Market Scorecard

US Jobs day on Friday reported a figure stronger than economists had expected, more than making up for the poor showing from February's data. For the month of March the US economy added 196 000 jobs, the unemployment rate stayed constant at 3.8% and wages grew by 3.2%. All numbers point toward a strong US economy. More data like this will hopefully quell all the talk of an impending recession.

Now that the jobs report is done, the market will switch its attention to earnings season which kicks off on Friday with the big banks. For Vestact, we will be paying close attention to JP Morgan. Can you believe that it is earnings season again? It feels like we just had one.

On Friday the

JSE All-share closed up 0.11%, the

S&P 500 closed up 0.46%, and the

Nasdaq closed up 0.59%.

Our 10c Worth

One thing, from Paul

What is the

most popular financial product in the world? Is it shares in Apple? US Treasury bills? Gold coins? $100 dollar bank notes? Units in the S&P500 exchange traded fund?

None of the above! The answer is units of the

Tianhong Yu'e Bao Fund. More than a third of China is now invested in one giant unit trust. There are 588 million active users of Alipay, and they all have cash parked in Ant Financial's flagship fund. Its assets under management were 1.13 trillion yuan ($168.26 billion) at the end of last year.

According to the Wall Street Journal, the fund's name means "leftover treasure". It lets users of Alipay invest their spare cash for short periods before they spend their money online. Its investments in bank certificates of deposits and other high-yielding products gives it an annualized yield which was recently 2.4%, which is well above short-term Chinese bank deposit rates.

One third

Naspers owned Tencent also has a money fund, called Lingqiantong, which is catching up fast.

More from the Wall Street Journal (may require a subscription):

click here

Byron's Beats

Permabears make me very frustrated. You saw Paul chatting about Nouriel Roubini last week but there are many more out there like him. They have cost investors billions of dollars by convincing them to get out of equity markets.

Humans progress, businesses improve and our populations increase. Equity markets will trend up because of this.

Josh Brown and Michael Batnick, the kings of Twitter Finance, have a really cool YouTube channel called The Compound.

Here they talk about permabears with immense frustration. It is great to watch!

Michael's Musings

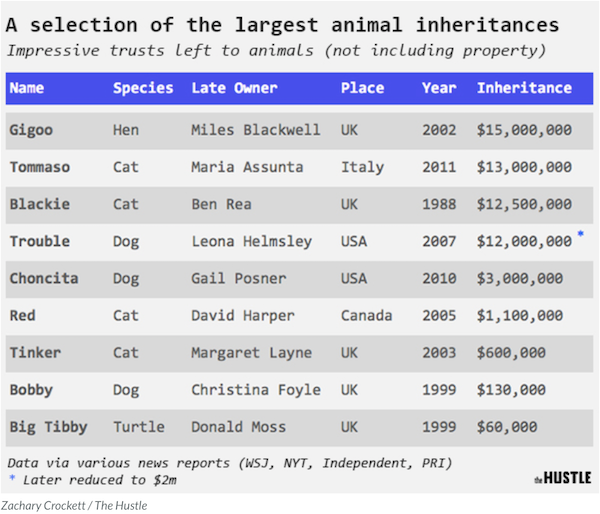

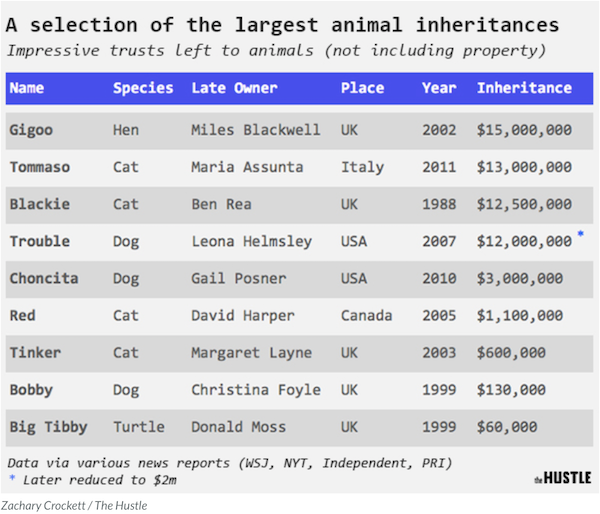

If you think about it, leaving some money behind to look after your pet once you have left the land of the living is a prudent thing to do. Food and annual check-ups are not free.

The article says the average cost of keeping a dog in New York is $2 858 a year! Thank goodness it is cheaper in South Africa.

Leaving behind some money to keep up with the annual cost of having a pet is fine, what blows my mind is leaving millions to your pet. Humans can find any number of ways to blow through millions of dollars, from cars and houses to clothes to luxurious holidays. What will a dog spend it on? Food and daily grooming?

You can read more here -

The wild world of trust funds for pets

Bright's Banter

Liquor producer famous for brewing Corona beers

Constellation Brands is trying to get rid of its bottom shelf "price-conscious" wines and spirits to the tune of $1.7 billion. That's a lot of cash sitting in working capital if you ask me!

The list of these wines and spirits comprises of 30 labels which include wines like Clos du Bois and Ravenswood, cheap stuff that usually goes for around $11 a pop or less. The company prefers to retain the more expensive wines such as Robert Mondavi and the Prisoner.

If you remember, last year

Constellation spent almost $4 billion to increase its stake in a Canadian canibanoids producer Canopy Growth in order to change with the times. We are quite happy to be out of this industry as a whole as there's been a lot of sudden regulatory changes after studies have shown that liquor is very dangerous for your health.

Linkfest, Lap it Up

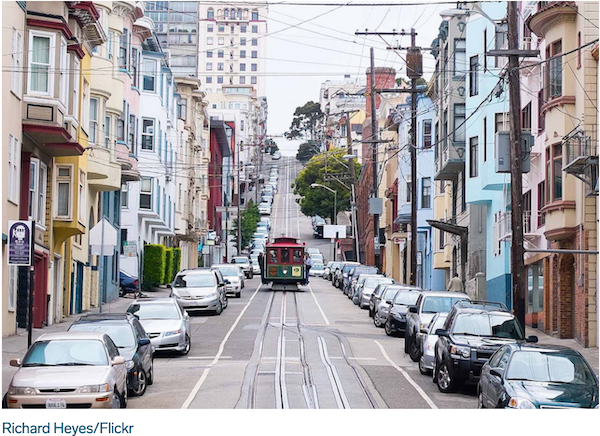

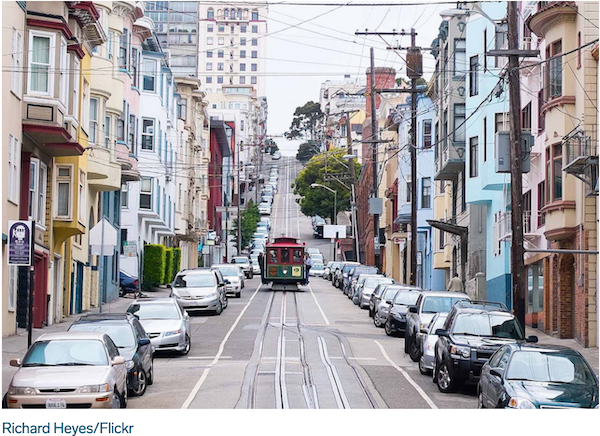

Imagine earning R1.7 million a year and still being considered 'low-income'. Part of the problem in San Fran, is that there are government restriction on the height of buildings. Demand now far outstrips supply -

San Francisco is so expensive that households making over $100,000 a year qualify for low-income housing.

To protect their brands

To protect their brands food producers are lobbying lawmakers to be more strict about the wording used in food descriptions -

Arkansas lawmakers have passed a law against cauliflower rice

Vestact Out and About

Vestact Out and About

Did you catch the latest episode of Business Day's

The Week That Was - 05 April 2019?

Signing off

Signing off

Asian markets started the day higher and have just slid through their trading session. The big events for the the week are the Brexit talks, there will either be a deal or a long delay. Then MTN's Jumia might be listing this week, the Nasdaq webpage has not been very forthcoming with information though.

Sent to you by Team Vestact.