Just when you think that markets have stabilised, you get another smack in the face. It is during these tough periods that I think it might be better to only receive quarterly portfolio statements, instead of the weekly statements our clients currently receive.

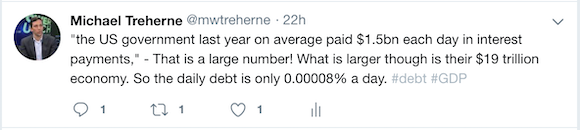

I saw this tweet yesterday, which made a good point.

If you have bought local equities, either through direct investments like we have at Vestact or through your pension fund/RA's, then you own those two categories of South African companies, and your performance has been shoddy. The poor performance of RSA assets has not been limited to equities though; you would struggle to sell your house today for what it was worth 12-months ago. We are not fans of gold, but even this 'safe' asset has struggled in Rand terms over the last 12-months. We won't even talk about Bitcoin!

This is why diversity away from a particular stock, sector and country is essential. For Vestact clients, that diversity comes in the form of investing directly in US-listed companies. These tough times are a reminder that the good times don't roll forever and that we need to 'make hay while the sun shines'. Make sure that you are saving and investing while things are good, so that when 'winter comes' you can weather the storm.

Yesterday the JSE All-share closed down 1.60%, the S&P 500 closed down 0.03%, and the Nasdaq closed down 0.04%.

Company Corner

One thing, from Paul

Another

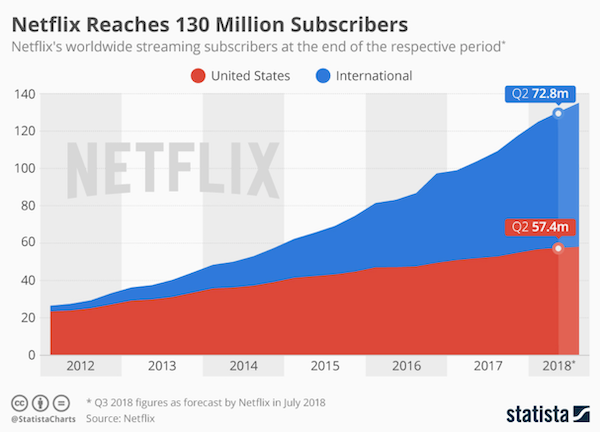

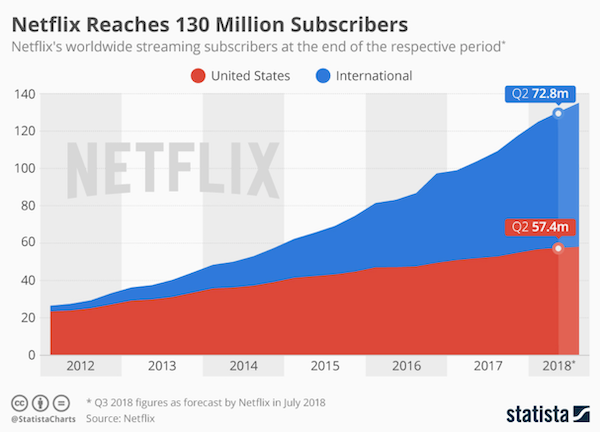

Vestact recommended stock in New York portfolios is streaming entertainment service Netflix. The company has a fascinating history. It was founded in 1997 as a DVD movie distributor and didn't start offering online streaming until 2007. It was listed on the stock exchange in 2002, when it had just 600 000 subscribers, all of whom were in the US.

It passed the 100 million-subscriber mark in April 2017, and now has over 137 million subscribers. It only started expanding internationally in 2010, when it launched in Canada. Today it's available in over 200 countries.

People love TV content, but they don't love linear TV anymore, where channels present programs only at particular times on non-portable screens with complicated remote controls.

Internet entertainment is on-demand, personalized, and available on any screen, and Netflix is the global leader. Given its enormous library of compelling content, the monthly fee of $14 is really a bargain.

Interestingly,

Netflix co-founder and CEO, Reed Hastings, encourages account sharing. He has called it a "terrific marketing vehicle" that helps expose Netflix to new viewers, noting that those who initially use someone else's account often become paying customers down the road. Many youngsters only ever watch Netflix content on their smartphones.

Watching the latest must-watch series on Netflix has become a global phenomenon. Staying home and binge watching is the way the middle classes spend their evenings these days.

There is even a phrase to describe that: "Netflix and Chill". Haha, no. That phrase actually means something else. According to Urban Dictionary, "Netflix and Chill" means having s#x with your partner, with Netflix on in the background.

Netflix will spend $8 billion on original content this year, and "a lot more" in the future. It is striking deals daily with the world's top producers, writers, graphics experts and actors. Some stars like Adam Sandler premiere all of their content exclusively on Netflix worldwide. It does of course have competition such as Hulu, Amazon Prime and YouTube.. From 2019 onwards, Disney is also launching a new content streaming service.

The recently released Netflix third quarter results exceeded consensus expectations, and the stock shot up yesterday. Subscriber net adds came in just below 7 million (almost 6 million of which were outside the US). What is more, they provided fourth quarter guidance for another 9.4 million adds, which is far higher than most analysts' expectations. That's a reflection of the strength of their content line-up for the rest of 2018, new distribution partnerships in emerging markets and growth in the addressable audience, particularly in earlier stage mobile-first markets.

The company has a lot of debt, and thin profit margins. However, it is growing fast and has the ability to increase margins in future with modest fee increases.

We remain Buy rated on Netflix and believe the shares will continue to significantly outperform. Only 15% of our customers in New York own Netflix (59 out of 407). Make a plan to add it to your portfolio now!

Byron's Beats

Yesterday Mediclinic released a trading statement which left the market very disappointed. It felt a lot like Aspen in fact. The market was expecting so much more and it took no prisoners. Not many bear markets do.

Let's look at the update. In constant currencies revenues were up 2%, adjusted EBITDA was down 4% and EPS is expected to come in at 10 pence compared to 11.3 pence last year.

Which region let the team down? Switzerland was particularly disappointing.

The Swiss healthcare system is complicated (which system isn't?). I actually met a Swiss person a few weeks back and she explained how it all works to me. I also double checked this on Wikipedia. Citizens are forced to take on private insurance to fund private healthcare. There is no state provided healthcare. If a citizen gets treatment, there is often still excess that needs to be paid. This excess can also be insured, for a higher monthly premium of course. The insurance companies are not allowed to make a profit on this insurance but can do so on supplemental plans.

The patient can then decide which facility to go to, knowing that the more high-end facilities are more expensive which means a higher excess. By the way, the Swiss lady told me that Hirslanden (Mediclinic) is world class.

In 2004 the government introduced TarMed. This is a tariff system which sets the prices for certain procedures. It also forces certain procedures to be considered outpatient. This means that the patient does not sleep the night which is bad for hospital margins. This was implemented to take the pressure off the hefty insurance premiums which is a political hot topic at the moment, as the citizens think it is too high.

The problem here is that medical inflation is the highest in the world. Although innovation is rife, it comes at a very high cost. So when your prices are fixed but your costs are increasing, margins get crimped. Management's margin guidance was 17.3%. The trading updated is expecting 16%. This was the big miss that disappointed the market.

Having said that, Switzerland is still a global beacon for private healthcare. Most internationals come during the winter months for operations, which will be included in the second half numbers. SA and The Middle East are showing some green shoots. We expect the numbers to be better in the next 6-months. The quality will also shine through as citizens and internationals will pay the excesses for world-class healthcare.

We still feel that Mediclinic offers a great product in a sector where demand is constantly growing. It hasn't been easy out there but we should remain patient. Just like their biggest shareholder, Remgro.

Our 10c Worth

Michael's Musings

The rise and fall of companies has always fascinated me. Especially for businesses that are over 100-years old. The hardest part is to get the initial foothold and economic momentum, then as time goes on it becomes less about establishing yourself and more about staying relevant.

The two most common reasons, in my opinion, that companies fail are because they have either not kept pace with change or they have taken on too much debt. In the case of Sears, they were impacted by the shift to online shopping, but the huge debt burden is ultimately what sunk them.

Sears has some impressive milestones in its 125 years. The company was the first retail company to list on the New York stock exchange, and they were the biggest retailer in the US until Walmart took the title in the 90's.

Timeline: The rise and fall of Sears

Linkfest, Lap it Up

Linkfest, Lap it Up

This is a huge step forward for Tesla. Once this factory is built, it is expected to produce 250 000 cars a year - Tesla currently produces around 100 000 cars a year -

Tesla buys land in China to build new gigafactory

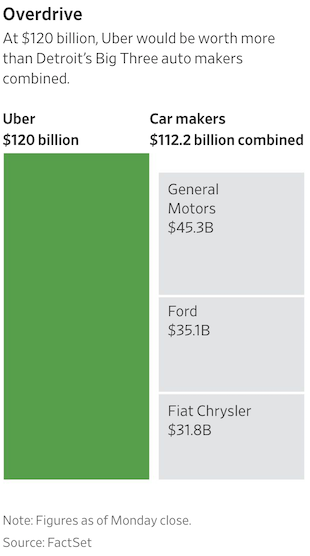

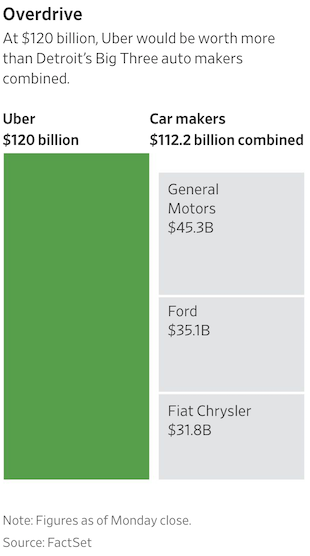

As the Uber IPO nears, bankers are starting to place values on the company -

Uber Proposals Value Company at $120 Billion in a Possible IPO

Smart watches are gaining traction

Smart watches are gaining traction among the elite watch brands -

Montblanc's Summit 2 is the first smartwatch with Qualcomm's next-gen wearable chip

Vestact Out and About

Vestact Out and About

Signing off

Signing off

It is another down day for the JSE. Some good news out of yesterdays data was that RSA retail sales grew at 2.5%, higher than estimates and higher than our GDP growth. Later today, there is UK retail sales and RSA mining production numbers.

Sent to you by Team Vestact.