Market Scorecard

There is a new timetable for the resolution of the US and China trade war. President Trump announced that he thinks they are four weeks away from reaching a deal and then a further two weeks to draw up all the paperwork. Can you imagine how many pages this thing will be? All in all six weeks until this chapter of international politics is done. There will be a signing summit between Trump and Xi at the end. It will be HUGE and the greatest.

Yesterday the

JSE All-share closed down 0.37%, the

S&P 500 closed up 0.21%, and the

Nasdaq closed down 0.05%.

Company Corner

Byron's Beats

You may have noticed that Tesla dropped 8% last night. That is because they announced delivery numbers that disappointed the market. In the first quarter they produced 77100 vehicles but only delivered 63 000. This was down 31% from the previous quarter but still up 110% from the first quarter last year.

So what went wrong? I will let the company explain.

"Due to a massive increase in deliveries in Europe and China, which at times exceeded 5x that of prior peak delivery levels, and many challenges encountered for the first time, we had only delivered half of the entire quarter's numbers by March 21, ten days before end of quarter. This caused a large number of vehicle deliveries to shift to the second quarter. At the end of the first quarter, approximately 10,600 vehicles were in transit to customers globally".

This will also mean the company will have a poor financial quarter.

This may have surprised the market but is it really that surprising? Tesla have never delivered so many cars around the world before. There are always going to be teething pains for a company doing something no one else has ever done, mass production and delivery of electric vehicles. If you are looking at the long term picture, is a delivery bottleneck really the end of the world? I don't think so.

What the headlines failed to mention from the release was that the Model 3 was yet again the best selling mid-sized premium sedan in North America. Smashing the runner up by 60% more units.

As we always say, this stock is going to be volatile. If you want exposure, keep it small and manageable. But I still believe Tesla has the potential to be the next Apple.

Our 10c Worth

One thing, from Paul

Back in the

financial crisis of 2008/09 there was a particularly prominent and especially irritating TV pundit called Nouriel Roubini, who shot to stardom because he "called the recession". In other words, he was perennially bearish, forecast a slump and got it right.

In 2010 and 2011 he kept coming on CNBC and Bloomberg,

talking about how there was going to be a "double-dip recession". Actually, Roubini is of Iranian descent and was born in Turkey then grew up in Italy so it sounded like he was predicting "ah double-dip-ah recession-ah".

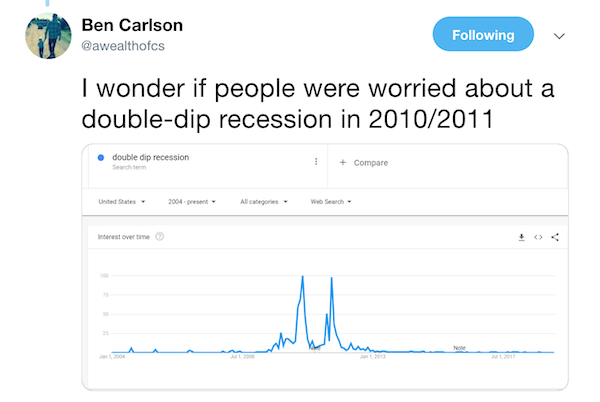

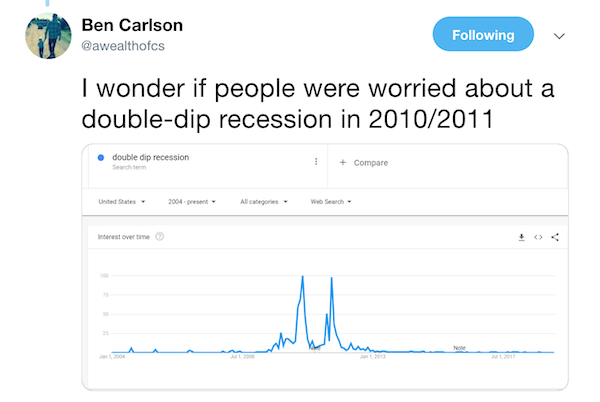

Double dipping was previously a phase only used to describe those monsters at parties who stuck the same nacho in the guacamole bowl twice. The chart below shows what an obsession that was at the time. Ben Carlson checked and saw how often the phrase "double-dip recession" was searched on Google.

As we now know that forecast was rubbish. There was no double dip. We have had a fairly smooth expansion since then, and no recession at all. As the joke goes,

bearish economists like Roubini have predicted 15 of the last 2 recessions. Guys like him are like a broken clock - right every 12 hours.

Michael's Musings

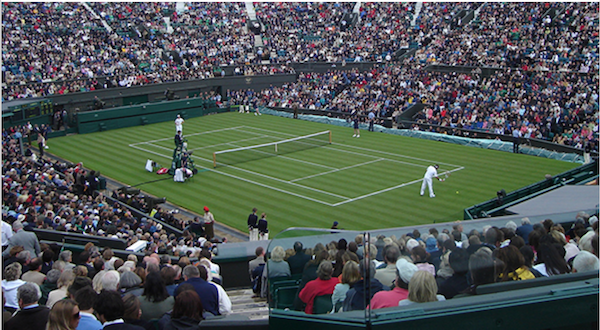

Here is another type of financial instrument, a season ticket to Wimbledon -

Wimbledon tickets are on sale for $104k, but don't expect any if you're not royal. Yes, R1.5 million for a ticket does sound like a lot of money, but the ticket is for the next five years. What some buyers will do is buy the five-year season ticket, break it up and sell off individual years. Sounds like a financial instrument to me?

To put things into perspective,

the official price of a ticket to the men's final last year was GBP 2 667, around R50 000. On the black market, the price is much higher. Assume that you can get R100 000 per ticket for the men's final every year, that is already R500 000 of the R1.5 million spent. That means you have five years to find buyers for other days, like the woman's final, to raise the other R1 million. Any takers?

The whole exercise highlights to me the value and power of live sport. There is only one Wimbledon final, where the court only fits 15 000 people. Very high demand with limited supply leads to the high prices. One of the reasons we kept our Multichoice shares is because it is very difficult for the likes of Netflix to take the place of live sport.

Linkfest, Lap it Up

Linkfest, Lap it Up

Commercial 5G has officially landed. It is still a while away from South Africa but global roll out will pick up stream now -

South Korean, U.S. telcos roll out 5G services early as race heats up

Could you say that South Africa is a world leader in head safety?

Could you say that South Africa is a world leader in head safety?

You will find more infographics at

Statista

Vestact Out and About

This week on Blunders: Life imitates art in Ukraine as comedian to be elected President; R1 billion Chateau de Poof; Myspace and Facebook lose the backup files; BA flight to Dusseldorf lands in Edinburgh -

Blunders: Episode 138

Signing off

Signing off

The JSE All-share is slightly lower this morning. The Hong Kong and Chinese markets are closed today, so expect a more muted day from Naspers. It is jobs day in the US. At 14:30 our time, we will hear how the US job market faired for March and what the unemployment rate is. With the Fed already on a go slow, these numbers are of less importance than they have been in the past.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista