Market Scorecard

Yesterday there were trading updates from a couple of South African mining companies; ties in nicely with the mining indaba happening in Cape Town this week. For both Impala Platinum and Anglo Gold, they have swung from being loss-making last year to making profits this year. Management of both companies have been working hard to make operations more efficient, part of that involves selling or shutting non-core assets. For Impala, the share was up 8% yesterday and is up 30% over the last 12-months. In the case of Anglo Gold, it dropped 5% yesterday but is still up 43% over the last 12-months. Over three years both stocks are only marginally higher though. Like the rest of the market, it would have been better to leave your money in a savings account.

Yesterday the

JSE All-share closed down 1.00%, the

S&P 500 closed up 0.68%, and the

Nasdaq closed up 1.1%.

Company Corner

Bright's Banter

Diversified social media giant Facebook turned 15 yesterday, a big milestone for a company that was started in a university dorm room. Accel Partners invested $14.8 million in a website called 'the facebook.com' back in 2005, today the returns are north of $5.6 billion or 378 times their initial outlay.

Facebook owns three of the five platforms that got to 100 million active users the fastest i.e. Facebook, WhatsApp and the mighty Instagram. Mark Zuckerberg's Midas touch is unparalleled, having bought Instagram for just $1 billion - - a business that could be worth well above $100 billion today.

Facebook reported a robust set of numbers to put an end to what has been their most controversial year yet. The company has had blunder after blunder from the Cambridge Analytica data breach, to recently collecting data from teenagers, which to be fair

they received parental consent for.

The social media company reported a 9% increase in both its daily and monthly active users on the Facebook platform. The growth came from Asia-Pacific; India, Indonesia, and the Philippines. The phone is still the most important screen in our lives and Facebook still owns six of the top ten Apps. Since we spend 80% of the time "in App" Facebook is going to continue to print strong numbers.

The company netted $16.91 billion in revenues in the quarter ending December 31, beating its previous record by more than $3 billion. Facebook's most important markets which contributes 90% to revenues, North America and Europe, grew revenues by 55% and 19%, respectively. Its global average revenue per user is $7.37, a number that's grown five fold since listing.

You will find more infographics at

Statista

Many publications have been expecting Facebook to lose subscribers faster than ever but that has not been the case. The largest social network now has

2.32 billion monthly active users, of which 1.52 billion of them use the platform every single day!

Facebook's headcount has increased by 42% to over 35 000, of which management reported that more than 30 000 of the employees were working on security, to address the social issues I have stated above. Founder, CEO and Chairman Mark Zuckerberg said the following on the topic:

"We've fundamentally changed how we run this company. We've changed how we build services to focus more on preventing harm. We've invested billions of dollars in security, which has affected our profitability. We've taken steps that reduced viral videos in Facebook by more than 50 million hours a day to improve well-being."

This leads me to the same conclusion as the one I had back in August last year. Facebook management seems to be learning from recent history with regards to the important role the company plays in society, given the general demise of newspapers.

By taking action to clear out these accounts, Facebook is choosing the long-term good over short-term profits.

Byron's Beats

Yesterday MTN released a trading statement for the full year ending 31 December. The company expects an improvement of at least 20% in headline earnings per share. Having said that, the comparable period still had some Nigerian fine influence as well as hyperinflation in Nigeria.

It seemed like the market was expecting more. The share dropped 2.5% on the news. Even after this increase, earnings of R3 a share is far off the potential of this business. When once-offs consistently hurt your numbers they can no longer be considered once-offs.

Regardless, the potential is still there.

215 million subscribers is a massive base to monetise. Let's wait and see what the detailed results expected in March have to say. I am sure we will also get more clarity on Nigeria.

Our 10c Worth

One thing, from Paul

One problem with theme investing is being early. As you know, we like to position Vestact customer portfolios in transformative stocks, where an emerging regional, economic or consumer trend is driving rapid growth in sales for a well-positioned company.

The trouble is,

. If they were, they wouldn't be new and there'd be no investment edge! Once intellectuals catch wind of a big change coming they start writing opinion pieces about the topic, and the shift can seem more certain than it really is.

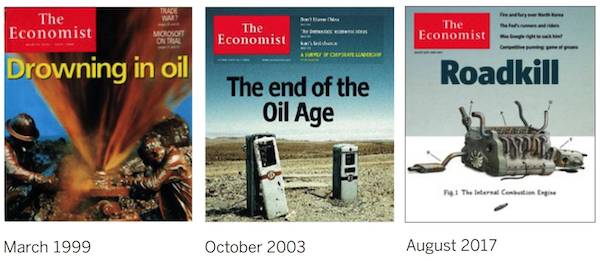

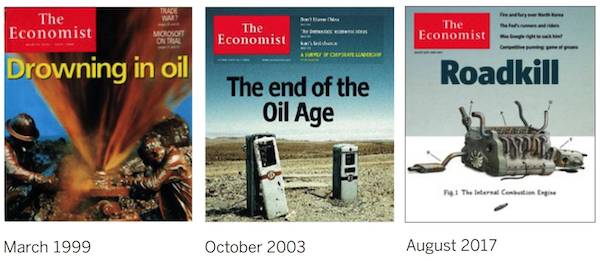

A good example is electric vehicles. Consider the graphic below, made up of covers from The Economist magazine. If you followed that perspective, you'd think that no oil was being used in the world anymore and that internal combustion engines were extinct. In truth, that is not the case. Not at all.

Anyway, buy Tesla. Just be aware that we are all a bit early, and that their sales might be a bit unpredictable. Buckle up.

Michael's Musings

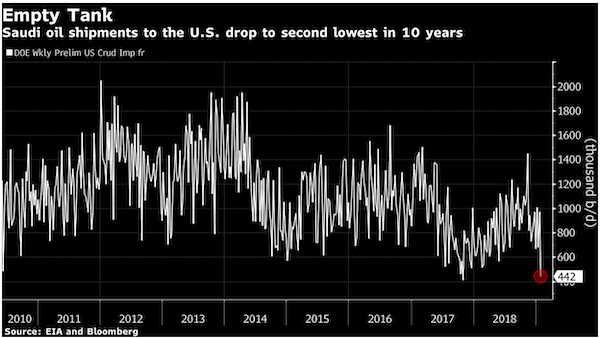

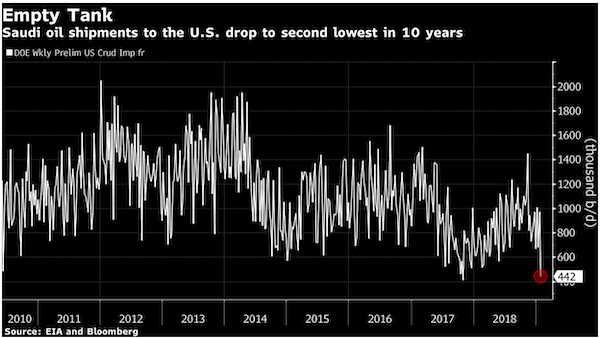

With the shale revolution, the mix of oil types produced has changed, meaning the refineries have to change their setups again. This FT article has a look at the shifts - From heavy to light and back again.

The problem for many refineries was that they assumed heavy sour oil would dominate the world, given that large producers like Saudi Arabia and Venezuela (well used to be large) pump that style of oil.

"Crude isn't the same everywhere: the kind pumped from the shale wells of West Texas resembles cooking oil -- thin and easy to refine. In Venezuela's Orinoco region, it looks more like marmalade, thick and hard to process."

Based on this Bloomberg article, America Is Producing the Wrong Kind of Oil, it is still cheaper for many American refineries to pay a bit more for heavy sour oil, than to switch to light sweet from the frackers.

From what I have read, it is not a simple process to change the type of oil you refine and using the wrong type of oil as a feedstock means refining efficiencies drop. Some refineries have the capabilities to refine more than one type of oil, which does help.

What happens to OPEC when global refineries decide that shale will be a long term sustainable oil supply, and shift their production to predominantly light sweet?

Linkfest, Lap it Up

A quick and interesting read. It is inspiring to learn about guys who backed themselves - Here's how South African execs rebuilt their company after it went spectacularly bankrupt in 2009

Do you think you are rich, poor or neither? Here is how the US ranks different incomes.

You will find more infographics at Statista

You will find more infographics at Statista

Vestact Out and About

Signing off

Asian markets are closed again today for the Chinese new year. The Hong Kong market will open again on Friday, but mainland China will be closed until next week. Yesterday, we spread 'fake news' by saying that Aspen reports numbers this week. They don't report on the 7 February, they report on the 7 March. So now you know! The JSE All-Share is higher this morning.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista

You will find more infographics at Statista

You will find more infographics at Statista