Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Yesterday food services business Bidcorp released 6 month results for the period ending December 2018. Since it's spin off from Bidvest in 2016 the share price has been flat. Considering the recent environment, that has been better than most!

I was glad to see that the results booklet was online as soon as the results were released. Let's look at the numbers. Headline earnings increased by 9.2% to 700c. This resulted in a cash generation of R3.9b and an interim dividend of 310c.

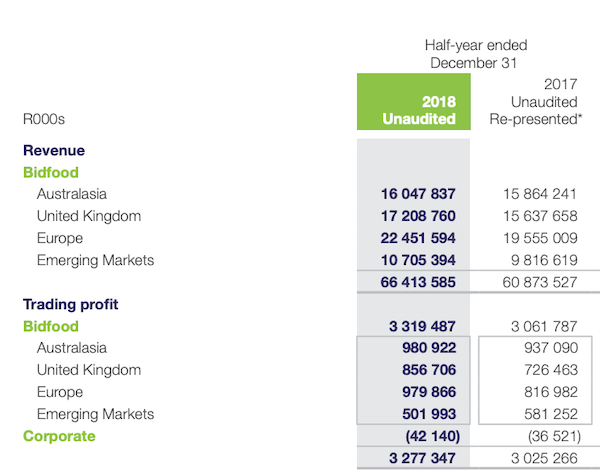

The numbers per segment make for interesting reading.

As you can see, Australia, where they make most of their money was decent whilst Europe and the UK soared. Developing markets, which is mostly SA and Asia did not fair as well. The disappointment in this region was mostly China after losing a key dairy partner. The SA business was actually very resilient. Within the European region, Eastern Europe proved particularly strong. More people eating out as those societies develop it seems.

That UK Contract Distribution business (the one that supplies KFC UK) is still up for sale. Costs associated with the exit have been provided for and further costs are expected to be minimal.

We really like the food services sector. People are busy and want to eat out. Even if they don't eat out, they get food delivered by the restaurants who are still clients of Bidcorp. It is of course very competitive and sensitive to increasing input costs like fuel (electric trucks will be a thing soon). But in sectors like that, the big dogs (like Bidcorp) have the scale to win. And when they see innovative products, they buy them. On that note, they spent R337 million on various acquisitions for the period. They have around R5bn in cash for further bolt-ons.

The company trades on around 20 times forward earnings which is about right for a globally diverse business like this operating in a defensive sector. We expect them to outperform expectations. This share is must have in local portfolios.