Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Last week our favoured biotech stock, Amgen, released results for the fourth quarter and full year 2018. As we have alluded to before, Amgen is going through a phase where a few of their blockbuster drugs are slowing down because of off-patent competition. At the same time they are pushing new exciting drugs into the market. That is not always as easy as it sounds, even if you assume the drug works really well. You still need to convince the doctors, insurers and hospitals to endorse the product.

Let's look at the numbers then we can delve into the products. For the full year, revenues increased 4% to $23.7bn. Because of the favourable tax rates, earnings per share increased by 14% to $14.40. Of that, $5.41 is paid out as a dividend, providing a very solid yield of 3%. The share is currently trading at 11 times 2020 predicted earnings.

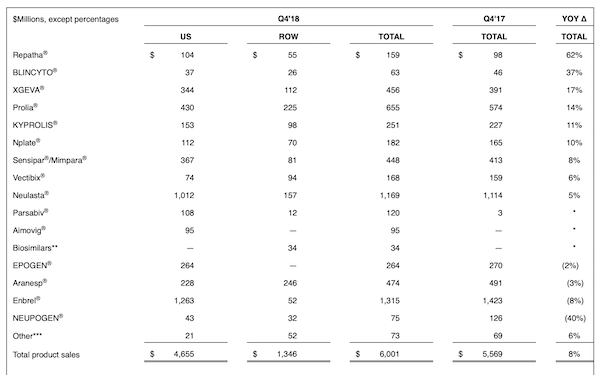

Take a look at the sales mix. This may look foreign to you but I'll do some explaining.

As you can see, Enbrel, a super drug that fights five chronic diseases, is slowing down in sales because of competition from another blockbuster called Humira, owned by AbbVie. This is the biggest gap that needs to be filled. Having said that, management expect sales to be stable in 2019.

Amgen have earmarked Repatha (heart disease) to become a big blockbuster. They are currently trying to convince the insurers to hop on board. Even though it works very well, it is expensive.

Aimovig is another drug with big aspirations. It is very good at fighting migraines. As you can see from the sales, it has just launched. This launch brought in double the expectations. Sales estimates for this drug in 2019 are $570mn.

I won't bore you too much more with the ins and outs of the pipeline but I hope you get the picture. Amgen is a biotech ETF in its own right. It is very hard to tell which of these drugs will succeed and become blockbusters.

We love the sector and we have chosen the diverse Amgen portfolio to gain exposure. They spent nearly $4bn on research and development last year. That is 16.5% of sales. Some drugs are slowing, others are growing. You are being paid a 3% yield while you patiently wait for the pipeline to reap the rewards. We are very happy with Amgen as a core holding in our portfolios.