Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

On Tuesday Stryker reported really solid numbers. So much so that the stock shot up 11% yesterday. Remember Stryker are leaders in manufacturing medical devices. From hospital beds to artificial hips, knees, spines. Basically, any bone in your body can be replaced with an intricately designed Stryker device.

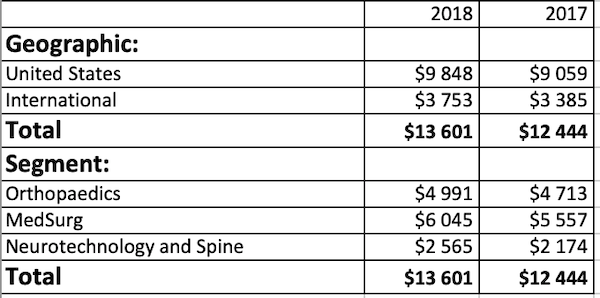

Let's look at those numbers. These are for the fourth quarter and the full year. For the quarter, sales increased by 9.4%. 8.6% of that was organic. For the full year sales increased by 9.3% to $13.6bn. 7.9% was organic. Organic growth is an important metric for this business because they make a lot of bolt on acquisitions.

Earnings per share increased by 12.6% for the year to $7.31, exceeding all expectations. Take a look at the below table. It breaks down sales growth per division as well as geographically.

From what I hear from people in the industry, Stryker in the US is world class. Service is second to none and they are ruthless at streamlining new acquisitions. However internationally, SA in particular, there is room for improvement. That seems like a good opportunity for a company with world class products and a low international presence.

The commentary was positive and the guidance looks solid, they expect organic sales growth of 6.5%-7.5%. and EPS of $8-$8.20 in 2019. That puts Stryker on a forward multiple of around 22. Also expect more bolt on acquisitions. The sector is full of small, innovative companies creating exciting medical devices. We continue to recommend Stryker as a core holding in our portfolios.