Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Yesterday Discovery released a good set of full-year numbers for the year ended in June 2018. The shares closed down 4% on worries about global geopolitics and how the company was going to navigate the regulatory landscape in all its markets going forward. The other factor contributing to the share price was the inevitable share dilution as the company seeks to raise R1.8 billion to buy back the 25% stake in DiscoveryCard from FirstRand to pave the way for Discovery Bank.

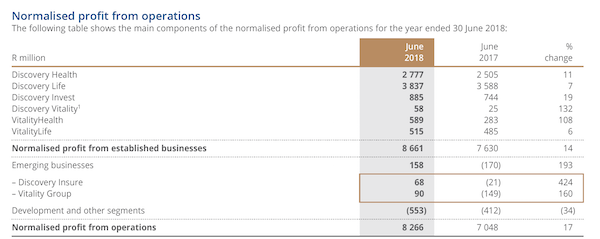

Normalised operating profits are up 17% to R8.2 billion, while normalised headline earnings per share increased 16% to R8.37. This is all thanks to strong performance in VitalityHealth and what Discovery refers to as their "emerging businesses" i.e. Discovery Insure and Vitality Group. VitalityHealth saw it's profits improve by 108% while the emerging businesses swung to profit of R158m from losses of R170m in the previous year, a 193% change.

The biggest uncertainty that could potentially affect the local business was the proposed National Health Insure Bill and the Medical Schemes Amendment Bill that my colleague Paul wrote about in this informative piece here. Adrian Gore said that most of the findings and recommendations in the provisional report are sound and consistent with Discovery's views, and they're going to have a positive impact on private healthcare if implemented as proposed.

A lot of investors are infatuated with Discovery's China partnership with PingAn and rightfully so. Discovery has a 25% stake in PingAn Health, a business that saw a 87% surge in new business to RMB 2.9 billion and revenue growing by 80% to RMB 4.9 billion. Discovery's take of the profits increased by 279% to $4.4 million. This is all thanks to a significant move towards focusing on individual retail products. But management still sees more opportunity to scale the business using technology. Most importantly the company said that capital required to sustain business growth over the next three year is unlikely to exceed R500 million.

Vitality Group, the bit that sells the Vitality model to third parties saw all its business segments turn profitable thanks to strong growth and operational efficiency. This means better overall management of the business segments. The vision is to alter member behaviour through proactive ways rather than reactive. The focus is on changing lifestyle behaviour (life and health), driving behaviour and other controllable behaviour in savings and banking. The goal is to have healthier clients that live longer on average and have enough money saved up for retirement.

We're excited about the prospects of the new Discovery Bank even though it will come at a cost in the short-run, but in the long-term this is a business that will be significant in the groups bottomline. We are still happy shareholders and clients of Discovery. Now let me go grab my free Kauai smoothie!