Market Scorecard

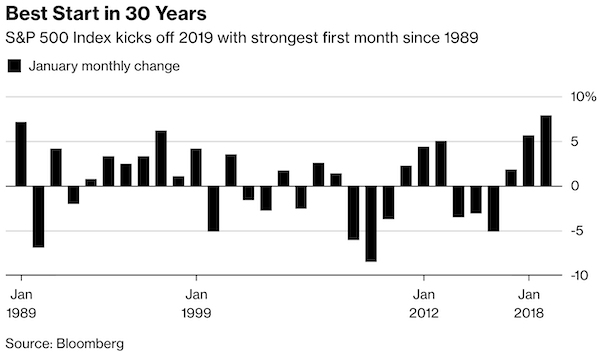

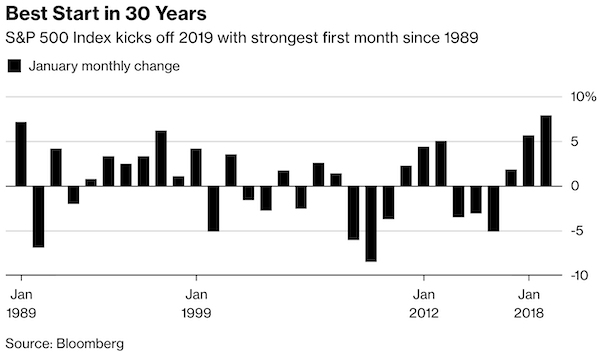

If you used your Christmas bonus to buy stocks or if you used the new calendar year to send more money to the US, pat yourself on the back. January 2019 was the best start to trading in over 30 years. Who would have thought, considering how gloomy things were going into the festive season? It goes to show that trying to time that market generally doesn't work. While some have been 'waiting for things to look better' the market is up over 10%.

Our best advice to clients is to invest regularly, have a cash reserve to cover any unexpected expenses which then allows you to not worry about the short term fluctuations. We say this repeatedly, investing in stocks is for the long term, where the short term journey can be very bumpy.

Yesterday the

JSE All-share closed up 0.05%, the

S&P 500 closed up 0.86%, and the

Nasdaq closed up 1.37%.

Company Corner

Michael's Musings

On Wednesday after the US market closed,

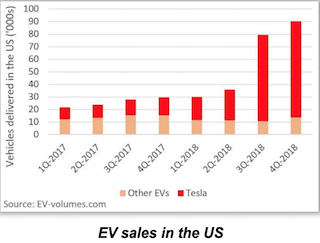

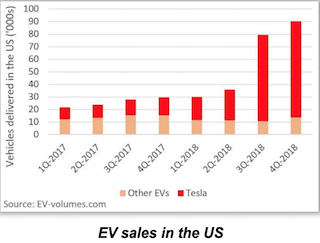

Tesla reported their Full-Year and Q4 numbers. It was the first time in the history of the company that it reported a profit for two quarters in a row. This feat was all thanks to the massive ramp-up of the Model 3 production. The graph below shows you just how impressive the accomplishment is.

There are two benefits to growing production, the first is the obvious increase in revenues, where

automotive sales are up 134% to $6.3 billion from $2.7 billion 12-months ago. The second benefit is the drop in production costs, which will allow Tesla, in time, to introduce their targeted $35 000 Model 3 version. Showing the benefits of scale,

Tesla now needs 65% fewer man hours to produce a Model 3 when compared to 6-months ago.

The very exciting target for 2019 is for their

Shanghai factory to be operational by the end of 2019, and for the factory to be producing 10 000 cars a week by the middle of next year. For reference purposes, the goal for the US factory is 7 000 Model 3's per week by the end of 2019.

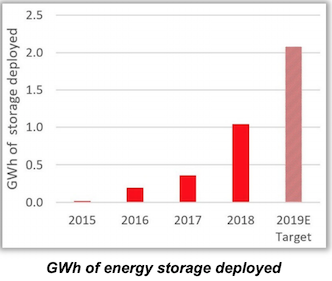

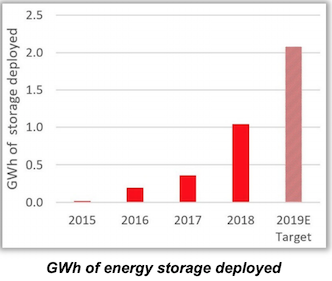

While most of the focus for 2018 was on the car side of the business, their energy business continues to grow exponentially.

In 2018 they installed 57% higher energy capacity, and in 2019 they plan to double the 2018 number.

All the growth means that Tesla has swung from burning cash to making some. In the Q4 2017, it made a loss of $770 million. In Q4 2018 it made a profit of $210 million. To justify their $53 billion market cap though, the company will need to continue with their current growth trajectory. No doubt, it will be a steep hill to climb.

Given that last year only 2% of cars sold were EV, there is more than enough room for all car makers to play and grow sales.

Bright's Banter

Gene sequencing giant Illumina reported Q4 numbers on Tuesday after the market close. The San Diego, California based company reported record revenues of $867 million, up 11% year-on-year. For the year 2018, Illumina reported $3.3 billion of revenues, up 21% thanks to strong demand for sequencing and array systems, consumables and services.

On the earnings call, CEO Francis deSouza said "

2018 was our 20th consecutive year of growth as genomics continues to enable an increasing number of research, translational and clinical applications across a broad range of customers.

For the quarter, Sequencing consumables revenues came in at $466 million showing growth of 8% but up 23% for the 2018 year to $1.8 billion. Sequencing services and other revenues were $104 million, up 20% year-on-year, largely driven by Genomics England or GeL as it's known.

GeL is a project to sequence 100 000 people in the UK. Illumina is developing the infrastructure to enable the sequencing of those genomes as well as the data management of the project.

The idea was to understand health economics of why sequencing helps improve healthcare, for quality of outcome, and reduced cost.

Illumina's goal is to enable flexibility that will enable customers to sequence-on-demand

Illumina's goal is to enable flexibility that will enable customers to sequence-on-demand rather than waiting to batch on the larger flow cell. According to a report by Goldman Sachs, Illumina could capture 75% of the exploding gene sequencing market by 2020; a market that is said to reach $20 billion by 2020.

deSouza announced a partnership with

Sysmex Corporation where their goal is to commercialise the first Next Generation Sequencing.

In 2019, Illumina expects revenues to grow between 13% and 14%. That guidance excludes any impact from the pending

acquisition of Pacific Biosciences which the company expects to bed down mid-year.

Illumina still enjoys margins north of 70% and a big chunk of the sequencing market share thanks to their ability to drive down the costs to consumers. Genome sequencing for example used to cost $100 million in 2001 and today it is less than $1 000. We like the space and we like a dominant player like Illumina!

Our 10c Worth

One thing, from Paul

In life, markets and the economy, some things change and other things stay the same.

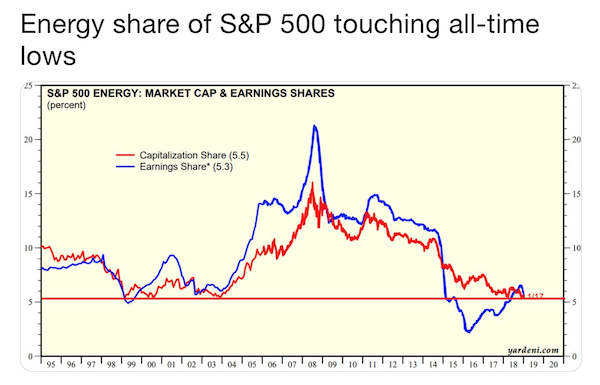

I stopped concentrating on commodity prices once we exited our oil, mining and resources holdings in about 2013. With the heavy infrastructure buildout in China slowing down, the demand for commodities waned and returns in the sector fell.

The supply of fossil fuels is not infinite, but then demand is not all that strong either. New technologies are coming to the fore, and they are less resource intensive. I just checked the twenty year chart of the oil price and saw that the all-time high was $160.72 a barrel in 2008. In January 2016 the price fell to $35.64 a barrel. In the last calendar year (twelve months) it has been as high as $73.93 and as low as $45.41.

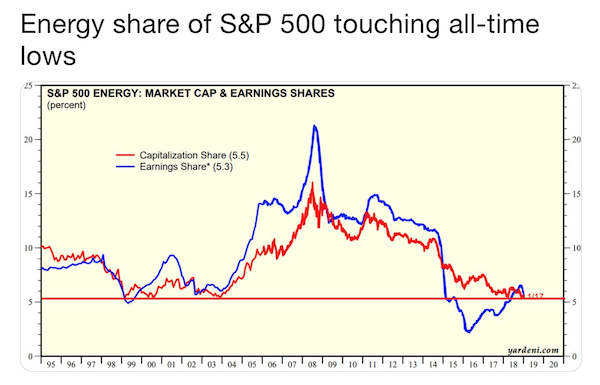

Not surprisingly, given this sloppy performance, interest in oil and gas stocks has declined sharply. Stocks in the sector trade on low forward earnings multiples.

ExxonMobil used to be the world's most valuable company, but it certainly isn't now.

The chart below shows energy stocks' share of the S&P 500. Back in the heyday they represented a capitalisation share of 16%. That just hit an all-time low of just above 5%.

Linkfest, Lap it Up

Linkfest, Lap it Up

What better way to know if you have a security problem than for 'trusted' people to try hack your device -

Japan plans to hack into millions of its citizens' connected devices

It is always great to read about South African companies in international media. In this case they are talking about Naspers amazing investment track record -

One of tech's best investors just bet $1.16B on the Russian classifieds industry

Vestact Out and About

Vestact Out and About

This week on Blunders: Water called Liquid Death costs $2 per can; Lithuanian scams Facebook and Google for $100 million; Credit Suisse stiffed by Canada Goose; Yes, but what will they wear at SONA? (

Blunders - Episode 131)

Paul's Visa note gets a mention in the Market Tamer blog. I hadn't heard of them until this morning, what about you? -

Need to Know: The last thing standing in the way of a rip-roaring rally for stocks

Signing off

Signing off

The day ahead holds CPI from the EU and then vehicle sales in South Africa. The top three selling cars locally are normally the Toyota Hilux, Ford Ranger and the VW Polo; no surprises there. Then in the US it is 'Jobs Friday', where we hear how the US labour market is doing and what their unemployment rate is. Good luck to the Proteas.

Sent to you by Team Vestact.