Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

On Thursday, Nike, the world's largest athleisure company released a strong set of numbers for their third-quarter, but Mr. Market wasn't impressed with its North America sales and its fourth-quarter projections in sales growth. The stock closed down 6.6% on Friday, the lowest drawdown since 2018 Christmas Eve. Nike is still up over 30% over one year.

Nike's revenues for the quarter came in at $9.6 billion of which $9.15 billion was the NIKE brand, up 12% on a currency-neutral basis. This was driven by growth across wholesale and Nike Direct, categories including sportswear and Jordan. Converse revenues came in at $463 million, down 2%.

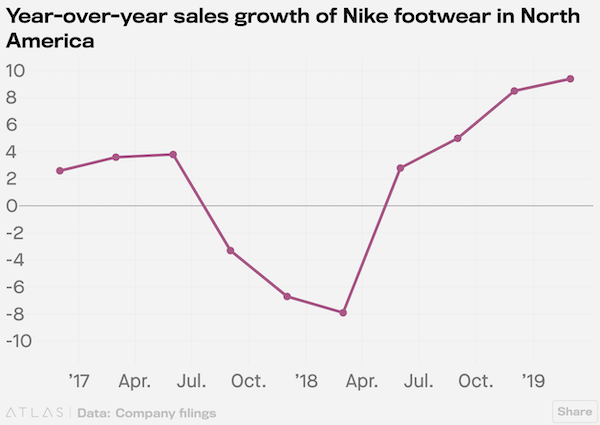

North America revenues were $3.81 billion, up 7%. However, the fastest growing geography was Greater China which accounted for $1.59 billion in revenues, up 19% for the quarter. Nike also beat expectations in Europe, Middle East, and Africa, China, as well as Asia Pacific and Latin America.

Nike reported earnings per share of 68c which was ahead of the street's 65c per share prediction. Gross margins increased 130 basis points to 45.1% driven by higher selling prices and growth in the Nike Direct platform.

Nike CFO, Andrew Campion said "We are still in the early stages of executing the 'Consumer Direct Offence' with much more opportunity ahead of us," . . . "So, we will continue to focus our investments on the digital transformation of Nike and in the areas of our business where we see the greatest potential to grow and create value for both consumers and shareholders."

I recently wrote that Nike had not been dethroned from being the sneaker king and as a matter of fact they've been stealing market share from all the other sneaker makers, thanks to top-notch innovation, good designs and incredible marketing!

Nike's sneaker collection includes the Air VaporMax, the latest overhaul of the air-cushioned sneakers that date back to the 1980s which retails for around $190, depending on the model. The soft and springy Epic React and AirMax 270 both cost around $150. There's the AirMax 720 for $180, and the out of reach Adapt BB a self-lacing smart shoe which will set you back by $350.

According to retail market researcher NPD Group, Nike had 7 out of 10 hottest sneakers in the US in 2018. Nike is now toying with the idea of releasing sneakers around the $100 price-point. With the Nike Tanjun dominating number 1 spot in both 2017 and 2018.

Nike projects that they will grow sales by single digits in the fourth-quarter due to unfavourable currency fluctuations, that means revenues will be well below the $10.4 billion that the analysts have estimated.