Market Scorecard

Welcome back to work, if you are working this week, it is the second of four 4-day working weeks. What will we do later in May when we go back to having to work 5-day weeks? Great job to Bright and Paul for completing the full Ocean's over the weekend.

US earnings season is now in full swing, with the next few days arguably being the high point. Today there is Stryker; then tomorrow is Visa, Facebook and Microsoft; Thursday is Amazon, Starbucks and Illumina and next week Tuesday is Apple. The reporting for these heavyweights will set the tone going forward. Exciting times!

On Thursday the

JSE All-share closed up 0.53%. Yesterday the

S&P 500 closed up 0.10%, and the

Nasdaq closed up 0.22%.

Company Corner

Bright's Banter

The worlds largest FMCG company Nestle seems to be doing better than before. The company

reported a 4.3% increase in sales in the first quarter and this is thanks to their partnership with Starbucks as people enjoy drinking a Starbucks coffee outside of Starbucks.

In May last year,

Nestle announced that it was going to pay Starbucks a mouthwatering $7.1 billion to license its brand of packaged coffee products sold outside of Starbucks chain stores. For example, the Nespresso capsules/pods and branded beans that are sold at your local grocer.

In February this year,

Nestle launched a new range of 24 Starbucks-branded products. These include whole bean, roast, and ground, as well as capsules/pods developed using the Nespresso and Nescafe Dolce Gusto coffee technology.

Nestle said it expects continued sales growth in the 2019 financial year, thanks to coffee as well as strong performance from the pet-care products portfolio. With the constant change in consumers food taste, Nestle has to play catch-up and also expand beyond its comfort zone to see meaningful growth.

Our 10c Worth

Our 10c Worth

One thing, from Paul

Facebook gets a lot of bad press, so we are quite often asked why it remains a Vestact recommended portfolio holding. The criticisms of the company mostly relate to the main Facebook platform, where

some feel that it does not do enough to prevent the spread of fake news, hate speech and terrorist propaganda. Others feel that it is bad for society, as people spend too much time online, instead of chatting in person. The

company's privacy policies are also attacked, and its CEO Mark Zuckerberg is accused of selling users' personal information to advertisers and other shadowy intermediaries.

I don't think that those criticisms are fair. For one thing,

Facebook can't police every single thing that its community of billions of users post. How would you feel if everything that you wanted to put up on Facebook was delayed by a day before appearing, while someone in a cubicle farm somewhere in the world had to moderate or approve it first? Also, what about free speech? On balance, I feel that they do a reasonable job in taking down really offensive material like the recent New Zealand mosque attack footage.

Fake news is also hard to combat because right-wing groups and Russian spam bots compose messages and save them as jpegs (picture files) before posting them. Those are harder to catch than text messages, obviously. Plus, they get re-forwarded by cranky old users who actually believe the content.

As for privacy concerns, it is the responsibility of users to check their settings.

If you don't want your interests to be assessed by the company's database systems and used to present you with tailored content and ads, then perhaps you should tell them that? Or leave altogether? Despite all the anti-Facebook yelling about privacy concerns, research shows that very, very few users are bothered by these issues.

In any event,

Facebook stock has been trending higher in recent months, as you can see from the one-year stock chart below. It closed at $181.44 in New York last night (they don't take a four-day Easter holiday over there). The all-time high was $209.94 in July 2018, so it still has some way to go.

There are a couple of reasons for the move higher that I can think of.

Firstly,

Facebook also owns Instagram, which has been doing very well. It now has over a billion monthly active users, and over 500 million users who access it every single day. Over 70% of its core audience is under the age of 35. Brands do very well on the platform, meaning that spending by large consumer companies on Instagram is soaring.

Secondly, the core market for Facebook is still the US. The North American ARPU (average revenue per user) is about $35 per quarter.

With a Presidential election coming up, Facebook stands to benefit from a surge in political advertising. Donald Trump's 2020 re-election campaign is spending 44 percent of its Facebook advertising budget to target users who are 65 and older, according to a report from Axios. He has already spent $4.5 million on Facebook and Google ads in the first two and a half months of the year. Brad Parscale, who was the digital director for Trump's 2016 bid and is now his 2020 campaign manager, said in an interview with CBS's 60 Minutes in October 2017 that Facebook "was the method" behind Trump's success. Democrats certainly won't take this lying down and they really, really want to defeat him, so expect their spending to skyrocket in the months ahead.

Finally,

Facebook also owns WhatsApp, with its billions of users, the company is rolling out monetisation strategies for that too. They include applications for businesses to service customers via the platform, and inter-user payment systems.

All-in-all, a good stock to own! I do, and so should you.

Facebook is expected to report first-quarter earnings tomorrow after the market close. According to an aggregate of 14 institutional analysts' forecasts, the consensus earnings per share forecast for the quarter is $1.65. We will certainly cover the numbers in this newsletter.

Michael's Musings

I found this blog post very interesting.

Why is it that we don't talk about money? Men would sooner talk about their feelings than how their finances are doing. Nick, the blogger, speculates that money translates into our status in society. The fear is that being honest about our finances will change how people perceive us.

"Before you start shouting that "Money isn't status" or "Net worth isn't self worth," let me say that I agree with you. We should never treat people differently based on the number of commas in their bank account. If you polled most people, they would likely agree with this statement. However, do you think that those same people would treat a homeless man the same as a rich man? I think not."

How many people speak to their children about the home's finances? About how the budget is composed and how to save and grow money. We don't learn these skills at school, and if we are not learning about it at home, where will the next generation learn them?

Here is the blog -

The Money We Don't Talk About

Linkfest, Lap it Up

Imagine analysing ice that is 1.5 million years old! -

This ancient ice core could reveal 1.5 million years of climate history

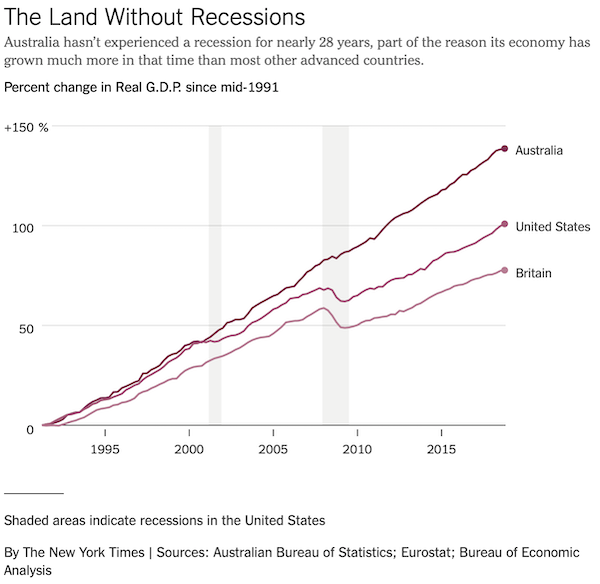

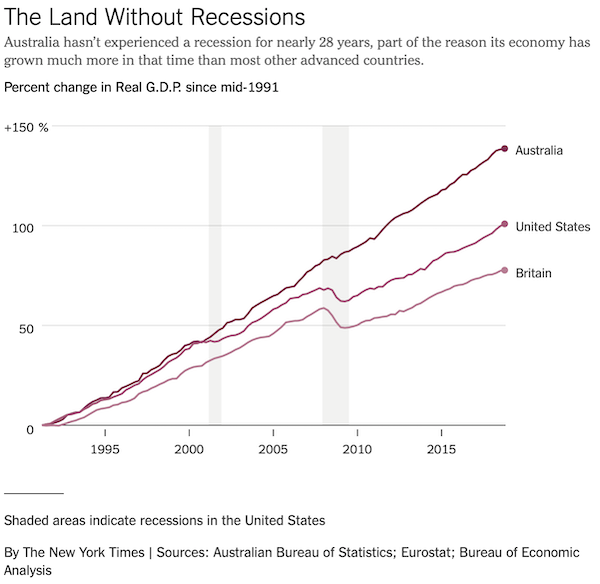

Thanks to a combination of natural resources and policy, Australia has been recession free since

93 1991 -

What the Rest of the World Can Learn From the Australian Economic Miracle.

Vestact Out and About

Vestact Out and About

Signing off

Signing off

The JSE All-share is very slightly higher this morning. Bloomberg noted this morning that the oil price has surged 40% in 2019, a mixture of production cuts and Iranian sanctions taking hold. This is very bad for the South African consumer, with fuel taxes being shunted higher, increasing oil prices is a double whammy. The only data point of note today, is new home sales figures from the US.

Sent to you by Team Vestact.