Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Richemont, the second largest luxury goods company in the world released its third-quarter trading update on Friday. The maker of Cartier had two very prominent strategies going into 2018. First, increase sales channels by pushing online/e-commerce, which was only 1% of the groups' total sales. Second, invest more in Chinese operations.

The company was successful in both. We saw a surge in online sales from EUR59 million to EUR694 million after the full acquisition of YOOX Net-a-Porter (YNAP) and UK-based Watchfinder.co.uk. Online now makes up 18% of total sales for the luxury goods company.

Sales increased by 25% year-on-year to EUR3.9 billion. However, excluding YNAP and Watchfinder, sales only increased by 6% in actual exchange rates. The biggest contributor with double-digit growth, notwithstanding the trade wars, a "slowing economy" and tariffs, was still mainland China.

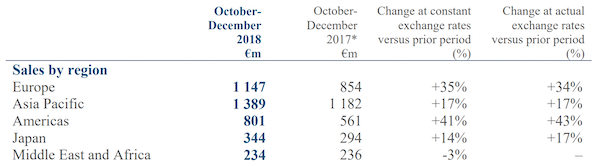

Sales by region were positive for most parts, except for the Middle East, Africa, and Europe. The reason for weak sales in Middle East and Africa was the fact that they were coming off a high base and the currencies weren't in their favour.

Richemont said they encountered problems in France with the "yellow vest" protests which "negatively impacted tourism and led to store closures for six consecutive Saturdays".

In terms of growth by business area, jewellery is still the shining star with a 9% increase in sales to EUR2 billion. Mostly thanks to the Van Cleef & Arpels Perlée Clovers bracelets that have seen a great year.

We are happy holders of Richemont in our clients portfolios as prospects for the majority of their products are positive, especially in mainland China, their largest market.