Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

On Wednesday evening Facebook released Q1 numbers. The stock popped 9% in after-hours trade and closed the day out up 6%.

Over the last year, they increased their revenue by 26% to $14.9 billion for Q1. As mentioned before, Facebook is ramping up their headcount to offer a better service and to better police the site. Over the previous year, their headcount increased by 36%. Extra salaries to pay means that their operating margin decreased from 46% to 42%. Even with the decline, their margins are better than most.

The organisation is a cash printing machine! Their free cash flow from operations increased from $7.8 billion to $9.3 billion, for the quarter. That is over $3 billion in free cash flow every month! Thanks to all the cash coming in they are currently sitting on $45 billion.

Probably the biggest news in the numbers is that they expect to get a fine from the U.S. Federal Trade Commission (FTC) of between $3 - $5 billion, relating to data and privacy breaches. Ouch!

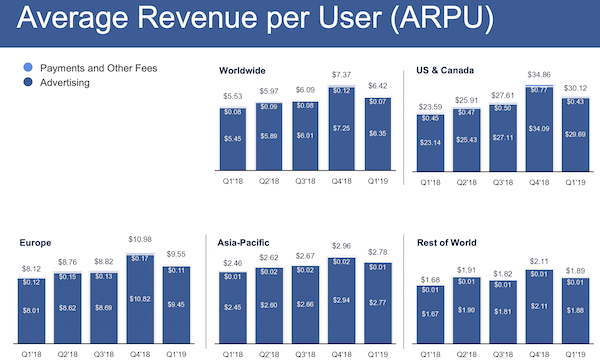

Looking at the platform, their Daily Active Users (DAU) increased 8% to 1.56 billion people, and Monthly Active Users (MAU) increased 8% to 2.38 billion people. The key metric for me though is the Average Revenue Per User (ARPU). The graph below shows how ARPU's are trending higher. More importantly, it shows how much more many can be made by all regions if they close the gap on the US & Canada. Even with zero user growth, their revenues can continue growing.

As Paul mentioned earlier this week, Vestact is still buying Facebook. The company still has huge potential, it just needs to get out of the sights of global regulators.