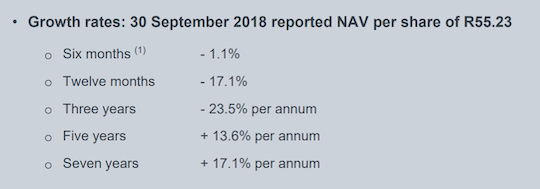

On Monday afternoon, Brait reported their interim numbers. All their investments have been under pressure over the last year, where managements' reported Net Asset Value (NAV) per share came down from R66 to R55. Their assets are Virgin Active, Premier Foods, Iceland foods and smaller assets which are remnants from Brait's private equity days. Then there is the disastrous New Look asset, which they still own but is valued at zero. Three years ago, their NAV was R123 per share, with New Look accounting for 45% of that. Below you can see how their NAV has performed over different time periods.

The main asset now is Virgin Active, accounting for 45% of their NAV. Over the last 12-months, revenue is slightly higher but profits are lower. Long term prospects look good though, their membership numbers grew by 13% with some exciting growth coming from Asia. This Virgin asset is one of the reasons why we initially looked at investing in Brait.

Glancing at New Look, the reinstated management has slowed the bleeding. The entity now makes an operating profit, but once they have paid interest on their significant debt burden, New Look makes losses. To help stabilise things, and bring down costs, they have closed 85 stores and have ended their push into China.

Brait is still in turnaround mode after having two tough years, I don't see the share price recovering in the short run.