Market Scorecard

Last night US markets closed in the green, marking eight straight sessions of being in the green!

That is the best streak in over 18-months. Asian markets are mixed this morning, so time will tell if the US can make it nine days in a row of gains.

Over in the UK, the House of Lords approved the House of Commons bill not to let the UK crash out of the EU without a deal. That means Theresa May has a handful of days to negotiate an extension deal with the EU. To ratify the extension deal, all 27 other EU countries need to agree to it though. The biggest problem with delaying Brexit further is that the uncertainty will continue for another year.

Uncertainty is not good for business. S&P estimate that this mess has already cost their economy GBP 66 billion! (

The price of Brexit has been more than R1 trillion so far, plus an impending recession - and it hasn't even started yet).

Yesterday the

JSE All-share closed up 0.36%, the

S&P 500 closed up 0.10%, and the

Nasdaq closed up 0.19%.

Company Corner

One thing, from Paul

Vestact recommended

pharma company Amgen has an extremely promising drug called Erenumab (trade name Aimovig) which is a medication which targets the calcitonin gene-related peptide receptor (CGRPR) for the prevention of migraines. It was approved by the US FDA in 2018.

As you can see from the picture, the drug is sold with an auto-injector so that the monthly dose can be taken subcutaneously. The list price is about $6,900 per year.

Because Aimovig was the first in this class of migraine drugs to get FDA approval, it got the upper hand and controls 53% of the market.

US sales of Aimovig were $119 million in 2018, but Wall Street analysts think sales could reach almost $2 billion by 2025.

In 2015 and 2017,

Amgen signed development and marketing agreements with Swiss-based competitor Novartis (including its subsidiary Sandoz) to sell the drug outside of the US.

Unfortunately, the

migraine drug partnership has become a headache (please excuse the pun), and a legal fight has erupted between the two parties. Amgen terminated the contracts last week, alleging that Sandoz (i.e. Novartis) violated the terms by helping another company, Alder BioPharmaceuticals, make a competing migraine drug. Novartis admitted this after the fact, yet said it would still help Alder for another five years, according to Amgen's lawsuit.

Novartis denies the claims, arguing it didn't significantly breach their agreements because Alder's pending product isn't a true competitor. Instead, Novartis asserted Amgen is inappropriately ending the partnership "to keep the Aimovig profits for itself" and before Novartis "has come close to earning a return on its investment."

It sounds to me as if Amgen is in the right and Novartis is in the wrong? Maybe I'm biased, since we have Amgen shares coming out the Wazoo? Let's see what happens. In the meantime, migraine sufferers should continue to benefit.

Our 10c Worth

Byron's Beats

Companies like Amazon, Google and Facebook need their clients to have access to the internet. Because they have already landed most of the existing connected client base they are desperate to see more people connected. So much so that they are willing to provide internet for free.

This is a fantastic outcome for the planet. Access to the internet is a massive equaliser. Over the weekend it was announced that

Amazon will be launching 3 236 satellites into orbit to provide high speed internet around the globe.

It makes sense for Amazon. That is potentially 4 billion new clients who could be buying things online, watching Amazon Prime and most likely using websites that are hosted by AWS.

This is how capitalism can benefit people at massive scale.

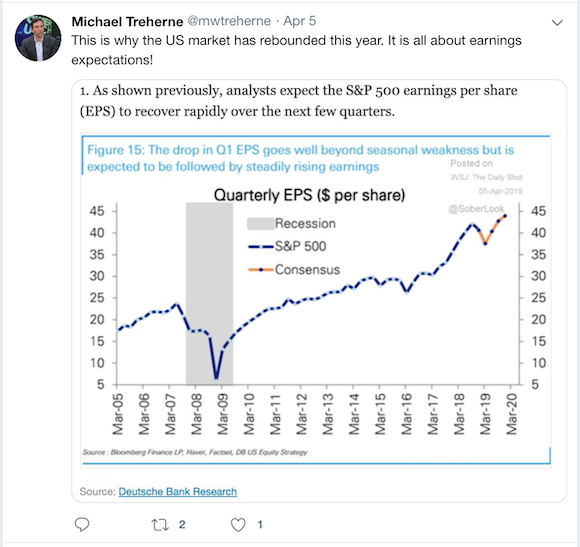

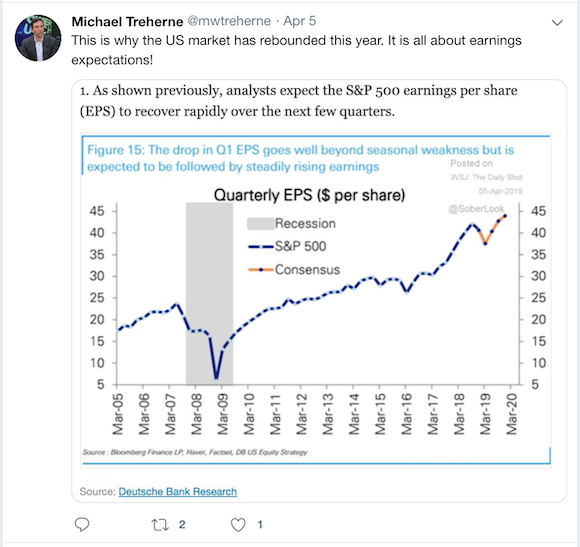

Michael's Musings

One of the things that we do at Vestact is to help ensure a smooth transfer of wealth from one generation to the next. Have you heard the saying, "Shirtsleeves to shirtsleeves in three generations" or the Scottish saying, "The father buys, the son builds, the grandchild sells, and his son begs"?

The Rockefeller's are now on their 6th generationthe family say that one of the best things for them was that there was no family business to fight over. In 1911 when Standard Oil was broken up, the family was just left with shares of many oil companies, no businesses to directly run.

The conservative values from John D, who tithed from his first paycheck, have moved down with each generation.

David Rockefeller Jnr, when interviewed said that he didn't know his family was rich. He only found out when other children at school told him.

Here is the full article -

How the data mining of failure could teach us the secrets of success

Bright's Banter

Nick Woodman,

CEO of GoPro recently announced that his company is unable to meet the surging demand for their action cameras. The reason for this is that there is a shortage on a very small part that these cameras use called the multiplayer ceramic capacitor.

The multiplayer ceramic capacitor is a very small item to build and manufacture, and it is used on cars, robots, and even phones. There's been a huge demand for them lately and manufacturers don't seem to care about ramping up production.

The process of making these capacitors is very complicated, but the margins are razor thin. Manufacturers are scared that if they start ramping up production and demand crashes, they will be left with a large number of these tiny items on hand, meaning a lot of their capital will be sitting in stock and they don't like that risk.

Recently demand has helped drive margins up which leaves manufacturers between a rock and a hard place. Do they take the big risk of ramping up production in hopes that the demand stays where it is today? Or they play it conservative and work on a case by case basis, whatever the answer, GoPro is hurting!

Linkfest, Lap it Up

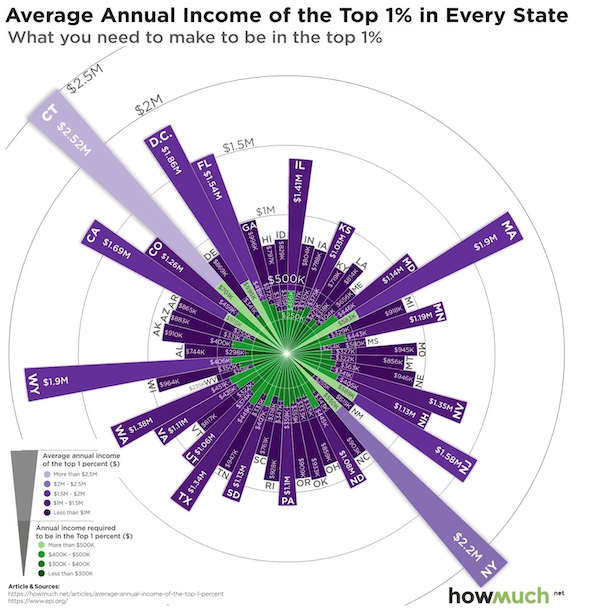

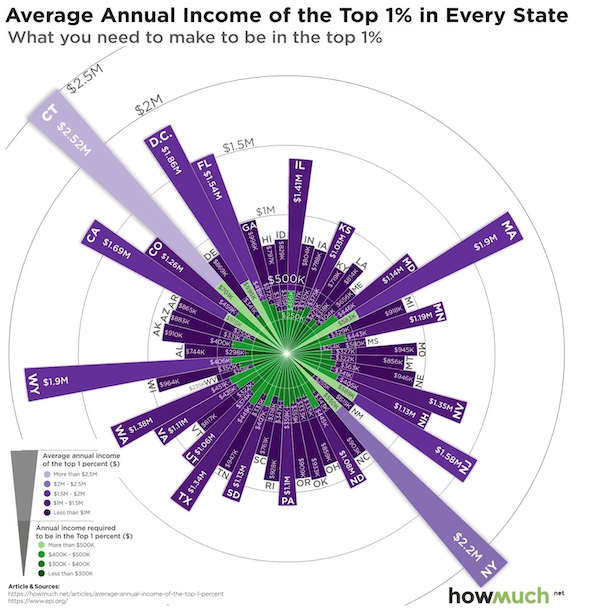

If you want to be a 1 percenter, here is how much you need to earn in each US state -

This is how much you need to get paid to crack the 1% in each state

E-tail continues to take over your shopping spend

E-tail continues to take over your shopping spend. Increased e-tails, means increased cashless payments. Long Visa and Amazon!

You will find more infographics at

Statista

Vestact Out and About

Signing off

Signing off

The JSE All-share is very slightly higher this morning and the Rand has steadied slightly above $/R14.00. In a month today we will know what our new parliament looks like, and South Africans can then focus on building the country instead of trying to say outrageous things to get the most retweets. There is not much data out today.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista