Market Scorecard

It is not often that you see a Top40 stock jump over 3% in one day. After their results yesterday MTN was up a whopping 18% in one trading session! Shifting to politics on a local front, this headline came across my screen whilst packing up to go home -

SA determined to nationalise central bank, Ramaphosa says. Who owns the Reserve Bank is mostly just a symbolic issue. Currently, it is the government who sets the policy of the SARB and appoints the Governor, who then reports to the finance minister.

The shareholders have no say in policy, least of all having a say on interest rates.

The main reason for having private shareholders is to indicate to the global investment community that the SARB is independent of government; it is symbolic.

Most countries don't have private central banks, the US being one of them. The bigger thing for investors is around who the governor is, is that person independent? No one wants to invest in an economy where the central bank plays with interest rates based on political motives, instead of basing the changes on economic data.

For many in South Africa, having private shareholders is symbolic of outsiders controlling us. By nationalising the SARB, there will be no change in the way the SARB conducts its business, international investors should know that. Given that the stance from the president previously was to keep the SARB private, this sudden changing of course came as a shock, as seen by the drop in the Rand. Having a public reserve bank is an important political subject and it is an election year, so it is important to win as many points as possible.

Yesterday the ECB announced that they will step up their stimulus plans. Increasing stimulus, in a time when it is meant to be decreasing, sent shockwaves through financial markets. It is a signal that the ECB thinks growth will struggle to take off. Also, money that was parked in the EU to take advantage of improving economic conditions is moving to the US Dollar now. Global stock markets are down, and the dollar is much stronger, meaning a very feeble looking Rand this morning.

Yesterday the

JSE All-share closed down 0.39%, the

S&P 500 closed down 0.81%, and the

Nasdaq closed down 1.13%.

Our 10c Worth

One thing, from Paul

Consider

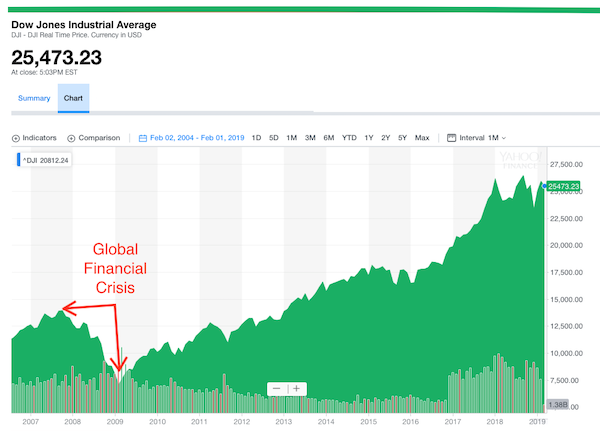

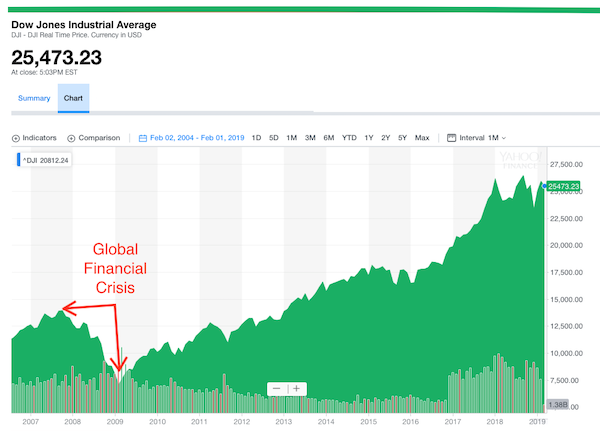

the chart below, which shows 15 years of the Dow Jones Industrial Average. The slump in 2008-2009 was a painful one, remembered as the Global Financial Crisis. Some twits called it the Great Recession. The

market low was reached on March 9th 2009, exactly a decade ago, tomorrow.

I remember it as a time when people lost their heads and sold anything that was still liquid. Here at Vestact, we counselled clients to stay calm and do nothing. The Dow is now at 25,473 points. Back then, at the depth of the selloff, it was as low as 6,500 points. After that, it quadrupled.

Byron's Beats

In this mornings weekly market review Eddy Elfenbein celebrates the 10 year anniversary of the current bull run. As Paul alluded to earlier, the market bottomed on the 9th of March 2009 and has since gone up 5 fold if you include reinvested dividends.

My investment career started in 2009. My timing was fortunate. Having said that and as Eddy reminds us, this has been one of the most hated bull runs ever. Throughout this fabulous run, very smart people have been harping on about an imminent pull back. Sometimes it was hard to ignore the noise. And sometimes the global economy did fall into precarious situations. I guess what I am trying to say is that it wasn't all easy, it never is.

I get frustrated when I hear smart people saying that this bull run was artificially propped up by The Fed and share buybacks. Firstly share buybacks are another form of dividend. This means that companies are in solid financial positions. I am not going to waste any more time explaining that.

Let's take a holistic point of view. What has changed for the better over the last 10 years? It is quite obvious to me. Healthcare has improved drastically. Genome sequencing, medical devices and drugs have all become more efficient and accessible. Don't believe me? Look at Michael's piece yesterday where Singapore had to increase the retirement age because people are living longer.

Technologies have also exploded. The smartphone now does so much more. GPS, radio, tv, banking, camera, video calls, music, news, email, health tracking, taxis, hotels, social, shopping, books. It is all in your pocket or on your wrist.

Online retail is now mainstream. Internet is faster and cheaper around the world. Cloud services have made businesses so much more efficient. This impact is huge but hard to measure. Companies like Uber, Airbnb and Netflix have become must haves during the last 10 years.

My point is, stop blaming the rally on The Fed and admit that the world has indeed become a better place over the last 10 years.

Bright's Banter

TikTok, the music video app that allows you to create cool short music videos has

surpassed 1 billion downloads, joining the prestigious billions club. In 2017, the Chinese company ByteDance which owns TikTok,

led the merger of TikTok with Musical.ly to form the largest short-form music video-maker app TikTok.

TikTok also allows you to interact and follow other musers on the app, making it a social media challenger app at some level. According to California-based app research firm Sensor Tower, In 2018,

TikTok was installed about 663 million times in 2018, compared to 711 million for the Facebook App and 444 million for Instagram.

The numbers above excludes a lot of Android installations in China as it only counts downloads on both Apple's App Store and Google Play outside of China. In 2018,

TikTok topped App Store downloads and was number 4 in non-gaming downloads coming in just behind Facebook, Messenger, and WhatsApp. Yes it had more downloads than Instagram!

TikTok is popular among young people because it is a cheap way to showcase their singing (more like lip syncing) and dancing, using video clips between 15 seconds to a minute. The app is also very popular in India because of Bollywood! We think it is about time someone gives ByteDance an astronomical valuation!

Linkfest, Lap it Up

I think the headline speaks for itself? -

Measles vaccine doesn't cause autism, says a decade-long study of half a million people.

"The question to my mind is should we continue to do more studies on this topic or is the uncertainty that is needed for having a researchable question gone at this point," he said. "This new study isn't going to change anyone's mind."

Spreading the wealth from success. Now the companies just have to list -

Uber and Lyft will grant top drivers stock in their highly anticipated IPOs.

Vestact Out and About

Vestact Out and About

This week on Blunders: What now Marie Kondo?; Saudi non-religious tourism initiative doomed; Israeli billionaire dies after "elective" surgery; world bridge game champion suspended for doping -

Blunders: Episode 136

Signing off

Signing off

It is an ugly morning for global stock markets, where there is much more red than green at the moment. Aspen released their half year results last night which the market is less than impressed with. It is jobs day again in the US, where we get to see how their job market is doing.

Sent to you by Team Vestact.