Market Scorecard

I woke up this morning to the sad news that Microsoft co-founder Paul Allen died of cancer on Monday. He was only 65, which is a sobering reminder that even with billions in the bank, when it is your time, it is your time.

Allen stated Microsoft, a name he came up with, with Gates back in 1975. He then left in 1982 when he was diagnosed with Hodgkin's lymphoma. He died of non-Hodgkin's lymphoma, both are cancers that effect the lymph nodes but are very different diseases (

What's the Difference Between Hodgkin Lymphoma and Non-Hodgkin Lymphoma?).

For us in Southern Africa, he will be remembered for his contribution to conservation. As a signatory to The Giving Pledge, most of his wealth will be given to charities over the next few years;

Paul G. Allen - The Giving Pledge. I suspect conservation will be one of those causes. Doing further reading this morning about his giving to conservation, I found this article,

Lions, gorillas and elephants: Paul Allen opens chequebook for wildlife conservation. It also touches on his work with Wild Dogs. Very interesting!

"His largest African grant, $3 million, was for a project that combines conservation with the type of cutting-edge science Allen finds fascinating: analyzing the scent markers left by wild dogs, with the hope of developing chemical mimics that could be used to steer the animals away from human settlements."

Yesterday the

JSE All-share closed down 1.88%, the

S&P 500 closed down 0.59%, and the

Nasdaq closed down 0.88%.

Our 10c Worth

One thing, from Paul

Property investing is not my bag, but it is interesting to see what's going on in that sector, if only for comparative purposes.

In Mecca, Saudi Arabia the world's most expensive new structure has just been opened. The Abraj Al-Bait Tower complex cost $15 billion to build. The main tower is just over 600 metres high. Oddly, it has old style analogue clocks up top?

Its located adjacent to the Kaaba in the Great Mosque of Mecca, the most sacred site in Islam. The towers were built on the site of a 1781 Ottoman citadel. The hotel caters mostly to visiting pilgrims, but there is also a giant shopping mall on the lower floors.

Read more here, on

Wikipedia.

Byron's Beats

Tonight we get numbers from Netflix which is always exciting.

This article from Yahoo finance delves into a Credit Suisse report which has some interesting estimates for the quarter.

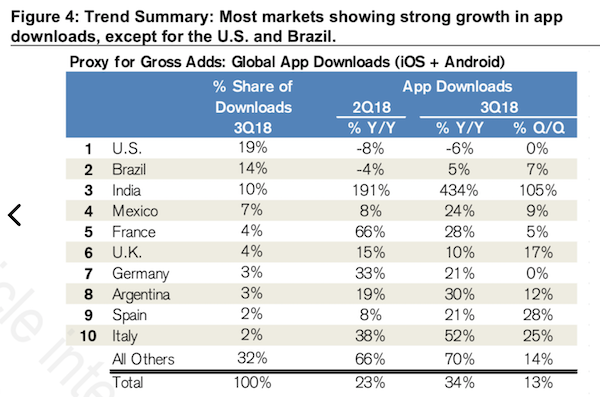

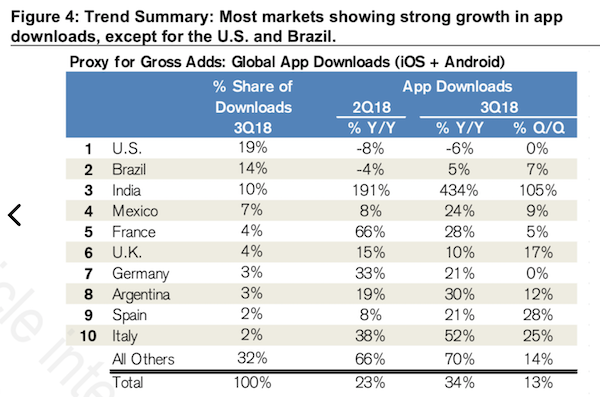

Take a look at the image below.

The report suggests that Netflix app downloads in India grew by 434%

The report suggests that Netflix app downloads in India grew by 434% for the quarter and this should spearhead a large beat in subscriber growth outside the US. I know Netflix has been pushing a lot of fresh content towards the Indian market.

This is the beauty of the Netflix model. They can make great content in Hollywood and feed it to a potential 1.3bn people in India without actually having a large physical presence there. Compare that to the mammoth task Amazon have with its online retail outlay in that country. No wonder Amazon has also branched into streaming and web services.

Michael's Musings

This truly amazes me, the rest of the world is struggling with a climbing oil price, but in Canada the price is plunging. (

$20 Oil? Welcome to Canada, Where Crude Prices Haven't Recovered)

How can that price differential exist in a free market? In Economics, prices can only equalise when it is cheap for the excess in one market to reach the deficit in the other market. In this case, there are only three oil pipelines in Canada, meaning they are struggling to get the oil from the fields to the refineries. Compounding the problem is that Canadian oil is 'heavy and sour', which makes it more expensive to refine.

So we have a product that is less appealing due to high refining costs and a cap on how much oil can be transported. But wait, there is more. Oil companies are increasing supply. So

we have a case where there is more oil than can be transported, meaning oil producers are willing to accept ever-lower prices just to ensure that their product gets sold and into the pipeline.

Bright's Banter

I follow Glencore with keen interest, just to learn from the best on how to run a successful company in a very tough market. We avoid investing in mining for many different reasons, subscribing to Howard Marks' way of thinking

"if you take care of the losses (by avoiding them), the winners take care of themselves".

This morning I got an alert that Glencore will be axing 400 jobs in its Hail Creek coal mine in Australia which sparked my interest. Glencore only bought this mine in March 2018 from Rio Tinto and they took over the operations on the first day of August. They have already hit the ground running.

There seems to be a constant here - they buy underperforming assets, get rid of the deadweight, introduce new management, and finally bring their own best practices, including automated systems that have been tried and tested. This helps them run a very lean and mean operation as compared to their competitors.

You can find the article

here for further reading.

Linkfest, Lap it Up

To survive hotter and longer summers, ski resorts are coming up with new ways to make sure their slopes have snow during peak season. In this case, they store snow under insulation boards and tarps, in the hope that 75% of it survives summer -

Snow Farming May Be the Key to Saving Europe's Ski Industry.

I simply can't explain this trend

I simply can't explain this trend. Is it a case of too much work, too few workers and the prospect of a promotion that makes people take less time off? This trend should change though as more research shows, taking a break makes you more valuable to your company -

Where Workers Are Most Likely To Use Their Vacation Days

You will find more infographics at

Statista

Vestact Out and About

Our broker in New York, Ted Weisberg gets a few segments in this market recap video; he talks about his 55-years on Wall Street -

The Breakdown with Toni Waterman.

Signing off

Signing off

Tencent, Naspers and the JSE All-share are down this morning. Asian markets started the day well in the green but drifted lower through their trading session, to now be negative. Then Netflix and JNJ report their latest numbers this afternoon, I always enjoy reading about these companies' operations. At least through the recent market rout the Rand has held its ground, overnight it even strengthened from $/R 14.50 to $/R 14.30.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista