Market Scorecard

It is finally here, the PWC report on the fraud at Steinhoff was released on Friday evening.

The full 3 000 page report is not publicly available, but the 10 page executive report can be downloaded from the company webpage here -

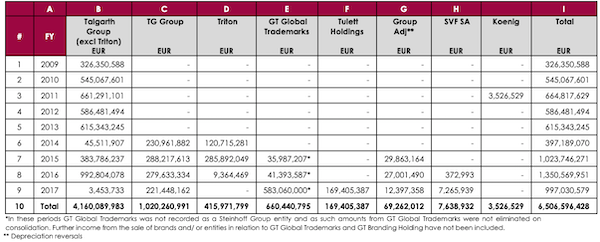

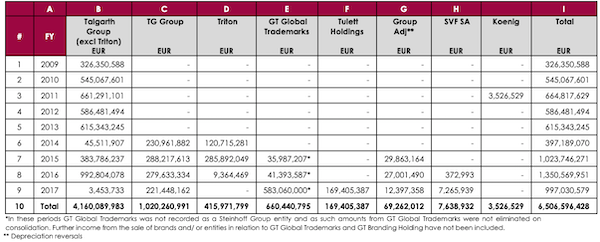

PWC Forensic Investigation into Steinhoff. The report goes as far back as 2009, a much longer period than people had originally thought, and there is a good chance that the fraud goes back even further than that.

The PWC report finds that between 2009 and 2017,

the fraud created fake profits of EUR 6.5 billion or ZAR 106 billion! That is huge considering that the market cap was EUR 25 billion before the collapse. What makes it worse is that the EUR 6.5 billion is higher than the profits declared by the company over that period.

Effectively,

assets that the company claimed to have didn't exist and cash that they reported having was also a fantasy. Part of the fraud was achieved by creating fraudulent legal documents, and management hiding Steinhoff subsidiaries from the auditors. Working from this report, 2015 and 2016 numbers will be restated, then they will compile the 2017 and 2018 financials.

On Friday the

JSE All-share closed up 0.45%, the

S&P 500 closed up 0.50%, and the

Nasdaq closed up 0.76%.

Our 10c Worth

One thing, from Paul

Chinese Internet giant

Tencent has had a nice share price recovery in the last six months, bouncing off a low of HKD (Hong Kong Dollars) 267 to its present level at HKD 366. That's obviously very important to our local portfolios, given that

Naspers owns 31% of Tencent.

Tencent seems to be

recovering from uncertainty about a regulatory crack-down by Beijing regulators. Head of State and Party Chairman Xi Jinping was flexing his muscles, imposing his own highly conservative views on rules around gaming and social sharing. Tencent has found ways to fit in, by imposing age limits on gaming activity and other measures.

There is

another important development in recent days that has aided Tencent. Late last week at the National People's Congress - - a once a year gathering of legislators to seal the country's most important policies - -

new rules relating to foreign investment in China were passed. In the final drafting process, the Party chiefs

dropped language that would have invalidated the so-called "variable-interest entity" structures employed by Chinese tech giants, including Tencent and Alibaba to list their shares in Hong Kong and US markets. That's encouraging, of course.

More on that story here, on

Bloomberg.

Byron's Beats

Here is some good news for a Monday morning. I came across this article on Friday titled

First plastic road paves the way for SA. What better use for a substance that is not degradable and is slowly destroying our oceans?

The article states that the Kouga Municipality and a Scottish company called MacRebur

would be pushing the project in Jefferys Bay. If all goes well they will set up factories that produce pellets from recycled plastic, that can be used for roads. I don't think finding the plastic will be an issue. We should follow the progress with interest and hopefully, the project can expand.

Michael's Musings

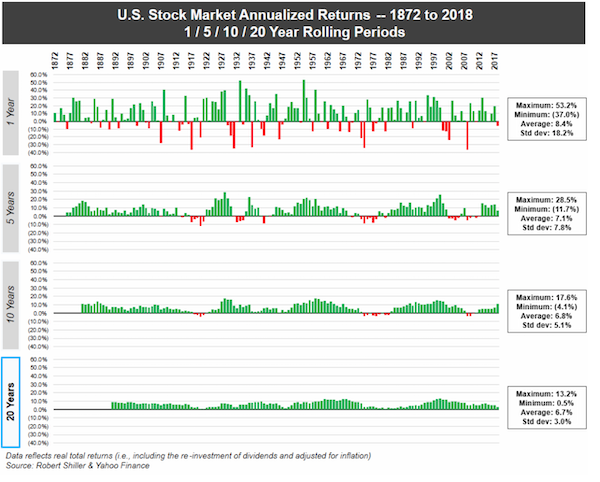

There is a simple reason that we encourage clients to be long term holders of stock;

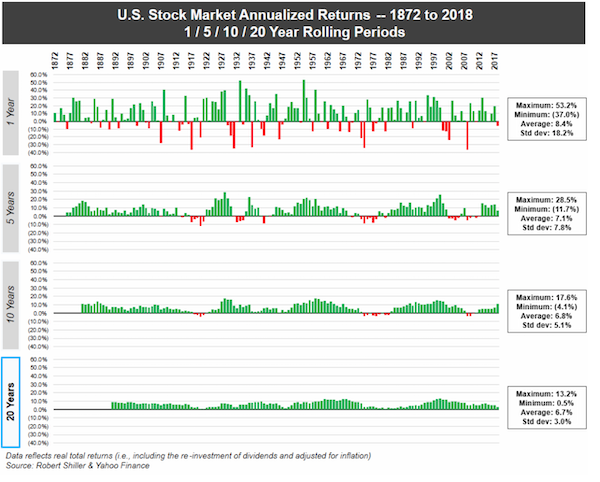

the longer you hold, the better your chance of making a profit. This graphic below shows that you need to consider long term investing to be at least 20 years.

Of particular importance in that graph is how the average returns vary.

On average your 20-year rolling return is 6.7% growth a year. There are some periods though, that over 20 years you will average a return of 13.2% a year, meaning you double your money every 5 years. There are other periods where your average return is only 0.5% a year, meaning you went sideways.

Read the full article here -

Check out this graphic and sleep tight on your retirement account.

Bright's Banter

According to the latest edition of

Knight Frank's Wealth Report , 2018 was a huge year for luxurious and liquid investments, I am talking about actual liquid spirits as an investment. These are sometimes referred to as vanity investments or investments of passion.

The Macallan 1926 single malt, in a one-of-a-kind bottle painted by Irish artist Michael Dillon fetched over $1.3 million in a record-breaking auction. A month earlier, a bottle of the same whisky set the then-world record price of 700 000 Pounds.

This obviously sent other rare bottles of whiskeys in Scotland, Canada, and Japan soaring in value. According to Statista, over the past year,

the value of rare whiskey has shot up 40% and over the past decade it has soared over 582%.

Below are other luxury assets that are soaring in value including vintage cars, rare coins, stamps etc. Unfortunately it might be a bit too late to invest aggressively into these, my only concern is the insurance involved in owning these investment; shares are still my go to investment!

You will find more infographics at

Statista

Linkfest, Lap it Up

If you only read one thing today, take the four minutes to read these quick bullet point facts. It is well worth your time -

The Twenty Craziest Investing Facts Ever

Here is one of the reasons that Alphabet

Here is one of the reasons that Alphabet dominates internet advertising.

You will find more infographics at

Statista

Vestact Out and About

Bright was on his weekly Business Day's -

The Week That Was.

Signing off

Signing off

Tencent is up by 2% this morning and so is Naspers. The JSE All-share is also higher today. The week ahead has a Fed interest rate decision, South African CPI and then results from Nike.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista

You will find more infographics at Statista

You will find more infographics at Statista