Market Scorecard

Negative economic news out of China yesterday was the driving force for equity markets. Chinese exports dropped by 4.4% and imports dropped 7.6%, forecasters were expecting growth from both. The data clearly shows that the trade war is starting to bite. Hopefully, as economic growth is impacted, both sides are more motivated to make compromises and find a middle ground.

Citi Bank was the first major Wall Street bank to kick off US earnings, where they missed on revenue expectations. Initially the stock dropped on the news but as investors dug deeper into the numbers and particularly comments from management on the conference call, the stock closed the day 4% higher. Our banking investment, JP Morgan, reports their numbers today.

On the Citi conference call, the CEO Michael Corbat said that there is a disconnect between Wall Street and Main street. Wall Street is busy looking for the next recession, where Main Street is ticking along nicely.

"The biggest risk in the global economy is one of talking ourselves into the next recession as opposed to the underlying fundamentals taking us there"

Yesterday the

JSE All-share closed down 0.31%, the

S&P 500 closed down 0.53%, and the

Nasdaq closed down 0.94%.

Our 10c Worth

One thing, from Paul

Based on news headlines, it's clear that there are many countries in trouble. Reckless politicians are everywhere and corruption is rife, right?

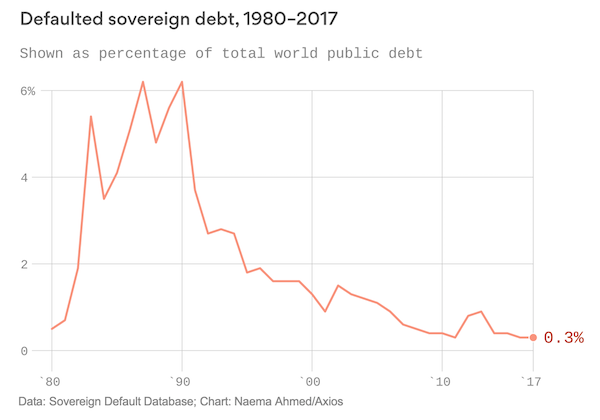

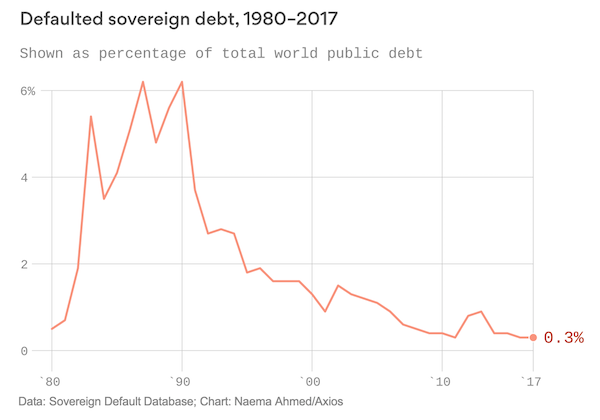

So you may be surprised to learn that

lending money to governments has never been safer. According to the Sovereign Default Database, compiled by staff at the Bank of England and the Bank of Canada,

defaulted sovereign debt accounts for just 0.3% of all world public debt. That's an all-time low, and is down sharply from the high point of 6.2% reached in both 1987 and 1990.

It's been well over a decade since defaulted sovereign debt accounted for more than 1% of total world debt. High profile blowouts by Argentina and Greece generated plenty of headlines, but were relatively small by historical standards.

Recent

defaulters include Puerto Rico, Sudan, Iraq, and Venezuela. I'm not sure where Zimbabwe and Mozambique stand, as they defaulted in the past and are probably unable to do new issues? The biggest risk on the horizon is Italy, which alone has $2.8 trillion in sovereign debt outstanding, or about 4.3% of total world public debt. They will probably be fine.

More info on the BoE blog site called

Bank Underground.

Byron's Beats

On Thursday night we will get results from Netflix. This is always an exciting one because the company is currently experiencing a massive surge in subscribers. That means that subscriber additions is all the market is really interested in at the moment. People put their necks out making predictions and guesstimates on what the subscriber growth will be for the next quarter.

Goldman Sachs is very optimistic for Q4. They expect 2 million domestic adds and 8.4 million international adds, versus the consensus of 1.8 million and 7.6 million respectively. That is a whopping addition of 10.4 million subscribers in just 3 months! Let's hope they are right.

We don't get too caught up in the estimates and whether the actual numbers beat these estimates or not. Of course, it is nice when the share price reacts positively. We are more interested in the long term trend of solid additions and whether these additions will outpace the long term expectations of the market.

And for Netflix, we believe they can achieve that. More on the numbers on Friday.

Michael's Musings

We have exposure to the payments industry through Visa and indirectly through JP Morgan. So when I saw this article come across my twitter feed it sparked my interest,

PayPal Quietly Took Over the Checkout Button.

The article highlights that

PayPal's success lies in their ability to make paying at checkout easy. When things are easy, consumers tend to spend more. We have very short attention spans, so if we hit an obstacle or get distracted when it comes to paying, we tend not to follow through with the purchase.

"PayPal's conversion rate is lights-out: Eighty-nine percent of the time a customer gets to its checkout page, he makes the purchase. For other online credit and debit card transactions, that number sits at about 50 percent."

Many of PayPal's 250 million users have their credit card linked to the platform.

That means every time a transaction is processed with the linked credit card, Visa gets a slice of the action. There is no doubt that fintech is an industry with a bright future. Choosing which company will succeed is too difficult though, so we have stuck with our Visa investment which provides the backbone to most fintech companies.

Bright's Banter

Norwegian subscription-based streaming services company

Tidal is under investigation in Norway for allegedly inflating streaming data for artists. The Norwegian Authority for Investigation of Economic and Environmental Crime is probing the company after leaked data showing that some artists including Kanye, were paid for millions of non-existent streams.

This would be an interesting find and an annoying outcome for the artists since they pour their lives and souls into the music for it to be played, enjoyed and streamed on all platforms. Streaming payouts are based on a ratio of the total number of streams that particular song attracts.

This brings about a lot of controversy considering the fact that Jay-Z and Beyonce acquired Tidal for $56 million, a company that is

rumoured to be worth north of $600 million. Some of the artists that were robbed of their dues are Jay-Z's personal friends and Beyonce is his wife!

Linkfest, Lap it Up

Linkfest, Lap it Up

This is a very creative move from Twitter. During the first half of a game, Twitter users will vote on a player they want to follow during the second half. Then Twitter will follow that player on an isolated camera feed -

Twitter, NBA deal gives fans a new way to watch games

Heathrow airport is already busy and massive! With new planning they may be able to increase traffic from 480 000 to 500 000 planes a year -

London's Heathrow Airport Looks to Add 25,000 Flights a Year on Existing Runways

Vestact Out and About

Vestact Out and About

Signing off

Signing off

The JSE All-share is higher this morning, following strong positive moves from Asia. As mentioned earlier, JP Morgan reports earnings before the US market opens this evening. Then shifting to politics, the next major mile stone in the road to Brexit happens today. The UK parliament is set to vote on the current deal, where political analysts don't expect it to carry. The focus will be on how many votes the motion fails by. Locally there is mining production numbers released this morning and then this afternoon, there is a retail sales number. For the US, they release their import and export figures. How will they fare compared to the Chinese?

Sent to you by Team Vestact.