JPMorgan kicked off the 2019 earnings season with better-than-expected numbers, thanks in part to higher interest rates late last year.

Banks are seen as a bellwether for the broader economy. The record profits and revenues from JPMorgan are telling us that the US economy is still firing on all cylinders, regardless of the government shutdown that happened in the first quarter, Brexit fears and the not so exciting trade war with China.

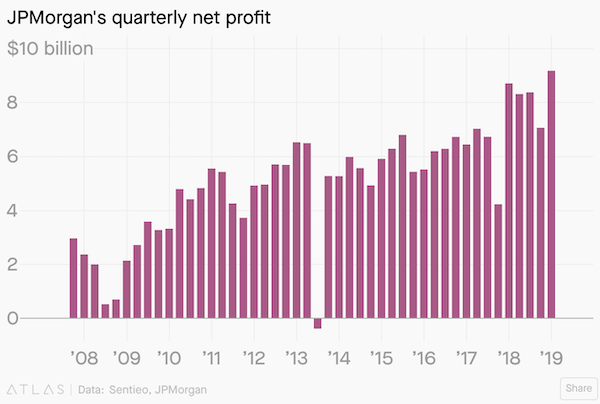

Revenues for the bank were up 5% to $29.9 billion and profits were also up 5% to a record $9.2 billion for the quarter. Net Interest income was up 8% to $14.6 billion thanks to the impact of the higher rates.

The bank's consumer lending division saw stronger profit margins on deposits and loans grew across the credit card and auto units. Provisions from credit losses were flat at $1.3 billion. CEO Jamie Dimon said the following:

"We had record revenue and net income, strong performance across each of our major businesses and a more constructive environment...Even amid some global geopolitical uncertainty, the U.S. economy continues to grow, employment and wages are going up, inflation is moderate, financial markets are healthy and consumer and business confidence remains strong."

The Fed did indicate that it's unlikely to hike rates any further in 2019, which means that the growth in interest income could stall in the coming quarters. We like JPMorgan, it is a well run bank, in the best economy in the world. This is why it has space in your portfolio.