Sign up for our free daily newsletter

Get the latest news and some fun stuff

in your inbox every day

Get the latest news and some fun stuff

in your inbox every day

Last week MTN released their interim results. As always, Rob and Ralph looked upbeat and cheerful during the presentation even though some of the news they had to deliver wasn't easy.

The underlying business is in decent nick. Service revenues were up 10.2%, data revenue was up 26.7%, there are now 223 million subscribers, and mobile money now has 24 million users.

But under the hood there were a few once-offs that were not so cheerful. Of course Iran is the first issue that comes to mind. They have halted a $750m fibre investment plan in the country. The rial depreciated 19.4% against the dollar over the period, and Trump is bringing back a whole host of sanctions. Even though Asia and Europe do not agree with the sanctions, many corporates do not want to risk their relations with the US and are pulling out. That is not good for an economy where MTN has over 40 million subscribers. The group repatriated R1.2bn from Iran during this period, but future repatriations could prove difficult.

The other issue concerning shareholders is the debt levels which are now at R70bn. Much of this is in hard currencies while they earn in volatile developing market currencies. Although the business is profitable, CapEx plans are still massive. They plan on spending R25bn this year on CapEx. They need to do this to stay competitive in a data hungry, underserviced continent.

Having said all this, we think the share price still represents value. The debt levels are still manageable for a company that has annual revenues of R120bn. Earnings for next year are expected to come in at around R10 a share, assuming no once offs of course! That puts the company at a far cheaper multiple than the market average.

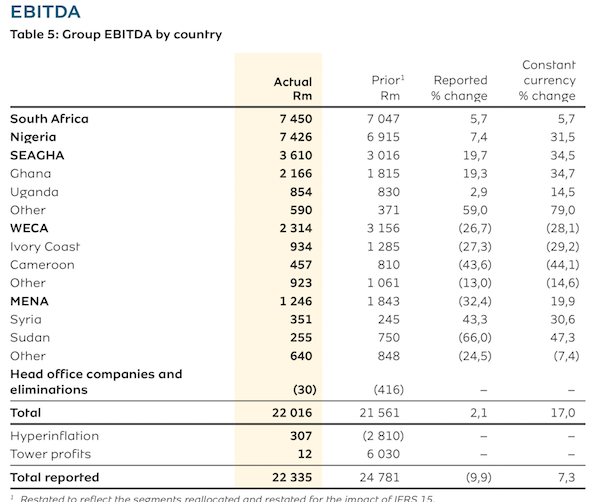

The image below represents the current state of the business and where the money is being made.

They are well spread out and in many cases are the market leaders in these countries. That is the benefit of operating in the tough conditions that they do. No one else wants to come there and compete.

I know we have said this before but we continue to remain patient, the new management deserves more time. We continue to be holders of MTN.