Market Scorecard

Despite Tencent being down 7% yesterday in Hong Kong, Naspers only closed down 0.7%. Today Tencent is up 5%, so there is a chance we have a green day on our local market, for a change. Looking at Asian markets this morning, they are all moving higher. It may be what traders call a 'dead cat bounce' though; my wife hates it when I use that term. What it means though, is when the market/stock has an up day after a massive sell-off, but the reprieve is only temporary, and the sell-off then continues.

The US CPI data released yesterday showed that inflation was lower than people were forecasting, which means the Fed might not have to raise rates again this year. Good news for stocks. After the data release, US futures and then US markets were actually in the green for the early part of trading. Today, before the US market opens, the big US banks report their earnings. Depending on how strong those numbers are, either this weeks' rout will be a distant memory, or it will gain momentum.

Yesterday the

JSE All-share closed down 1.11%, the

S&P 500 closed down 2.06%, and the

Nasdaq closed down 1.25%.

Our 10c Worth

One thing, from Paul

A recurring theme in our Vestact newsletters is that

investors should ignore the noise, and search out the signal. The daily news headlines are ever more strident, and thanks to the wonderful devices which we all now have, we are always plugged into the stream. We simply must keep in mind that

it is the really big, underlying trends in human society that are important, not the latest Trump brainfart.

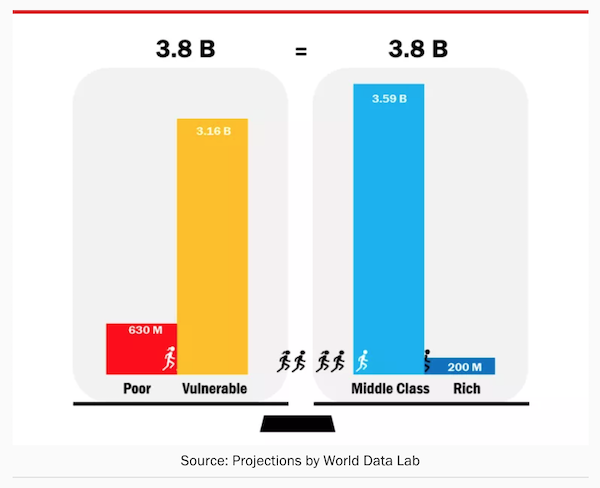

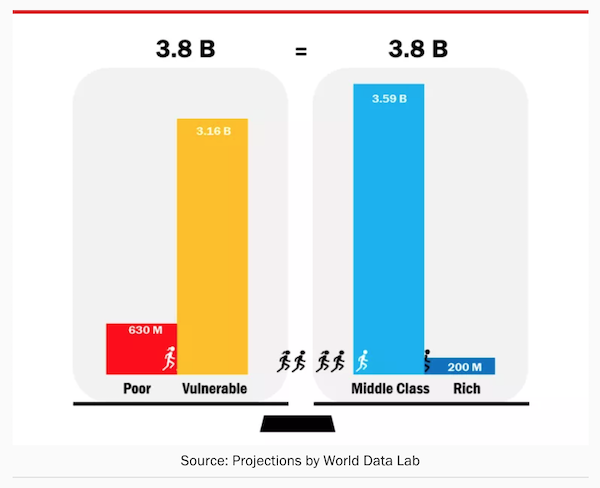

The Washington, DC-based Brookings Institute has reported that

for the first time since agriculture-based civilization began 10,000 years ago, the majority of humankind is no longer poor or vulnerable to falling into poverty. By their calculations, as of this month, just over 50 percent of the world's population, or some 3.8 billion people, live in households with enough discretionary expenditure to be considered "middle class" or "rich." Barring some unfortunate global economic setback, this marks the start of a new era of a middle-class majority.

The writers draw this important conclusion:

Why does it matter that a middle-class tipping point has been reached and that the middle class is the most rapidly growing segment of the global income distribution? Because the middle-class drive demand in the global economy and because the middle class are far more demanding of their governments.

Read the full article, by

Homi Kharas and Kristofer Hamel.

Byron's Beats

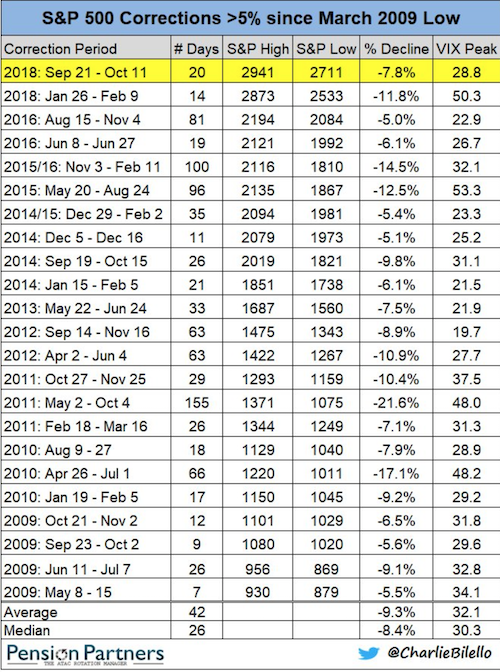

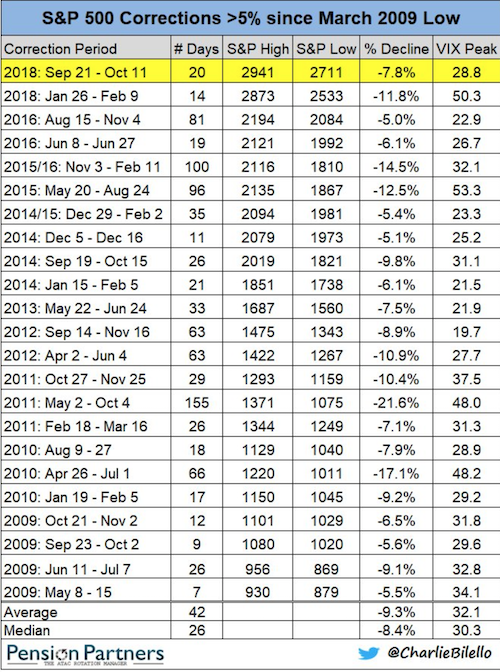

When chatting to clients about this recent pullback, I always ask if they remember February 2018. Most of them do not. But in reality, it was pretty brutal. The S&P declined 11.8% in 14 days. Our more direct portfolios probably fell closer to 15%.

This tweet from Charlie Bilello points out all the >5% corrections since March 2009. There have been 23 of them with an average decline of 9.3%. The current pullback has been a 7.8% decline. The point is, these declines happen fairly often. Around 2.5 times a year.

So what to do

So what to do? Take a look at what is causing the pain. An increase in interest rates because of a very strong US economy is not a financial crisis in the making. It is a market adjusting to a new environment. The companies we are invested in are all in good shape. Stay long and buy these dips.

Michael's Musings

It is great to see South African products making waves internationally,

Time magazine has named this South African invention one of its top 50 'genius' products.

If you haven't used the Wonderbag before, it is a clever and safe way to do a slow-cooked meal. It also has the added benefit of saving on energy costs.

"After boiling a pot of food over a stove or fire, it is then put into the Wonderbag, which retains heat for up to 12 hours, so the meal can continue to cook without the use of power, throughout the day."

Bright's Banter

Yesterday was a very interesting time to be invested in the markets. That is because for some markets it was the worst day since the Brexit vote in June of 2016. The fears are driven by the rising interest rates in developed markets due to Fed tightening; which some people say signals a sharp slowdown in growth and perhaps may lead to a recession which is not good for equity markets.

This market pullback has a take-no-prisoners attitude, so what it means is that even the market darlings like the FAANGs suffered as they have no birthright to superior returns. The infographic below shows that the FAANG group of shares lost a total of $220 billion in just one day, ouch!

After yesterday's sharp decline, investors are acting with impulse and selling in haste. The classic phrase "shooting from the hip" comes to mind. Our advice is to refer back to yesterday's note and take the wise counsel of Jim O'Shaughnessy that we shouldn't be like Art but be like Art's kids. Don't churn the portfolio, add regularly, forget the password to your investment account, and only check your portfolio at tax year-ends.

If you're a true contrarian and you're feeling a bit brave, add at such opportunities.

Investing is the only place where people rush for the exit when everything is on sale.

You will find more infographics at

Statista

Linkfest, Lap it Up

A gaming laptop will set you back at least R15 000, but could also cost over R100 000. Google is testing a platform where your gaming will be done on the cloud, like some many other things you currently do -

Google's Project Stream is a working preview of the future of game streaming.

Following on from yesterdays' link

Following on from yesterdays' link on the new longest flight, here is a look at the top 10 longest flights -

The World's Longest Non-Stop Flights.

You will find more infographics at

Statista

Vestact Out and About

This week on Blunders: world class looting in South Africa; spy chips on computers from China; Banksy artwork gets shredded; and man-eating tiger to be lured with Calvin Klein's Obsession fragrance -

Blunders - Episode 120.

Signing off

Signing off

Since writing the introductory paragraph, the Tencent share price has shifted from being up 5% to being up just short of 7%. I hope the brokers for the company were loading up on stock yesterday, as part of their share buyback program. Data out today is Industrial production figures from the EU, which will give us a sense of how the block's economy is doing. Then of course we have the highly anticipated banks latest numbers.

Sent to you by Team Vestact.

You will find more infographics at Statista

You will find more infographics at Statista

You will find more infographics at Statista

You will find more infographics at Statista