Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

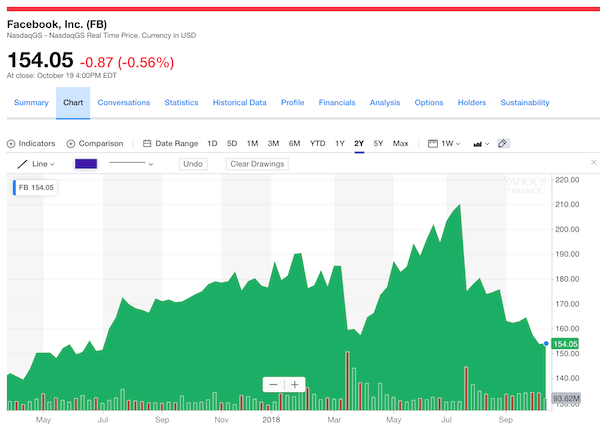

Facebook stock has been quite weak lately. If you look at the two year chart below, you can see that it peaks at $210 a share in July 2018, and has slipped steadily since then, to $154 at the close last Friday. What gives?

Well, the overall market has been softer in recent weeks, but Facebook has also had company specific problems, mostly relating to data leaks, privacy concerns and regulatory challenges. Perhaps more importantly, some fear that its user engagement is slipping, and advertisers are deserting the platform? The pundits usually forget that the Facebook group has multiple platforms, and the secondary ones like Instagram and WhatsApp are booming.

The Goldman Sachs analyst who covers Facebook is Heather Bellini, and she has developed a system of "channel checks" with major advertisers, in order to predict revenues. The following text is a shortened version of a report she published this morning.