Market Scorecard

After not releasing a statement on Friday evening, Moody's published a report on South Africa yesterday, giving us a view on their current model. Most of the information is already known to the market. One of the key risks to South Africa is SOE's, in particular Eskom. Moody's said that if the liabilities from SOE's continues to rise, they will have to downgrade South African debt.

Some positive news for your South African investments though, came out of China last night (

China Just Approved More Foreign Videogames, and That's Good News for Tencent Stock). Tencent is currently up 2.7% this morning, to HKD 375 a share, roughly where it was in the middle of last year. Expect Naspers to soar this morning. We had a look at the Naspers share price over the last 12-months, and had forgotten that for one day last year it reached a low of R2 289 a share. Currently it is at R 3 388 a share, plus R120 for Mulichoice, gives you a value of R 3 508. It is up 53% since October!

Yesterday the

JSE All-share closed up 0.08%, the

S&P 500 closed up 0.00%, and the

Nasdaq closed up 0.25%.

Our 10c Worth

One thing, from Paul

For one reason or another,

government bonds around the world are in great demand. I can't see the attraction, frankly? Regular, but low-interest payments, and at the end you get your capital back, where's the excitement in that!? Plus,

government finances are run by elected politicians, and you know what kind of bozos that job attracts.

Of course, government cash flows are based on taxpayer revenues, and those are set down in law, so they are pretty secure. All around the world, investors running pension funds and insurance companies want government bonds to match their long-term obligations to their policy holders.

Bonds issued by the most established economies are trading at levels where they offer very low yields (that's a sign of strong demand).

German 10-year bond yields recently fell below zero for the first time since 2016. So, you are paying them for the privilege of holding the asset. It's just a safe place to park money, I guess? Japan's 10-year yield is near -0.10%, the lowest since 2016. Australia's 10-year bond yield fell to an all-time low of 1.772%.

US 10-year bond yields are currently at around 2.5%. Take a look at the chart here, which shows those yield levels since the 1960s.

Despite being a country in a part of the world hard to find on a map,

Tajikistan's $500 million bond offering in 2017 received $4 billion worth of bids, which was 8 times more than it offered. That was with a credit rating well below investment grade and absolutely no track record. Dion Rabouin at Axios recently pointed out that

Uzbekistan, another former Soviet country that has never before sold bonds to the international market, recently produced a $1 billion bond offering at a 4.75% coupon (well below average) that received $5.5 billion of bids.

When you consider the bigger picture,

perhaps it's no wonder Moody's kept South Africa's credit rating unchanged? Investors want to own them anyway?

Byron's Beats

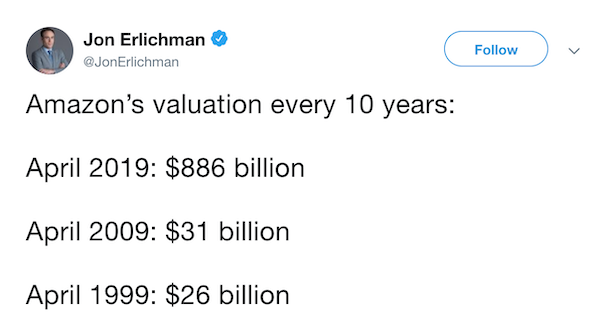

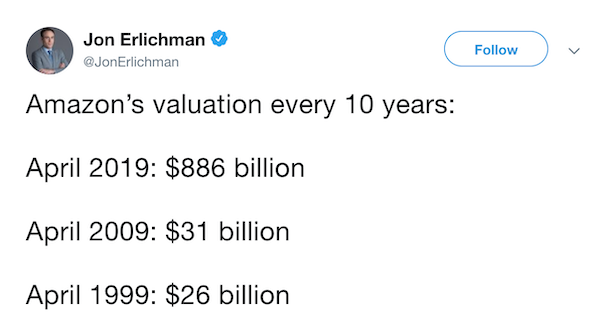

I saw the following tweet which pointed out Amazon's market cap over the decades.

I think there is a huge lesson in there

I think there is a huge lesson in there. You could have held Amazon for a whole 10 years and made a return of just 19%. "What a terrible stock. It is surely time to get out of this one, it is just a value trap."

If you had sold your shares in 2009 after being very patient for 10 years you would have lost out on 2500% in gains. It may say sound harsh to pin point a period of falling stock markets to suit your thesis but this is in fact when a lot of people do end up selling.

Moral of the story: If your thesis is in tact about a business, stay long and strong.

Michael's Musings

Yesterday Bloomberg had the headline, 'Lyft below IPO price'. Would you consider the IPO a failure or a success? It depends which side of the trade you are on. The price popped on the first day from $72 to $87 a share, and now it is below $72.

Some of you may remember the Facebook listing, when the price dropped almost out of the gate and financial media was calling it a failed IPO. Our argument was always that as a company selling its own shares, you want to get the best price possible, so it wasn't a failed IPO, it was very successful for the company.

I wonder why more companies are not doing an opening auction to determine the price of the IPO, something like Spotify did. Currently you have investment bankers setting a price that they feel is fair, based on the interest they receive during the IPO roadshow. Seems flawed to have a team of humans setting a price, when the market is much better at doing it.

Here is a blog post talking about the Lyft IPO -

Lyft's IPO Pop Is Evidence Of Failure, Not Success

Bright's Banter

There has been several IPOs recently, from the Levi's IPO

which was more than ten times oversubscribed after seeing high demand, to Lyft which listed this past Friday with the same optimism (we've covered this one in previous messages). Many people have the impression that IPOs that pop on the first day are always a sure thing and the companies continue to perform very well in the future.

There is also the myth that IPOs are the surest way to make easy money. I mean even author Robert Kiyosaki wrote about it in his Rich Dad, Poor Dad series of self-help books right? The data shows that in reality IPOs are very hard to call even if they do pop on the first day like Lyft; in the long-term they can still be bad investments.

The chart below shows how a theoretical IPO investor could've performed had they just had a portfolio made up of all the cool technology IPOs that listed in the past 9 years. Spoiler alert, not as good as you'd imagined e.g. you would've been better off buying a GoPro action camera than its shares on IPO!

Here at Vestact we don't really participate in many IPOs, we prefer to stick with the boring big blue chip companies that have been tried and tested through the ebbs and flows of the market. This shouldn't be misconstrued with the fact that we will never invest in an IPO if we see a good opportunity. Thank you!

You will find more infographics at

Statista

Linkfest, Lap it Up

How would you solve this problem? This is the risk you take for staying at an Airbnb at a lower rate than a hotel -

Airbnb Has a Hidden-Camera Problem

Slow and steady change

Slow and steady change, which will have a big impact in the long run -

EU Toughens CO2 Limits for Cars in Bid to Spur Electric Vehicles

Vestact Out and About

Vestact Out and About

Signing off

Signing off

The JSE All-share is higher this morning, the Rand is holding steady after the Moody's report yesterday. The current trend of for emerging market strength, so we could soon see the $/R below 14. Who knows with currencies though. The only significant data out today is US crude inventory levels in the US. Higher than expected inventory levels normally leads to a lowering of the the oil price.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista