There has been much talk about Facebook, and it's recent fall in share price. To the untrained eye, this may look like a bubble pop that could continue to get worse. But I strongly disagree. Facebook has one critical thing that many bubbles do not possess. An incredibly profitable business.

Last night I was scouting through companies that trade on a similar or higher price to earnings multiple to Facebook (currently around 23 times this year's earnings). The list includes Coke, Anheuser-Busch, Richemont, AVI, Mr Price and Shoprite, amongst others.

The difference between all of these companies and Facebook is the growth projections. Facebook is expected to double revenues over the next three years. Not many small businesses can achieve that, let alone a company that already has annual revenues of $56bn. I haven't even touched on their current annual earnings before tax of $25bn.

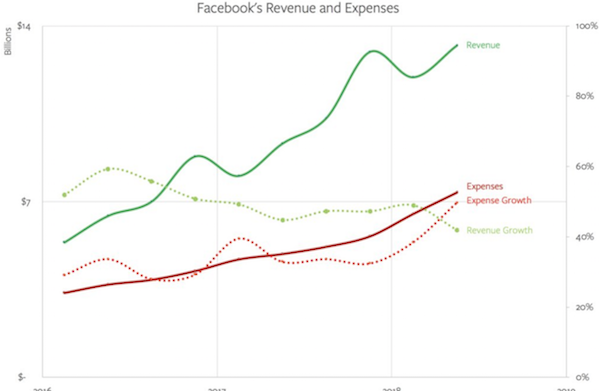

The problem at the moment is the market perception. Facebook is stuck between a rock and a hard place. Society wants them to clamp down on negative influencers. This, however, slows down profits and sponsored content. This graph from Ben Thompson illustrates the market's concern.

Facebook has decided to go with societies needs, and that has dampened their profit projections. We are long-term investors, and we are more than happy to focus on the user experience instead of short-term profits. We see this as a good buying opportunity.