Market Scorecard

So it is Monday and it looks like we missed a downgrading from Moody's. Friday came and went with no announcement or statement from the ratings agency, effectively meaning that they had nothing to add to their previous announcement. Moody's has two days a year scheduled for a rating announcement, the next one is only 1 November.

The agency will probably comment shortly after our elections. So, till then we wait.

Another two deadlines came and went with the month of March.

The US and China were meant to have a trade deal signed by now. Luckily for the globe, even though there is no deal yet, both sides are still talking and a palatable deal seems imminent. We can only hope.

Global trade is a good thing. If everyone does what they are good at, the world is a better place.

Then Brexit was meant to have happened on Friday, that was the 2-year deadline since the UK triggered article 50. They now have an extra two weeks to decide on a roadmap to overcome the deadlocked parliament. Bloomberg this morning was reporting an increasing chance of another election. What are the chances that Theresa May comes out today and says, 'April fools, we are not leaving the EU'?

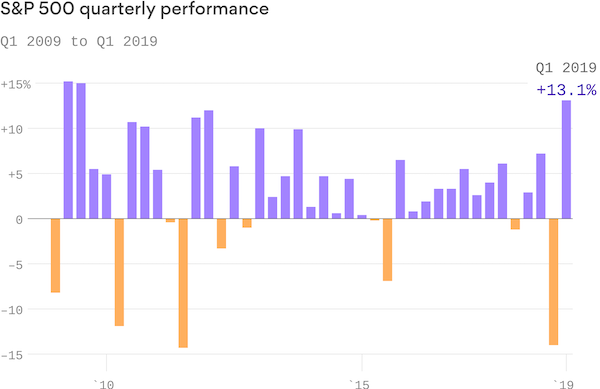

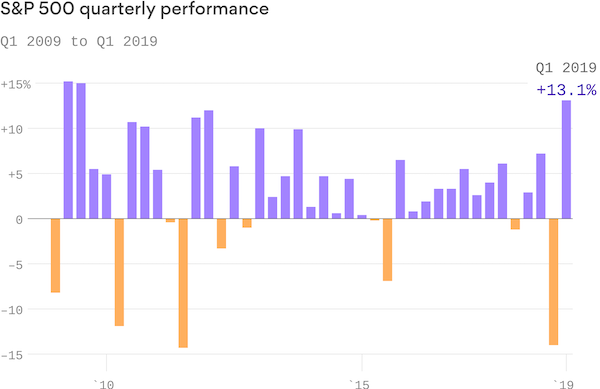

Friday marked the end of Q1 for global markets.

The JSE All-share is higher by 10% for these three months, still well short of the highs from January 2018 though. We would need another quarter like this to break those levels. In the US, the S&P 500 is up 13% for the quarter, and globally the FTSE All-World index was up 11%, its best start since 2012.

On Friday the

JSE All-share closed up 0.72%, the

S&P 500 closed up 0.67%, and the

Nasdaq closed up 0.78%.

Our 10c Worth

One thing, from Paul

Keep calm and carry on. That's the most important thing that we do here at Vestact:

remind our clients that buying quality, then staying invested and dialling down the noise is the best investment strategy. Don't sell, just because the market is having a wobble.

As Bright mentions below,

quarterly returns on global markets in the last six months have been bizarre. After a fall of almost 15% in the last three months of 2018, we were up 13.1% in the first quarter of 2019. These numbers are for the broad US market S&P500. See that in the 10 year chart below from Axios. Note how

there are far more purple (up) quarters than there are mustard (down) quarters.

We regard the S&P 500 as our benchmark index for New York portfolios, so how did the Vestact model portfolio do by comparison? In Q14 2018 we slid by 16.3%, and rebounded by 15.7% in Q1 2019. Our clients are almost, but not quite, back at their all-time high portfolio values.

Byron's Beats

Sometimes I think back at life before smartphones and wonder how we got by without them. The generation before that will have the same thoughts about the Internet or even television. I get the feeling that in about a decade we will look back at our current money transfer system as archaic.

My prediction is that in 10 years time, money will flow freely all over the globe for minimal fees or hassle. Hopefully, SA joins the 21st century and drops exchange controls.

What prompted this thinking was an article from GeekWire titled

Remitly teams up with Visa to enable money transfers to debit cards. Users will now be able to send money from the US to Visa debit cards in other countries. The first thing that popped into my mind was why is this not being done already?

If you have sent money to an offshore bank account before, you will know that it is a mission. This happens all over the globe. Imagine being able to send money to someones debit card on the other side of the world with a few clicks on your phone.

I am glad to see progress in this department and very happy to see Visa spearheading the process.

Michael's Musings

In my opinion, the only effective way to limit climate change is to encourage countries to grow and become wealthier.

Poor nations simply can't afford to spend the resources on creating clean energy. As countries become wealthier they can start switching to green energy.

As more countries switch, the cost of producing green energy drops meaning more countries can make the switch. China is a good example, where they are one of the leading countries in the installation of renewable energy -

China's carbon emissions could peak before 2030.

Bright's Banter

The US stock market experienced the best quarter in almost 10 years. Last years' fourth-quarter meltdown was short-lived as the bounce back has been stronger than any we've seen before. The S&P 500 is a few percent away from recovering all the ground lost.

This past quarter was the best since the second quarter of 2009 after the financial crisis of 2008, and

the S&P 500 is only 3% away from its all-time high. Had you been out of the market, you'd still be on the sidelines looking for an opportunity to come back in as the market roars ahead.

The Lyft IPO was a great signalling effect of investors sentiment towards initial public offers as the stock popped on the first crossing meaning that there's a lot of bullishness out there. Lyft shares ended up 8.7% on its first day of trading as it closed at $78.29 from an IPO price of $72 due to high demand from investors.

Linkfest, Lap it Up

This computer will be able to do a quintillion calculations a second. Take 1 billion and then multiply it by 1 billion, that equals 1 quintillion! -

Intel and the Department of Energy are building America's first exascale supercomputer

This is why Netflix and Apple TV+ still have tremendous potential.

You will find more infographics at

Statista

Vestact Out and About

Bright did his regular Business Day TV slot -

The Week That Was - 29 March 2019

Signing off

Signing off

The JSE All-share is up this morning, hopefully the trend for the rest of this quarter. The Rand is stronger today against the Dollar, where it is now trading in the $/R 14.30's down from $/R14.70 reached on Friday. There is manufacturing data out of the EU, UK and US today, and retail data from the US.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista