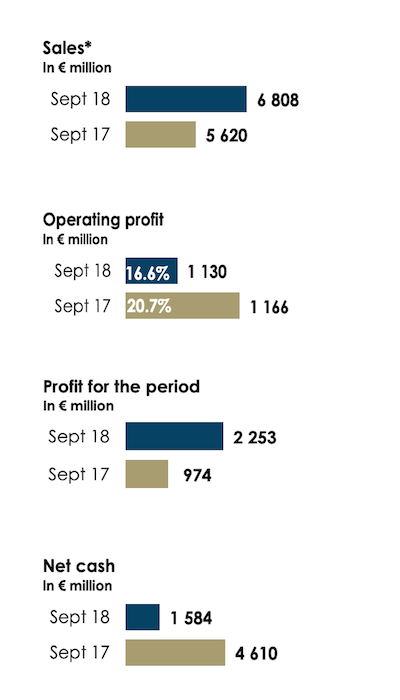

Late last week Richemont released interim 6-month results for the period ending 30 September. The below table indicates the change in numbers over the comparable periods.

There were quite a few moving parts over the last 6-months; Richemont purchased Watchfinder and fully incorporated Yoox Net-A-Porter (YNAP). Online retail now compromises 14% of group sales. Sales increased 24% including online retail. If you exclude online, sales increased by 8%. From the trading update in early September, management indicated they expected sales to increase by closer to 10%, the market did not like this miss.

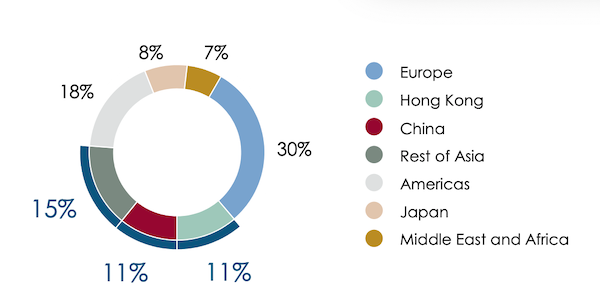

Here is the sales mix by region.

Sales in Europe increased by 28%, up 20% in Asia Pacific, 42% in The Americas, 14% in Japan and 4% in the Middle East and Africa. These numbers all included the online retail businesses, which were not reflected in the comparable numbers, hence the solid growth numbers.

Luxury is still a good investment theme. The US and China are thriving, as seen in the numbers. Having said that, the regulatory environment in China is getting stickier, both for gifting and for bringing in luxury items from international travels.

Richemont is an outstanding global business which we are lucky to have exposure to on the JSE. It is trading at 18 times 2019 earnings, the cheapest it has been for a while. Luxury goods companies, with 200-year-old brands, typically trade at a premium to the rest of the market. We think this is a decent time to buy.