Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

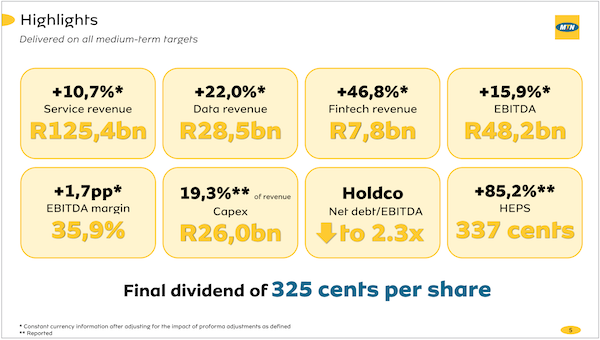

Last week MTN released their full-year numbers, shooting the stock up 15%. Going into these results, the market wasn't expecting much from the group, especially given that the stock fell significantly a few days earlier when they released their trading update. Here is the first slide from the results presentation, showing the numbers that the group is most proud of.

Two key positive areas that I think the market focused on from the presentation were, the progressive dividend policy from the company and their drive to pay down debt. For 2018, the full year dividend was R5 a share, down from 2017's R7 a share, but the company has committed to increasing the dividend payment by between 10%-20% each year. That is a very positive sign from management. Then over the next three years, the company plans to sell off non-core assets, which includes their towers and fin-tech companies that they are invested in, like listing Jumia. With the cash raised from these sales, MTN plans to pay down debt.

Between Nigeria and South Africa, they account for roughly 70% of MTN Groups profits. Swapping from last year, Nigeria is now more profitable for MTN than South Africa is. Which means the current rally in oil prices is good news for the group. Both regions saw an increase in their total subscriber numbers, 1.7 million to 31.2 million for South Africa and 5.9 million to 58.2 million for Nigeria.

The group has a few key growth areas that they are focusing on to increase the profit figure. The first is the increased usage of data as more people get access to smartphones. In the case of Nigeria, only 70% of the country has access to 3G, so simply improving access to mobile internet will see data usage rise. Next is the potential of Mobile Money, particularly in Nigeria where they have applied for a license. For the long term there is the potential from the internet of things. Imagine your car having a sim card in it, and then communicating with other cars on the road.

In South Africa, there is the potential to see a jump in margins as more spectrum is released. To be cautious and prudent, MTN management says that they have not included this scenario in their forecast for the business going forward. If it happens, it will be a nice boost for the group, but if it doesn't, they will still be fine.

It looks like MTN has now turned a corner and hopefully it is only higher from here. Given the markets that they operate in though, even the best laid plans can go awry.