Market Scorecard

Thanks to good earnings released before the US market opened, our local market went from being down for the day to solidly positive at the close. US markets also soared.

Yesterday one of our readers gave some more insight into Canada's falling oil price. Here is what he had to say:

"Useful story for me on the Canadian Oil as I am a US transportation analyst. To put it in context, the cost to rail the crude from Canada to the Gulf Coast refineries is ~$12/bbl so massive spreads going to arbitrage traders there - If they can get the tank cars.

Currently most of the fleet of tank cars are focused on the Permian where the Midland-Gulf spread is ~$16/bbl with ~$9/bbl to transport via rail. Railroads and car owners still not motivated to increase the tank car fleet as all Permian excess capacity will clear by 2H 2019 when new pipelines come on line, so avoiding an overhang.

This leaves Canada out in the cold as no new capacity to close their massive spread. Expecting that Canadian- WTI spread to contract significantly in the coming few quarters. New pipelines in Canada are hampered by environmental issues which delaying new capacity to c. 2021."

Yesterday the

JSE All-share closed up 1.48%, the

S&P 500 closed up 2.15%, and the

Nasdaq closed up 2.89%.

Our 10c Worth

One thing, from Paul

One of the great things about working in asset management is that you get to sit around reading all day. Reading news updates, company reports, political analysis, research reports, investor newsletters, investment blogs, tweets and more. Even better, your colleagues are doing the same thing, so you can share insights throughout the day.

Bright found this blog post by

Bill Miller, which I found valuable. Miller ran the famed Legg Mason Value Trust mutual fund for many years,

solidly outperforming the S&P500 for 15 years straight between 1991 and 2005. He had a bad patch over the 2008/09 financial crisis but has bounced back since then. Like us he's a fan of investing in companies that are changing the world.

In this post, Miller reviews the argument that

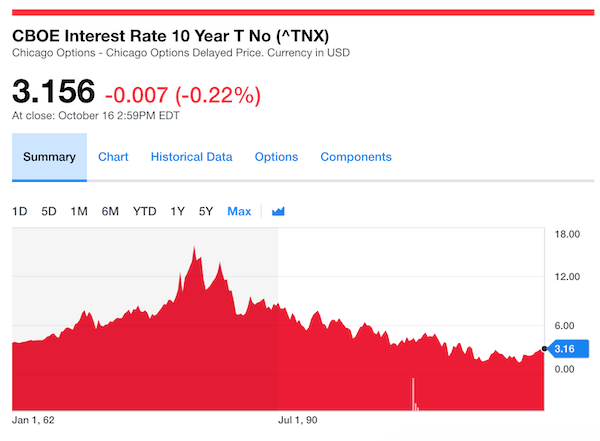

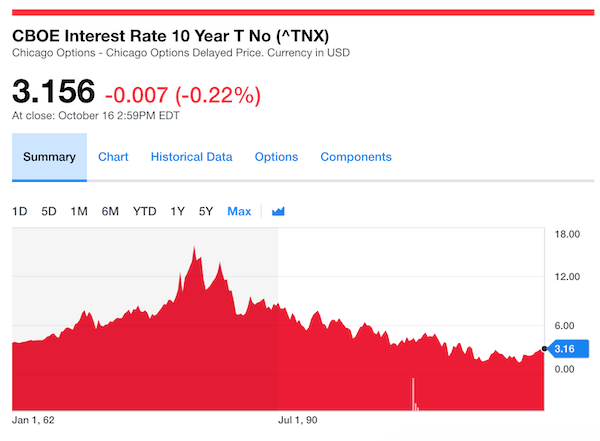

since bond yields (as measured by the annual payout of 10-year US Government treasury notes) in the US are rising, stocks must surely be getting less attractive? Here's what he has to say about that:

It's a bull market in stocks and it will continue until it ends, and no one knows when that will be. It will end when either the economy turns down and earnings decline, or when interest rates rise to a level where bond yields provide significant competition for stocks. I have seen some folks saying that will be at 3.5% or more on the 10-year, which I find implausible as bonds will still be trading at close to 30 times a return stream that does not grow, while stocks are at just under 17x next year's earnings, and those earnings will likely advance about 5% or a bit more over the long term. During the bull market of the 1990s, bond yields averaged 6%. Today's rates are still among the lowest in history, and only 2 years ago they WERE the lowest in history. Valuations of stocks do not appear demanding compared to returns available in other asset classes.

For the record, here's the long-term chart of the yield on US 10-year Treasuries, going all the way back to 1962. As you can see, the all-time high over this period was 15.8% back in 1981. Now it is at 3.16%.

Byron's Beats

I was on CNBC Africa yesterday evening and got to ask

Richard Brasher, CEO of Pick n Pay a few questions. Richard has done a great job at Pick n Pay and has successfully implemented a solid turn around during a very tough period. My question was focused on their rewards program which has been a huge success for Pick n Pay in recent years.

I am tired of carrying all these cards around in my wallet. The Starbucks app is great, you load your credit card to the app, and then everything is done through the app. You can see exactly what rewards you have, how much you are spending and how much you need to spend to get more rewards.

The app makes you preload money from your credit card before paying, this is every retailer's dream as they get the money before you even sell the product. Back to Pick n Pay, Richard Brasher told me that Pick n Pay did, in fact, have their entire rewards program on the app. Good work guys. Any feedback out there? Business Insider covers a few details of the rewards program

here.

Many other retailers like Woolies do have apps but so far the experience is clunky. I am looking forward to these guys using the Starbucks model and getting loyal clients to spend more.

Michael's Musings

Today Canada becomes only the second country globally to legalise weed,

Marijuana becomes legal in Canada on Wednesday, but barriers remain for consumers. In other countries like the US, weed is illegal at a federal level but legal in a handful of states.

Simply from an economics point of view, it makes sense to have it legal. You have heard the arguments before, if it is legal you can charge taxes and not waste money on trying to fight distribution. More money for governments should make them happy? An out in the open industry also means quality standards can be applied, making it safer for consumers.

I've recently been watching the program

Netflix: Explained, where they have a new 15 min episode every week on a range of topics ranging from explaining Cricket, to the gender pay gap. I've enjoyed the few episodes I've seen so far. One of their episodes is on weed, where they make further good arguments for having it legalised. Due to the negative stigma around the drug, coupled with all the hurdles in getting approval for testing, there has been very little money spent on the health benefits of the plant.

The world will be watching Canada to see what the consequences are of their new law. I suspect that we will look back on this period in history with similar views as probation on alcohol in the early 20th century.

Bright's Banter

A judge finally approved Elon Musk's settlement with the SEC. This is good news for Tesla shareholders as it puts to bed what has been one of the rockiest months in Tesla's history.

The problem started when Elon Musk said that he was taking Tesla private at $420 in his famous

"funding secured" tweet. Of course not a lot of people can pull that one off, including the mighty Musk himself because there are very few people who can write a +$50 billion cheque.

The filling by the SEC alleged that Musk misled investors and made false or misleading statements about funding in addition to failing to take the necessary steps to identify regulatory approvals for the transaction.

Musk ended up taking a no admission of guilt settlement of $20 million in his personal capacity and another $20 million by Tesla; which the government says will be used to pay back investors who lost cash due to the volatility in the Tesla stock price in the period under question.

Tesla shares closed up 6.5% on the news, the shares are still 19% away from the day before the famous "funding secured" tweet.

Linkfest, Lap it Up

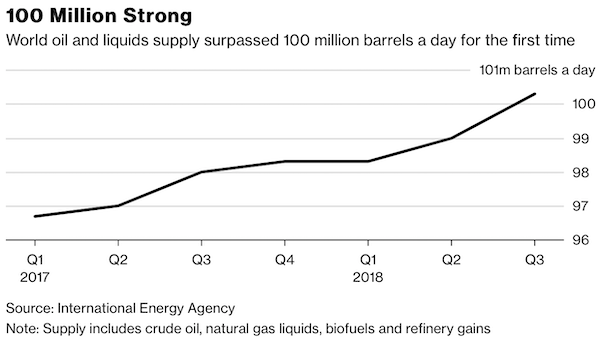

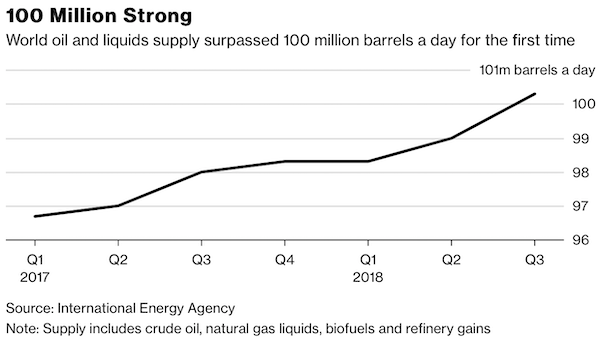

Sticking with the oil theme from above, even as global supply has been increasing, so has the demand, which is why the price has been climbing -

100 Million Barrels: The World Hit a Daily Oil and Liquids Record.

Taiwan's famous boba aka bubble tea

Taiwan's famous boba aka bubble tea or what some call pearl milk tea is back in the news again. This is one of the fastest growing beverages in the planet with expected sales of $3.2 billion by 2023. The chewy concoction is made by combining tea, milk and black pearls made of tapioca.

Here are some

fun facts on boba from Quartz.

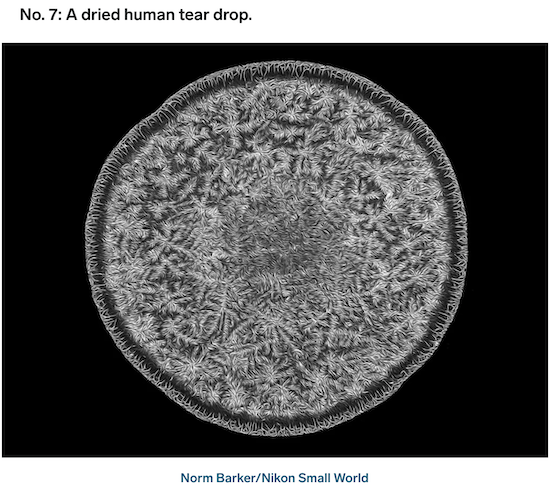

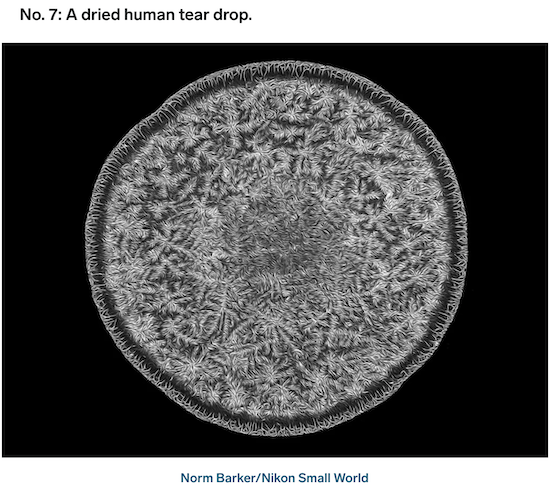

These microscope pictures are amazing. How long will it be until the iPhone has a lens that can take pictures like this? -

A miniature universe exists just beyond our sight - these photos capture it in beautiful, breathtaking detail.

Vestact Out and About

Vestact Out and About

Signing off

Signing off

The JSE All-share market opened in the green this morning. Yay! But then promptly slid lower. Ahh. Netflix crushed analyst estimates last night, and is up 11% pre-market. Yay! Mediclinic though, released their interim numbers which missed the mark and is down 8%. Ahhh. We will have more on both companies tomorrow. Then on the data front, we have RSA retail sales out at 13:00, and then CPI for both the UK and EU.

Sent to you by Team Vestact.