Market Scorecard

Yesterday was a very lacklustre day for global markets. South African and US markets both moved sideways, bobbing between red and green.

Even news that Xi and Trump won't be meeting in March, as originally planned but in April instead, didn't move markets. As expected, the UK parliament voted to extend the Brexit deadline.

Yesterday the

JSE All-share closed down 0.07%, the

S&P 500 closed down 0.09%, and the

Nasdaq closed down 0.16%.

Our 10c Worth

One thing, from Paul

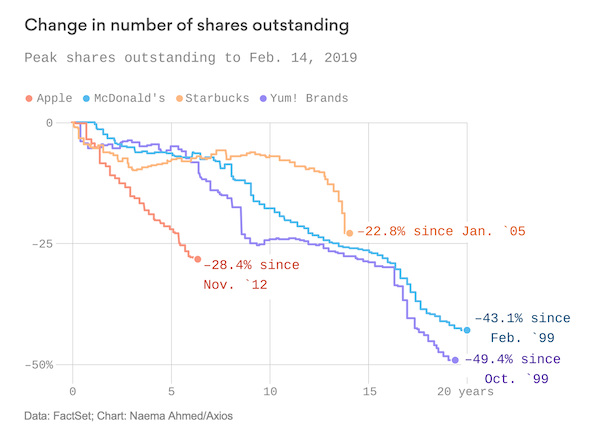

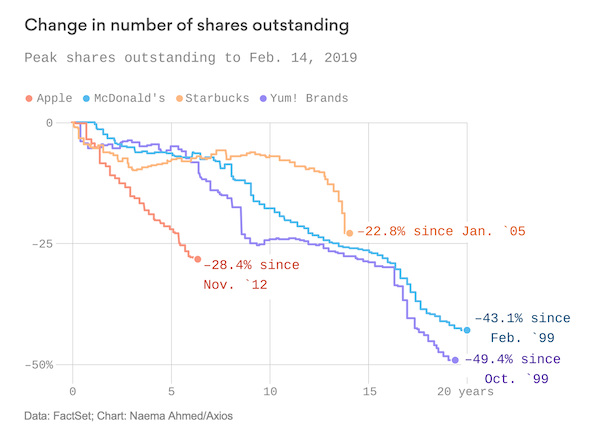

I really love stock buybacks. The idea that the number of shares in issue of a big company that I own is going down fills me with joy. It's the permanence of the removal that I like - the idea that I will be amongst a reduced group of remaining shareholders at all of the future earnings updates, when profits and dividends are being shared out.

Sadly for the capitalist stock-owning classes, stock buybacks are becoming a political hot potato in America. Old goats like Senators Chuck Schumer and Bernie Sanders are pushing proposals to require companies to pay all their workers at least $15 an hour before being able to buy back their stock. Employees would also need to have health benefits and 7 days of paid sick leave. I have my doubts that they will succeed in getting any such regulations enacted.

Buybacks are extremely popular in corporate America, which spent some $1 trillion on them last year. In fact, the benefit of corporate tax cuts in 2018 went largely to financing buybacks. The scale of the reduction in shares in issue has been quite amazing. Felix Salmon of Axios estimates that

Apple's share count has fallen from 6.6 billion to 4.7 billion since late 2012. That's an incredible 28.4% reduction, which helps explain why the stock has done so well since then.

Another Vestact recommended company,

Starbucks, has seen its share count drop by 22.8% since 2005. Yum Brands and McDonalds have almost halved their number shares in issue, albeit over a longer time horizon.

One point to note. Buybacks only have the desired effect if companies avoid issuing loads of new stock for compensation purposes and for acquisitions.

Byron's Beats

We constantly harp on about services being the next big thing for Apple. It seems like the worlds worst kept secret at the moment is Apple's big announcement of its mainstream video streaming service at a conference on the 25 March.

You can already go onto iTunes and stream shows but I always forget that is even an option. It is still unclear who will jump on board. If you were HBO and Apple offered to buy your content for their 1 billion clients, would you say no? The problem is, the service will cannibalise HBO's own streaming services.

It seems like Apple wants to put their hand up as an aggregator of content as well as create their own content. Remember how they dominated the music industry when they decided to sign all the labels? Is history going to repeat itself? Time will tell.

Michael's Musings

Last night Elon Musk launched Tesla's latest car, the Model Y, a cheaper crossover SUV. This completes the Tesla set of cars, which spells S3XY when you put the names together. Musk even ended his presentation by saying 'We are bringing Sexy back'.

The car is expected to be

sold towards the end of next year, with a starting price tag of $39 000, and increasing to $60 000 for the fully kitted version. During the presentation, Musk noted that 11 years ago Tesla had only made one car. By next year they will have produced their millionth car, a perfect example of exponential growth.

You can read more about the car here -

Tesla Model Y announced.

Bright's Banter

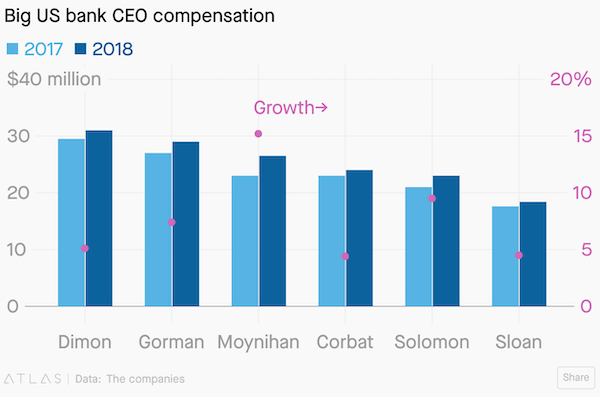

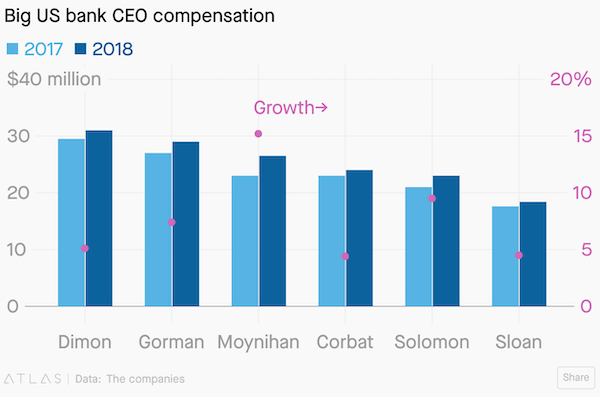

According to Quartz, last year Jamie Dimon of JPMorgan, James Gorman of Morgan Stanley, Brian Moynihan of Bank of America, Michael Corbat of Citigroup, David Soloman of Goldman Sachs, and Tim Sloan of Wells Fargo collectively made $151.9 million in salary and bonuses. Altogether, that is an 8% increase on 2017.

Naturally this is eyebrow-raising. Here's a good example,

Tim Sloan, CEO of Wells Fargo made a staggering $18.4 million in 2018, an amount that's 283 times the median pay of staff at the bank. Since 2016 Wells Fargo has paid more than $1.5 billion in fines for many offences which led us to swapping our Wells position to JPMorgan.

If you remember, Wells Fargo is still in the dog box with the US financial regulators for

multiple scandals from staff opening 3.5 million fake accounts in order to meet sales targets, signing customers up for credit and debit cards without their consent, charging them for insurance they didn't need and overcharging for mortgage refinancing.

In 2018, the six banks made $119 billion in profits, and the CEO salaries as a ratio of the profits only amounts to 0.1%. I don't want to get into the argument of whether they're overpaid, or if they deserve them because the competent people in the compensation committees of these banks decided this and shareholders approved them.

According to a NYTimes article, these bankers aren't really happy. Ask the Harvard MBA who attended his 15th reunion last year to learn how many of his former classmates didn't enjoy their professional lives, and in fact were miserable. Everything comes at a price unfortunately and some people sell their souls to the devil!

Linkfest, Lap it Up

It was Pi day yesterday, 03/14, here are some fun facts -

It's Pi Day! Here are 3.14 facts about pi

On Tuesday the World Wide Web

On Tuesday the World Wide Web turned 30. Here is the percentage of people who have access to it.

You will find more infographics at

Statista

Vestact Out and About

This week on Blunders: Boeing loses altitude; how PingAn sells insurance in China; Hungarian stock photo fail; ancient banking practices in Japan; and Ronaldo bonds make a comeback -

Blunders: Episode 137

Signing off

Signing off

The JSE All-share is higher this morning. Later today there is CPI data from the EU and a job opening figure from the US. Knowing how many job openings there are, gives a good indication of the state of the jobs market in general. Next week there are numbers from Nike, and the Fed has their next interest rate meeting.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista