Market Scorecard

Yesterday the market moved in one direction, down. On the local front every time we refreshed our screens, there was a slightly deeper hue of red. The best explanation that financial journalists could come up with for the moves locally was, "Investors are in a risk-off mood". While reading financial news and research recently, there has been more focus on negatives than positives. The theme through all of the negative articles is that the current rally has lasted too long and that there is no more room for markets to continue higher.

In the US, the focus was back on China and US trade talks. The expectation was that Trump and Xi would meet before the 1 March deadline where they were expected to make significant strides in reaching a deal. In a press conference yesterday Trump told reporters that he doesn't plan to meet Xi before the deadline. Maybe it is just tough talk ahead of lower level talks?

Yesterday the

JSE All-share closed down 1.26%, the

S&P 500 closed down 0.94%, and the

Nasdaq closed down 1.18%.

Our 10c Worth

One thing, from Paul

Benedict Evans is a partner at investment firm Andreessen Horowitz in Menlo Park, California. He writes a great blog on tech trends. His latest post is about how

the cameras in smartphones are getting better and better, and the software in the photo app is doing amazing things.

Our smartphone pictures are vastly better now than the ones that we used to take on early models. The lenses are amazing, and the software features are incredible (autofocus, light balancing, HDR, portrait mode, night sight, etc). Most of this stuff is now automatic - the camera app just knows how to make the best of the moment. The selfie-taking generation has endless options.

Next comes the application of machine learning and artificial intelligence techniques to photos

Next comes the application of machine learning and artificial intelligence techniques to photos. So, when snapping a group pic, focus on that particular child (or cat or dog), because the phone knows he's mine. File that schedule to my diary, because the phone knows that this photo is of a table with dates and specific information. Buy those ingredients from Amazon now, because the phone knows that this picture is a recipe. Better still, you will be able ask your phone five years later to "find that photo of me on Clifton beach with my old school friend James".

Very exciting stuff.

The investing takeaway is obvious - buy Apple!

Read Ben Evans'

whole blog post here. You can also sign up there for his occasional email newsletters.

Byron's Beats

Many people are getting very excited about the

oil discovery off the coast of South Africa. In the past South Africa has not taken full advantage of its resources. During the Apartheid era, resources benefited only a small handful of the population and during the ANC's tenure, policies have not allowed us to take full advantage of the Chinese growth story.

When I think of the potential advantages of this discovery I am more excited about becoming energy self-sufficient than trying to export the product. I did some digging on the interwebs and found this very informative blog called, South African Market Insights, which does some extensive analysis on oil imports in South Africa. According to this piece titled

South Africa's crude oil imports, Where is it coming from? we spend R8 billion a month importing oil. Oil constitutes 11% of all our imports.

Further digging found that out of our average daily consumption of around 520 000 barrels a day, we produce 160 000 (mostly Sasol). The potential 1bn barrel discovery could make us completely self-sufficient. This means our petrol price would not be reliant on currency fluctuations. You'd probably find that the petrol price would come down drastically. Immediately benefitting all South Africans in a very big way. A lower petrol price will make everything cheaper. It's like a reverse tax. And this is before all the side benefits such as jobs and potential exports.

Of course there is a lot that remains to be seen. I am sure there are many cynics reading this thinking that we will mess this up (personally I am most concerned about the environmental impact). But after having watched SONA last night and hearing Cyril say they wish Total all the best with the discovery, I do feel we may possibly reap some benefits here if the deposit turns out to be feasible.

Michael's Musings

One of the most powerful concepts/forces to grasp when it comes to investing is

Dollar-Cost Averaging. It is central to our approach to investing. Unfortunately, it is a topic glossed over by many.

So when I saw the latest blog post from Nick, as you can imagine the headline immediately caught my eye -

Even God Couldn't Beat Dollar-Cost Averaging.

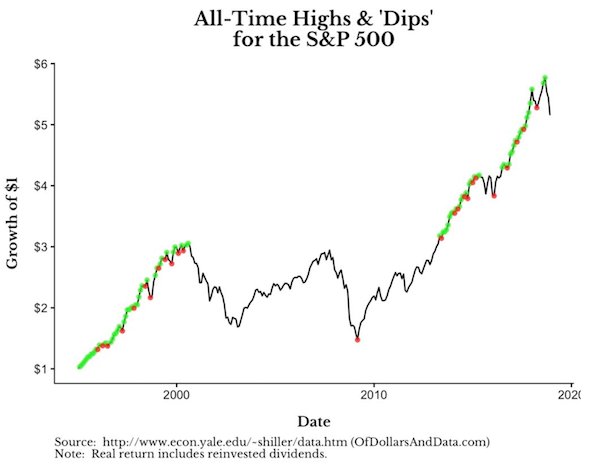

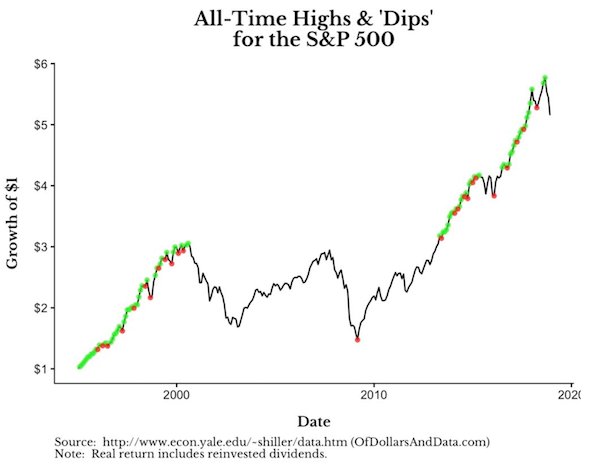

He compares the performance of DCA, where you invest on a monthly basis, compared to saving money each month and only buying at the market's lowest point between all-time highs. The massive assumption here is that we can know the exact low point in the cycle beforehand. Experience shows we almost never buy at the bottom. Normally we only start buying back into a market once it has bounced at least 10%.

The blog is long but it is easy to read. If you have the time, I would encourage you to give it a go. Here was his main conclusion though.

"So if you attempt to build up cash and buy at the next bottom, you will likely be worse off than if you had bought every month. Why? Because while you wait for the next dip, the market is likely to keep rising and leave you behind."

Bright's Banter

Streaming behemoth Spotify is

making two acquisitions in the podcasting space in an effort to boost its audio business. The Stockholm domiciled company is acquiring Gimlet Media and Anchor FM.

Gimlet is the maker of podcast shows like

"Homecoming",

"Reply All", and

"Uncivil". Anchor is a business that offers editing, distribution, hosting and monetisation tools for people in the podcasting space. Spotify has between $400 million and $500 million set aside for acquisitions this year.

"Spotify is already one of the

world's most-used apps, but we see an opportunity apart from where we sit today," CEO Daniel Ek wrote in a letter. "This opportunity starts with the next phase of growth in audio - podcasting."

Spotify announced these deals on the same day it reported its first profit ever, as well as strong subscriber growth. The company added 16 million new users in the fourth quarter of 2018, nine million of whom pay for its premium services. Both of those numbers exceeded analysts' forecasts.

Spotify wants people to spend more time on their app and so naturally, podcasting makes sense. I don't know if this differentiates Spotify from the competition because Apple already has a big base when it comes to podcasts and the music-streaming business has grown to be bigger than Spotify's.

Linkfest, Lap it Up

Here is another example of a negative impact from the uncertainty caused by Brexit.

Nissan scraps plan to build new X-Trail model in Britain

Have you watched the new Netflix show Tidying Up with Marie Kondo? Thanks to the show, decluttering is front and centre of peoples' mind in 2019 and business is capitalising -

Clutter is raising $200-250M led by SoftBank for on-demand storage and moving

Vestact Out and About

Vestact Out and About

This week on Blunders: Cryptocurrency exchange boss dies and leaves no password; WhatsApp with this Nigerian deodorant?; Chinese New Year leads to fireworks; and a super Valentine's day promotion at the El Paso Zoo -

Blunders - Episode 132.

Signing off

Signing off

Asian stocks are red this morning. Hong Kong is trading again today, it unfortunately opened deep in the red. The JSE All-share is also lower this morning.

Sent to you by Team Vestact.