Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Picture this cricketing scenario. You are chasing 300 runs and your team is already 100/4. Your 6th batsmen, who is horribly out of form, comes in to try and save the day. After a shaky start, he finds his feet and comes through with a cracking century off 60 balls and saves the day. That is what it was like when Facebook released their results on Tuesday. Facebook, of course, were batting for team Tech. Amazon, Netflix and Google had gone out cheaply (although Netflix put up a brave fight). Fortunately, Facebook beat expectations and the share price shot up 5% premarket.

In total 2.6 billion people use Facebook, WhatsApp, Instagram or Messenger each month. Some use one or two platforms, many use all 4. This resulted in $13.73bn in revenue. $13.54bn of that came from advertising. The business has incredible operating margins of 42% which meant a very chunky net income of $5.1bn for the quarter. To put that into perspective, AB Inbev who own more than a third of the worlds beer market and have a history that dates back to 1850 makes $8bn a year.

Speaking of margins, all eyes were on company costs. This increased by a whopping 53% as the company tries to fight certain teething pains that come with an unprecedented industry. This includes fake news and large data breaches. Not only does the company hire people to pick up these issues, Facebook is also investing billions into AI (artificial intelligence) that will improve the product.

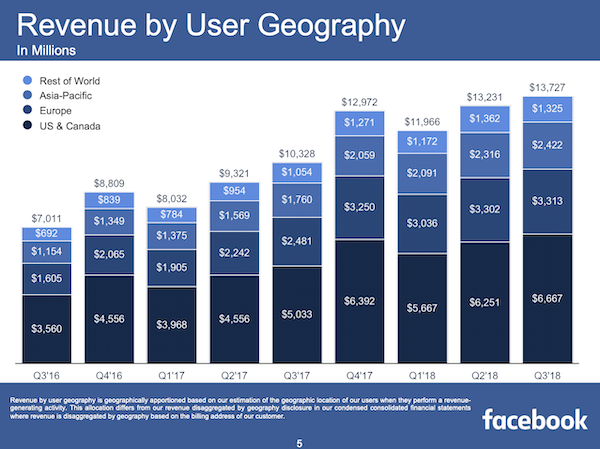

The below image shows where the company makes most of its money. Clearly there is still a big developing market opportunity here. Average revenue per user in the US is $27, in Europe $8.82, Asia $2.67 and Rest of world $1.82.

Facebook is far from a smoke and mirrors tech firm with lots of potential. It is now an extremely profitable business with $40bn in cash and 0 debt. At $154 a share it trades at 19 times next years earnings. We still believe it has huge room for growth amongst its various platforms whilst it continues to explore new opportunities in content, retail and video. The recent weakness is a good buying opportunity.