Market Scorecard

When the US market is closed, news flow dries up and generally markets globally don't move much. Even Asia is unsure of what to do with itself. The markets in the East are mixed this morning but none of them are moving more than a couple of points either way. When I fire up my email in the morning, normally there are around 100 unread emails, mostly research reports and updates from the US. This morning there were only 33 unread emails. I thought for a moment that our email server had died overnight.

Yesterday the

JSE All-share closed up 1.16% and US markets were closed.

Our 10c Worth

One thing, from Paul

Ahead of our national election on 8 May 2019, there is a lot of shouting and finger pointing in our politics. Political parties run by thugs wearing expensive loafers pontificate about policies which will take from the rich to give to the poor (and to themselves of course).

This

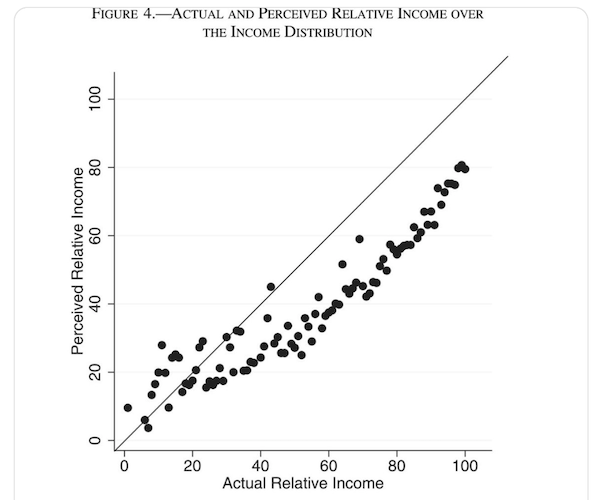

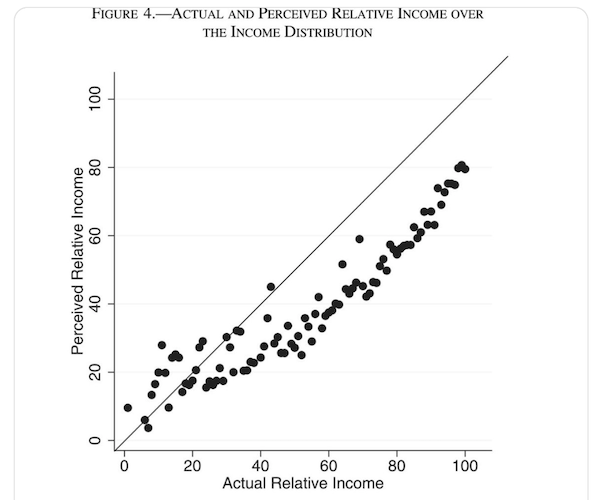

research paper by economists from Sweden looked at the relationship between where Swedish people think they are in the income distribution and where they actually are, then went on to look at people's politics and their demands for redistribution through the tax system.

What they found is that

those with really low incomes often thought that they were not as poor relatively, as they really were. Stoic and suffering.

The study also found that a

large majority of people (those below the line in the chart below) believed that they were worse off relatively than they really were. In other words, they were doing better than they thought they were, relatively. This is quite common worldwide, where middle-class people perceive themselves to be hard up and deserving of some kind of tax break or more free services. Finally, the rich often think that there are lots like them, but there aren't.

You can read the whole paper here, on the MIT Press Journals website:

Richer (and Holier) Than Thou? The Effect of Relative Income Improvements on Demand for Redistribution

Byron's Beats

Power generation is a hot topic in South Africa at the moment. And everyone seems to have an opinion. Although most of those opinions are not really solutions.

When it comes to problems like this, we do not have to reinvent the wheel. Why not look and see what has worked elsewhere. South Australia had big power issues a few years ago due to some crazy weather.

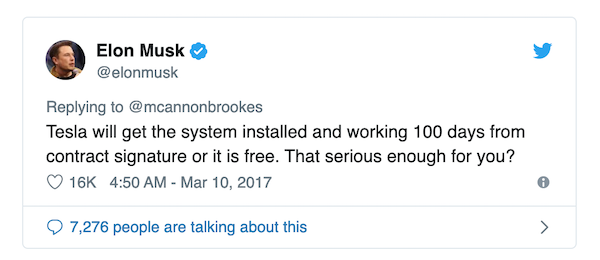

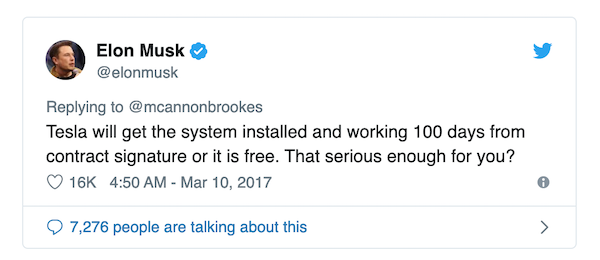

In a much publicised bet, Elon Musk said he could fix the problem with his battery Powerpacks. A private company called Neoen along with the government invested AUS $66 million in the system. In this case they used wind generation to charge up the batteries and when the power cut, the grid shifted to the batteries seamlessly resulting in no power cuts. When things were operating normally the operation can sell power back to the grid.

According to this article titled

Tesla's big battery made another $4 million on its way to pay for itself, the project has been a roaring success. The state has saved $40 million in energy costs and the batteries have almost paid for themselves already. Because the state invested alongside the private entity, the returns have benefited everyone.

The conclusion here? Eskom must outsource these types of projects to the private sector. The Northern Cape has oodles of space and sunlight with not much else going on. But this will take years I hear you say? This particular project took 100 days. That was the bet Elon made. If it wasn't up and running in 100 days he would do it for free.

Now the trick is to convince private investors to trust in Eskom as a partner. That is probably the hardest part.

The solutions are there, it is Eskom's willingness to cooperate that is key.

Michael's Musings

These sort of numbers just blow my mind,

MLB notebook: Padres reportedly offer Machado up to $280 million. That is roughly R4 billion to play sport for eight years. On an annual basis that works out to a pay cheque of around half a billion Rand.

Imagine having a salary of half a billion Rand a year?

My question now is, are these salaries too excessive? I would argue not, these sports stars are chased by numerous teams who bid at a level where they feel they are getting a good deal. The final salary amount is the rate that the market has decided is a fair value; there is a willing buying and a willing seller.

When it comes to CEO pay, it is a far more sensitive topic.

When it comes to CEO pay, it is a far more sensitive topic. I think it is more sensitive because the CEO is compared to other workers in the company. The mind then jumps to the thought of, is that person really worth that big number? With sports stars their statistics are clear to see, you can see their individual contribution to the team. With a CEO, generally, you can't see from the outside what they contribute to the company. You have to trust the remunerations committee on their decision that the CEO is worth what is being paid.

It is only the best of the best stars who can command contracts worth hundreds of millions, most make much less. When it comes to CEO's the hope too, is that it is the best of the best who reach the top.

Bright's Banter

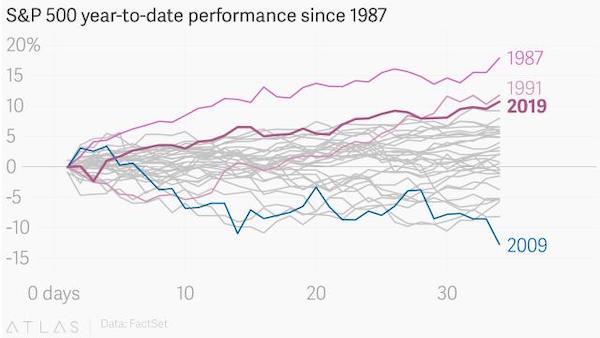

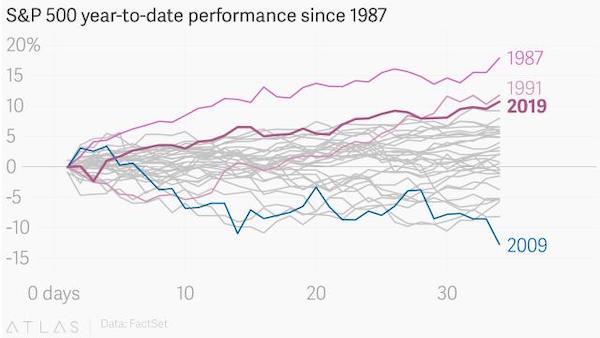

The US stock market is off to its best start to the year since the early 1990s. Year-to-date the S&P 500 is up almost 11%. I've been saying to my friends on the Beers & Small Caps WhatsApp group that now would be an ideal time to take a vacation!

This 11% gain is in contrast to the 20% drop we experienced in US markets in the final quarter of 2018. Of course, those jitters were short-lived and

the market has erased much of the losses over a few weeks.

The question in every investors mind is: why is the market recovering so quickly when just yesterday it was all doom and gloom? Well, I'm going to try stick to a simple answer here, but most of the recovery is because the predicted "imminent slowdown in corporate profits" wasn't as prevalent.

The kicker though is that there are signs that

negotiations to end the trade war have been progressing quite well, in fact so well that Trump is willing to be malleable. Of course, the doomsayers will be quick to say that the reckoning might simply be delayed and we are simply kicking the can down the road.

I would counter that argument with the fact that doomsayers have been negative on the stock market since quantitative easing started. They've been asserting that it will cause hyperinflation which will lead to the demise of all asset prices. However, the opposite has been true, America has had record low inflation and asset prices have been spared.

The narrative today has changed too. As the Federal Reserve Bank unwinds its balance sheet we will experience inflation (again almost similar as the argument above) which will affect asset prices negatively. All we can say is that it's more complex than that, otherwise it would be priced in the market already.

Linkfest, Lap it Up

What causes our bodies to decay over time? Science is trying to find out and develop new ways to make our bodies younger for longer -

A cell-killing strategy to slow ageing passed its first test this year.

Policy uncertainty and import tariffs have hampered the solar industry, just at a time when it is meant to be taking off.

You will find more infographics at

Statista

Vestact Out and About

Signing off

Signing off

The JSE All-share is slightly lower this morning, also being swept up in the lull of global markets. Data out today is unemployment numbers from the UK and then there are a number of JSE companies reporting their latest numbers. One of them is Comair, who won a R1.1 billion settlement against SAA last week. What will management say about spending that money?

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista