The more I look at this Starbucks - Nestle deal, the more I realise how good it is for Starbucks. The deal will bring $7.2bn in upfront cash, but Starbucks will still retain around 35-40% of the economics of the business due to the royalty agreement. That just shows the strength of their brand.

Starbucks plan on repurchasing some shares which should result in net earnings per share increasing, even though they are selling a portion of a profitable business. With the rest of the funds, they plan on rolling out stores more aggressively in China.

Currently, there are 3 300 stores in China compared to 12 000 in the US. The original goal was to have 5 000 stores in China by 2022. That has been increased to 6 000 because of this nice cash injection.

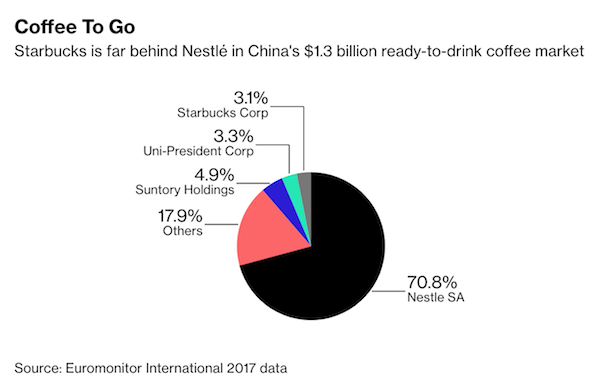

Nestle still dominate the 'Coffee to go' segment in China but with the Starbucks Brand and Nestle's distribution expertise that too shall change.

This Bloomberg article delves into the details nicely. Flush with Nestle Cash, Starbucks Unveils Bold China Plan.

I believe this a very good opportunity to buy Starbucks before a potential rerating. The stock has been flat since late 2015, and the fundamentals look good.