It was a big year for the group because management moved the company into online retail in a big way. They bought the shares that they didn't own in Yoox Net-A-Porter, and they bought Watchfinder, a leading omni-channel platform for premium pre-owned timepieces.

As a result of the two purchases, you can't easily compare these numbers with last year's figures. If we strip out the acquisitions, their sales were higher by 8% and their gross profit margin increased to 66.3%. When you add in their new digital division, overall gross profit margins and operating profit margins took a dive. While the digital arm built scale, it is like most new technology companies and is loss making.

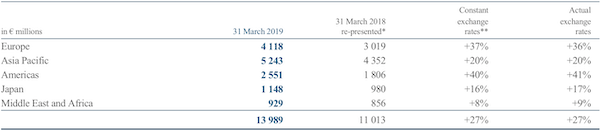

I suppose the number that counts is headline earnings (HEPS). The group reported HEPS that were higher by 15% and increased the dividend by 5%. Luxury as a whole is on the up again, after recovering from an industry reset when the Chinese cracked down on gifting. The Richemont share price probably won't shoot the lights out, but it has the potential to keep ticking higher and generating cash for shareholders. The share finished up over 4% on Friday, one of the only green stocks locally.