Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Yesterday foodservice company Bidcorp released their full-year numbers. I watched the results presentation online, while at my desk eating lunch. It is a very convenient way to take in the figures, the only downside is I didn't get access to all the free food being served after the presentation.

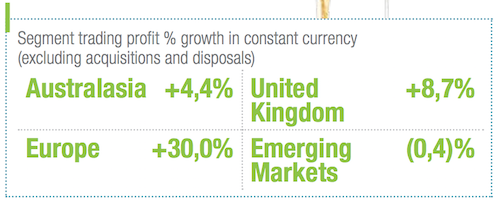

The company did what you expect from it, a steady rise in top-line and bottom-line numbers. When it comes to the food industry, because it is already established, you will never see the type of explosive growth as we see in tech stocks. Here is how each division performed.

Europe is now their biggest division by revenue and second biggest in terms of profit. On the earnings call Bernard Berson, the CEO, said that they saw growth from all the European countries that they operate in. Confirming the stronger economic data that we have seen coming out of the EU. They will continue to buy family-owned businesses in this region and bolt them onto existing operations.

One thing I love about reading company results and more specifically management comments, is that you get an excellent idea of what is happening at the ground level of the economy. This is especially powerful when you read commentary from companies in different sectors. On the local front, Bidcorp said the first 6-months of the year were much easier than the second 6-months of the year. This ties in with the rise and fall of 'Ramaphoria'.

Surprisingly though, the drop in their EM profits was not because of the South African division but due to struggles in China and then the week-long truck driver strike in Brazil. Management said that there was a clear shift in Chinese consumption when trade war tensions escalated.

Being a food services business, Bidcorp is one of the benefactors of the rise in food delivery companies. The more that millennials sit on their couches and order food, the less money your traditional retail stores make and the more convenience food companies make. These food delivery companies are even opening what are called 'dark kitchens', similar to a no-name brand product. Bidcorp supplies a few of these dark kitchens too.

Operating in the food industry is tough, you only have EBIT margins of around 4%-5%. That means you have to do a lot of work before you make any meaningful money. It also means that it keeps competition in the sector down and business gets given to efficiently run companies. The Bidcorp share price is not cheap; it trades around a 22 P/E, I would say it is fair though. You get steady growth, a strong balance sheet, coupled with the moat of selling food to people.

At the beginning of the results presentation, the comment was made that Bidcorp is the biggest foodservice business outside of the US. In our opinion, there is an outside chance that one of those monster US corporations might swoop in and make a very attractive offer to buy Bidcorp, to gain an international footprint.